1Pooja Bhagavat Memorial Mahajana Post Graduate Centre, Mysore, Karnataka, India

2Kirloskar Institute of Management, Harihar, Karnataka, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Over the last two decades, the behavioural finance literature has extensively relied on personality type to explain the non-rational behaviour of investors. This study considers Dark triad (Machiavellianism, narcissism and psychopathy) to explain its influences on investment preference and perceived success in investment. A primary survey was conducted on 227 individuals who invest in securities. Dark triad was measured using 27 items Short Triad Scale (SD3). The data were analyzed using multinomial logistic regression. The investment preference was evaluated by asking the respondents about their preferred investment avenues, individuals were asked how they evaluate their investment success. Personality variables were grouped into high, average and low based on the mean responses to the items under each variable. The results of the study indicate that individuals with low and average levels of psychopathy and low-level narcissism preferred investing only in mutual funds, bonds and equity. It was also found that Machiavellianism, narcissism, psychopathy and dark triad, all have a significant impact on investment preference. The dark triad also significantly impacted success, especially for those individuals who perceived their investment strategy as ‘Very Successful’. This study helps financial advisors to suggest appropriate portfolios or investment avenues based on their personalities.

Dark triad, Machiavellianism, narcissism, psychopathy, investors, investment preference

Introduction

Despite abundant information availability, the persistent contrary behaviour of investors to the efficient market hypothesis (EMH) is due to varied behavioural patterns. Prospect theory by Kahneman and Tversky (1979) paved the way for an alternative explanation of market movement (other than EMH) by incorporating psychological factors. Before the prospect theory, Slovic (1972) found that personality is the core of decision-making, influencing risk-taking attitude. Behavioural finance research has explored the non-rational behaviour of the investor and is critical of the expected utility theory (Kahneman & Tversky 1992).

Personality is a combination of multiple inherent characteristics, traits, behaviour and values. Personality helps us to know the drivers of an individual’s motivation (Baker & Ricciardi, 2014). The knowledge of personality is useful to overcome the biases and emotions, which influence decision-making. It is also a useful tool in the hands of managers and advisors to enable effective investment decisions and thereby create portfolios. Within behavioural finance literature, the research can be classified into behavioural finance 1.0, till 1990. Prospect theory and the cause of deviations from cognitive thinking were the focus of this phase. Behavioural finance 2.0, (since 2000) expands the domain of finance beyond capital asset pricing, market efficiency and portfolios. In this stage, individual investors are not merely labelled as irrational.

Over the last two decades, numerous personality models were used for behavioural finance research, such as the Myers–Briggs Personality Model (MBTI) (1920), Eysenck’s Three-Factor Theory (1963), Five-Factor Model (FFM) of Personality (1985), Meta theoretic Model of Motivation and Personality (3M) (2000) and HEXACO six-factor model of personality (2000). These models were considered to explain the behaviour, the sentiment of investors and the ability to invest beyond rationality. Risk-taking, herding behaviour, biases, investor confidence, investment preference and various aspects surrounding the decisions of investors regarding investment were explained by considering personality traits. Paulhus and Williams (2002) simplified personality variables located by Five-Factor and Six-Factor Personality Models and called it the ‘Dark Triad’. It was a combination of personality variables, namely ‘Narcissism’, ‘Psychopathy’ and ‘Machiavellianism’ which are distinct but culminate into callous manipulation reflecting the dark side of personality.

These personality traits (variables) are referred to as ‘dark’ because of their malicious and mean qualities exhibiting cruelty and manipulation. Very high dark triad composite scores indicate that the person has artificially magnified self-views (narcissism), is capable of manipulation to meet their goals (Machiavellianism), and finally, lacks empathy or remorse (psychopathy). If an investor exhibits traces of a dark side, hypothetically he or she should favour a rational decision. Existing literature on decision-making suggests the same which is discussed in the following sections.

If studies can establish the extent of the dark side and its influence on financial and investment decisions, it will be interesting to explore the extent of emotional bias, herding behaviour and non-rational decision-making. In the given context, the following review throws light on the dark triad and risk-taking, and rationality in decision-making.

Irrationality Debate

First, let’s understand rationality in the context of behavioural finance. It means combining the existing information with multiple new information accessed or available and analyzing it to take an effective investment decision.

The excess market volatility in the 1980s questioