1 National Law University Odisha, Cuttack, Odisha, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The concept of financial ecology encompasses the intricate interplay of financial systems, institutions, and technologies within the economic ecosystem. It emphasizes the symbiotic relationships and dependencies that shape the modern financial world. Development of Fintech has the potential to significantly enhance and reshape the dynamics of the financial ecology, introducing new players and altering established relationships within the ecosystem. In today’s digital realm, the financial landscape has gained significant steam in its adoption of technology tools to dispense its services. The ‘internet economy’ is relied upon to produce new market development opportunities and occupations and become the greatest business opportunity for organisations in the future. India has come up significantly in the global discussion on financial technologies over the last two decades. Through a systematic review of the literature on this area, this article identifies that the regulatory framework requires provisions to support greater fintech inclusion. Moreover, several issues still lie deficiently addressed, such as user privacy and cybersecurity. This article attempts to review the opportunities, scope and risks for the implementation of financial innovation in India.

Digitisation, fintech laws, financial inclusion, financial technology

Introduction

In the ever-evolving landscape of modern finance, the concept of financial ecology emerges as a crucial framework that underscores the intricate interplay of financial systems, institutions, and cutting-edge technologies within the economic ecosystem. As we delve deeper into this evolving financial ecosystem, one can recognize the pivotal role that Fintech, or financial technology, plays. Fintech has the potential to bring about substantial transformations in the dynamics of the financial ecology. In this paper, we will explore the pivotal role of financial ecology, and the transformative potential of Fintech within this ecosystem. Sensational improvements in the field of the digital revolution are taking off at a dramatic speed. The vast majority of the enterprises, including the banking and monetary service areas, have been impacted in one way or the other (Rajagopal, 2022). The onset of new innovation ordinarily prompts development in the business and is quite often embraced to make errands simpler and more proficient, and this applies to the financial sector also.

‘Fintech’ can be said to deal with technologically improved applications, processes, products and services of the financial industries ranging from digital currencies to regulatory technology (Walden, 2020). The term encompasses a rapidly growing industry with EY’s 2017 Financial Adoption Index revealing that at least a third of the consumers in the financial industry utilise a minimum of two or more fintech services in their daily life (Gulamhuseinwala et al., 2017). Most fintech companies are start-ups and share some common characteristics with each other. They are designed in a manner to eventually usurp traditional financial establishments by either being user-friendly or targeting a segment that has been underserved by traditional financial institutions. These start-ups can take multiple forms such as that of Tala, a London-based fintech company, whose customer base is centred around developing nations. It offers microloans with better options than banks to small businesses in these countries (Kagan, 2020). Some like Upstarts, on the other hand, use far varied and comprehensive data sets to determine someone’s credit score which allows them to offer better loans to their consumers than a traditional bank (Kagan, 2020).

The availability of free and cheap internet in India has led to a huge increase in internet usage while also increasing the number of internet users in the country. This had the side effect of having contributed to the expansion of the fintech market in the country. Almost 2,100 fintech entities were established in the last five years (Kapur, 2021). In the quarter ending June 2020, fintech investments worth US$ 647.5 million were signed. In contrast, both the United States and China, the two countries with a larger number of fintech companies, registered significantly lower investments. Fintech companies are expected to reach a valuation of US$ 150–160 billion by 2025, making India the biggest market (Kapur, 2021). Enablers like ‘Jan Dhan’, ‘Aadhaar’, and the demonetisation have made favourable conditions for the enormous scope reception of digital payment frameworks in India. The new-age innovations are assisting the economy with accomplishing the ideal outcome by offering some benefit-added administrations at an affordable expense.

Fintech Operations in India

Regardless of the sustainable development and enormous capabilities of a country like India in the economy, issues such as digital poverty, absence of infrastructure, lack of education and low-skill advancement have posed huge difficulties in the development of the rural region. The government authority, just like the private players, has taken various drives to energise the already under-banked and digitally backward populaces to take on a digitalised method of finance; however, issues survive from the last-mile network of banks and torpid accounts. As digital strengthening of the rural population is imperative to overcome any barrier among urban and rural India, some genuine endeavours should be made. Monetary incorporations in India are facing some unorthodox difficulties. These include an absence of strong digital infrastructure, an absence of trust and confidence in digitalised payments, also a deficiency of affordable and reliable web network choices. A few drives and arrangements have been dispatched by the government authority to work with digital empowerment, particularly for the rural population. The main initiative is the Prime Minister's 'Digital India' programme which was launched on 1 July 2015. The one-of-its-kind campaign envisioned numerous new drives to guarantee that all government organisation services should reach all individuals in the country over the internet. Another drive, the Bharat Net Project, intends to upgrade e-banking, e-administration, internet providers and e-education to the villages in India. The government means to carefully enable and associate each one of the Gram Panchayats and establish 100 Mbps networks. Furthermore, Pradhan Mantri Jan Dhyan Yojana additionally adds to the financial and digital consideration of provincial India by working with online exchanges through RuPay check cards. Understanding the way that rural India holds huge significance in accomplishing the digital development of the country, fintech organisations are progressively taking drives to make digital services open for the nation. For instance, the staggering drives by the public authority just as fintech organisations have taken India from a cash-driven country in the pre-demonetisation time frame to a digitally indulged nation where the digital method of payment is more well known than any time in recent memory. These organisations are continually putting forth genuine attempts to distribute Kiosks, PoS gadgets and mobile vans across rural India to carefully reduce repeating charges (mobile bills, electricity charges, DTH and water bills) from far-off villages. The payments are worked with through UPI, net banking, mobile banking, cards and even cash. These fintech organisations follow a completely secured blockchain-based payment passage. Further, generous ventures are being made in need-based items, financial proficiency just as in social and physical foundation. Making credit payments more adaptable and drawing in masses that utilise informal sources of credit are the top-most needs of these fintech organisations. These drives supplement in crossing over the digital gap in the country.

Additionally, a few government bodies such as the National Bank for Agriculture and Rural Development likewise offer varied finance-related facilities to various districts and villages. These incorporate direct finance, long-term loans, etc., for the financial inclusion of all corners of India. Dispensing with various layers of administration and better participatory roles by benefactors are likewise a portion of the drives that are assisting with building a superior conveyance framework in rural India. Directing risk management assessments, investing in audit studies and diminishing the danger of agent misconduct are a portion of the famous and powerful methodologies that the public authority is taking on.

Opportunities for a Fintech Future

In this era of fast-paced technological evolution, financial technology has emerged as the next step of technology integration in economies across the world. Extant research existing in the Indian economic landscape points to a certain potential in the fintech market. Valued at $31 billion in 2021 (Ishwari, 2022), it is expected to see a market valuation of $150 billion by 2025 (India, 2022). In this landscape, the key players are the newly emerging fintech start-ups and Unicorns (India, 2022), the traditional banks, bigtechs (Harasim, 2021), which is a new term to signify technology companies venturing into the fintech landscape—Apple Pay, Amazon Pay and lastly the Regulatory body which in itself is a player in the case of India (Venkatachalam, 2020). The opportunities that will be briefly touched upon are financial inclusion, artificial intelligence (AI) integration and a potential integration sector.

Opportunities for Financial Inclusion Growth

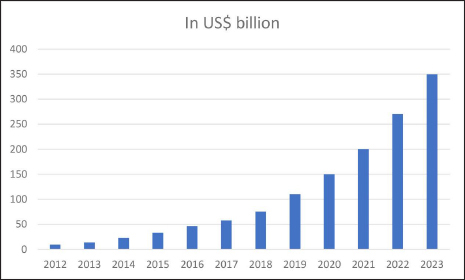

In recent years, with an increase in government emphasis on digital adoption, there have been a slew of reforms that have resulted in a significant increase in the banked population of India. Financial inclusion goes beyond the mere opening of accounts, in addition to that it must ensure that customers also utilise these accounts. Several studies have proven with empirical evidence that financial inclusion has a significant impact on the economic variables of a country (Barik & Sharma, 2019). In another parameter, i.e., the supply side of the fintech ecosystem (Kam Loon Loo, 2019), 'Ease of Doing Business' is a vital aspect that needs to be considered. This is a positive aspect for the Indian market as it has been presenting itself in recent years as a fertile ground for new business through the various government policies (see DPIIT, 2021). This presents unique opportunities for fintech to overcome certain issues such as high transaction costs (Barik & Sharma, 2019) and lack of credit information on borrowers for loan grants. According to data collected by Experian, India’s Digital Lending is set to scale to $350 billion by 2023 (see Table 1 and Figure 1) (Fintech Convergence Council & Ernst & Young LLP, 2021).

Table 1. India’s Digital Lending.

Source: Fintech Convergence Council & Ernst & Young LLP (2021).

Figure 1. India’s Digital Lending Scaled.

Source: Table 1.

With respect to high transaction costs, the traditional banks have an untapped market potential, which once penetrated through via active collaboration with emerging fintech companies and integration with the UPI infrastructure, will help to augment financial inclusion. Since these traditional banks are age-old institutions with several branches even in remote areas, they have the potential to carry forward fintech adoption. With the emergence of AI integration with fintech, several companies now use the extant data available on users for credit scoring (Ashta & Herrmann, 2021) which is an addition to governmental policies of identity creation through Aadhar. India’s mobile penetration is set to reach 96% by 2040 (Keelery, 2021); this is a rather positive figure however; it must be weighed in accordance with the prevalence of financial literacy rates which stand at a meagre 27% as per the survey done by National Centre for Financial Education (FE Bureau, 2020). Therefore, in order to harness these opportunities, steps must be actively taken by all the players in the ecosystem to improve the infrastructure and financial literacy of the untapped markets, especially in rural areas. By steps, it could be both collaboration as well as competition in the sense that active collaboration between the traditional institutions and emerging institutions could interchange resources and technology as well as harness the vast customer base. By way of a healthy competitive environment, traditional systems will be required, almost incentivised, to continuously adopt new technologies and integrate it within their systems whereas the newer companies will have to aim to penetrate deeper into consumer markets.

Opportunities Within an Emerging Sector: Green Finance

With increased awareness and emphasis on sustainability and green initiatives, several organisations as well as policies at the governmental level have shifted focus towards the implementation of sustainable practices. The Paris Agreement of 2015 which aims to maintain global temperatures below 2º Celsius requires intense investments levelling to about $5–$6 trillion annually as predicted by the United Nations Conference on Trade and Development. Going forward, with a focus primarily on the financial perspective of ensuring sustainable practices, fintech provides vast opportunities. As early as 2016, the United Nations Environment Programme has even identified several key areas where financial technology can be harnessed in achieving sustainable goals such as peer-to-peer renewable energy, green bonds, energy sectors, pay-as-you-go resource utilities etcetera. Implementation of blockchain technology in a decentralised peer-to-peer energy system can be created wherein there is a direct transaction between the supplier and utiliser of energy. This system can then go on to develop systems of carbon taxation. Development of carbon trading markets based on blockchain technology (Marke, 2018) and harnessing blockchain enabled bottom-level green financing through crowdfunding and crowdlending due to its potential for low regulatory costs, especially from private players, are some opportunities of integrating fintech with sustainable policies for the future (Marke & Sylvester, 2018). Lastly, we touch upon green bonds. The Union Budget 2022–2023 mentioned for the first time in a positive move, the issue of sovereign ‘green bonds’ in a step towards carbon neutrality to mobilise green infrastructure (The Hindu, 2022). According to Moody’s ESG Solutions, sustainable bond volumes in 2022 are expected to hit $1.35 trillion (Segal, 2022). It is in this hopeful environment that fintech proves to be opportune in its utilisation of faster and efficient transaction processes. Extensive research must be engaged by policymakers in order to keep up with this quickly developing technology. This will enable harnessing of the maximum potential of fintech which will simultaneously aid in achieving our environmental goals.

In the last few years financial technologies have evolved from simple ATM systems, credit cards mobile banking, UPI infrastructure to more recent developments of fintech such as blockchain, cryptocurrencies and digital assets. Technological evolution is only set to continuously evolve and change. In this changing landscape, the players in the ecosystem must adapt and have adequate foresight into potential emerging sector integrations such as green financing. Managerial practices of hiring must be kept in mind to retain and hire employees who show resilience in the face of excess adaptation. However, it’s not just adaptation to new technologies but also to regulation and policy changes which will emerge as a consequence of these disruptive technologies.

Fintech In India: The Legal Analysis

To understand the legal framework surrounding fintech in India, we need to talk about the general view which the state, judiciary and relevant entities have regarding the aforementioned topic.

Prepaid Payment Interface

The principal legislation we have regarding fintech in India is the Payment and Settlement Systems Act, 2007. It basically provides a framework for payment mechanisms in India and is what effectively governs all smart card operations and wallet systems. Wallet systems in particular come under the Master Direction released by the RBI in 2017 (Reserve Bank of India, 2017). Initially, the interoperability between wallets and banks was quite low perhaps due to the potential threat wallets pose to the market cap of the banks. State Bank of India even barred users from depositing money into Paytm (Dubey & Bhandari, 2018); however, this was reversed, and as of 2021 State Bank even entered into a partnership with Paytm (Business Today Desk, 2021). The Master Direction was updated in 2021 to change the specification of payment systems from three categories to two in order to increase the interoperability between different prepaid payment interface (PPI) entities. The new system allows PPIs to allow a transaction of up to 10,000 INR without requiring full KYC. This reduces the amount of hassle a customer has to go through and, hence, would increase penetration into rural areas as there is a general lack of resource to facilitate KYC verification over there. However, certain issues are prevalent even now, namely, the fact that the latest guidelines require conversion into KYC PPIs within 24 months from the date of issue. The structural problems in the nation such as access to KYC centres or lack of technological literacy in rural areas still exist, unless these problems can be fixed the time limit would act as a huge barrier. However, relaxing the KYC requirements would at the same time increase the cyber security risk which goes against the government mandate as demonstrated by the requirement of two-factor authentication for PPIs (Reserve Bank of India, 2017). Another particular barrier that exists is the net worth requirement for the establishment of a PPI by non-bank actors which is currently 15 crore INR. This while a barrier to entry for smaller entities can also be seen as a way for the bank to incentivise only ‘serious players’ to enter into this field, hence ensuring long-term growth and stability (Reserve Bank of India, 2017).

Universal Payment Interface: Differential Treatment

In this section, we analyse two orders coming from the Competition Commission of India (CCI). The first order involved Google Pay, the UPI application launched by Alphabet Inc. The contention is mainly that Google requires all manufacturers that use the Android operating system to pre-install Google Pay before they ship the phone (Order under Section 26(1) of the Competition Act, 2002, 2020). CCI claims this to be anti-competitive in nature and has decided to launch an investigation into the matter.

At the same time, however, in the case involving WhatsApp Pay the CCI has an opposite view point. The contention, in this case, was that WhatsApp bundles its UPI application with its messaging service which is extremely dominant in the nation. The CCI observed that since users are not barred from downloading other UPI apps, it is not anti-competition in any form (Harshita Chawla vs WhatsApp Inc. And Others, 2020).

The CCI had affectively very different stances on similar situation without much justification given. In order to make sure the fintech industry grows a standard must be followed. Before the cases mentioned above the NPCI did release guidelines which capped the market share for a third-party app provider (TPAP) in UPI to 30% (Rai, 2020). Adherence to this policy and creation of strict guidelines for TPAPs would be beneficial since it would create uniformity.

Cryptocurrency: A Legal Conundrum

The story of cryptocurrencies in India has been an unconventional one. It was initially declared to not be a legal tender by a circular released by the RBI (Qureshi, 2022). However, after the history of legal trouble including PILs, proposed blanket ban bills and circulars, the legal status of cryptocurrencies in India is still in flux. Currently, there is no ban on cryptocurrencies in India. Simultaneously there is also no regulation that exists for it. There is currently a draft bill that is pending in the parliament which aims to ‘create a facilitative framework for the creation of the official digital currency to be issued by the Reserve Bank of India’. The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, also intends to prohibit all private cryptocurrencies in India with certain exceptions.

Now there are certain potential problems in this scenario. A bill that ensures regulation is a good step forward since it would clear the air of uncertainty and bring forth some level of uniformity. However, the issue here is the provision about banning all private cryptocurrencies. Now once the text of the Bill is released there will be a bit more clarity. Banning private cryptocurrencies goes against the very concept of digital decentralised tender. Cryptocurrencies are meant to be a sort of framework which do not require a centralised authority (Joo et al., 2020). If private cryptocurrencies are banned and the government ones are instituted then this philosophy would not exist. A lack of a centralised authority is integral to blockchain networks as it allows anonymity to exist. Considering the ambiguity of the legal situation in India about cryptocurrency, the government should consider getting the Bill passed expediently.

Conclusion

In the last decade, finance technology (fintech) has proven itself as a long-time growing emerging market with great potential in terms of corporate and private sector development hand in hand with social economic development. With regard to India more specifically, through major governmental backing of a digital future for India as well as the active growth of startups, the ecosystem for fintech adoption has proved to be only on an upward trajectory in the future. Due to these factors, traditional finance institutions have also been incentivised to adopt new technologies. Financial inclusion is a key aspect in the economic development of a country as several studies have proven and this can be harnessed by way of fintech adoption. We have a long way to go in filling gaps within different sectors in the Indian economy; however, rather than seeing this as a hindrance to fintech penetration, it should be seen as a potential market to harness fintech growth.

With an increase in new innovations in society, regulations also increase in order to bear out the risks which ensue. Cyber security and privacy issues, as several studies have shown, have proven to be hindrances to the adoption of fintech. Further with a rise in new fintech innovations such as cryptocurrencies, market regulations are also necessary so as to provide an equal playing ground. Institutions of fintech must be resilient in the face of this growing and ever-changing ecosystem. With all this in mind, innovation for the entire country will only show its most effect when financial literacy and awareness increase among the masses. Thus, in addition to the steps to be taken by all the players in the landscape, a parallel and equally important weightage must be given to fill financial education gaps in India so as to harness all the opportunities fintech has to offer.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Ashta, A., & Herrmann, H. (2021, May 10). Artificial intelligence and fintech: An overview of opportunities and risks for banking, investments, and microfinance. Special issue: Artificial intelligence in finance (pp. 216–217).

Barik, R., & Sharma, P. (2019). Analyzing the progress and prospects of financial inclusion in India. Journal of Public Affairs, 19(4), 5–6.

Business Today Desk. (2021, December 30). SBI Card partners with Paytm for tokenising cards.

DPIIT. (2021). Ease of doing business report. Department for Promotion of Industry and Internal Trade.

Dubey, Y., & Bhandari, K. (2018). Interface between antitrust law and intellectual property in the payment systems market in India. Springer. https://doi.org/10.1007/978-981-13-1232-8_13

FE Bureau. (2020, November 24). Markets. Financial Express. https://www.financialexpress.com/market/only-27-indians-are-financially-literate-sebis-garg/2134842/

Fintech Convergence Council & Ernst & Young LLP. (2021 September). The winds of change: Trends shaping India’s FinTech sector. https://static.investindia.gov.in/: https://static.investindia.gov.in/s3fs-public/2021-11/ey-winds-of-change-india-fintech-report-2021.pdf

Gulamhuseinwala, I., Hatch, M., & Lloyd, J. (2017). EY fintech adoption index. EY.

Harasim, J. (2021). FinTechs, BigTechs and banks: When cooperation and when competition? Journal of Risk and Financial Management, 14(12), 614. https://doi.org/10.3390/jrfm14120614

Harshita Chawla vs WhatsApp Inc. And Others, 15 (Competition Commission of India August 18, 2020).

India, I. (2022, February 2022). BFSI – Fintech and financial services: Invest India. https://www.investindia.gov.in/sector/bfsi-fintech-financial-services

Ishwari, C. (2022, January 10). ETBFSI. https://bfsi.economictimes.indiatimes.com/news/fintech/indias-fintech-market-size-at-31-billion-in-2021-third-largest-in-world-report/88794336

Joo, M., Nishikawa, Y., & Dandapani, K. (2020). Cryptocurrency, a successful application of blockchain technology. Managerial Finance, 715–733. https://doi.org/10.1108/MF-09-2018-0451

Kagan, J. (2020, August 7). Financial technology: Fintech. https://www.investopedia.com/terms/f/fintech.asp

Kam Loon Loo, M. (2019). Enhancing financial inclusion in ASEAN: Identifying the best growth markets for Fintech. Journal of Risk and Financial Management, 12(4), 181.

Kapur, Y. (2021, July 26). India’s Fintech market: Growth outlook and investment opportunities. India Briefing by Dezan Shira and Associates. https://www.india-briefing.com/news/indias-fintech-market-growth-outlook-and-investment-opportunities-22764.html/

Keelery, S. (2021, Aug 24). Mobile internet and apps. https://www.statista.com/statistics/309019/india-mobile-phone-internet-user-penetration/#statisticContainer

Marke, A. (2018). Transforming climate finance and green investment with blockchains (1st Ed.). Elsevier Inc.

Marke, A., & Sylvester, B. (2018). Decoding the current global climate finance architecture (chapter 4). In M. e. al. (Eds.). eTransforming climate finance and green investment with blockchains (1st Ed., pp. 35–59). Elsevier.

Order under Section 26(1) of the Competition Act, 2002, 07 (Competition Commission of India November 9, 2020).

Qureshi, M. (2022, February 2). From ban to regulation, cryptocurrency’s journey so far in India. The Indian Express. https://indianexpress.com/article/technology/crypto/cryptocurrency-in-india-a-look-at-the-regulatory-journey-of-cryptocurrencies-7648767/

Rai, P. (2020, November 5). Guidelines on volume cap for third party app providers (TPAP) in UPI. NPCI.

Rajagopal. (2022). Critical insights on disruption in marketing strategies: Some perspectives in Latin American countries. In B. R. Rajagopal (Ed.), Managing disruptions in business. Palgrave studies in democracy, innovation, and entrepreneurship for growth (pp. 3– 31). Palgrave Macmillan.

Reserve Bank of India. (2017, October 11). Master direction on issuance and operation of prepaid payment instruments.

Segal, M. (2022, January 31). Sustainable bond issuance to surge past $1.3 trillion in 2022: Moody’s. https://www.esgtoday.com: https://www.esgtoday.com/sustainable-bond-issuance-to-surge-past-1-3-trillion-in-2022-moodys/

The Hindu (2022, February 2). Union Budget 2022 | ‘Green bonds’ target carbon neutrality. https://www.thehindu.com/business/budget/union-budget-2022-green-bonds-target-carbon-neutrality/article38360845.ece

Venkatachalam, P. (2020). Influence of FinTech companies on banking landscape an exploratory study in Indian context. Indian Institute of Management, Indore.

Walden, S. (2020, August 3). What is fintech and how does it affect how I bank? https://www.forbes.com/advisor/banking/what-is-fintech/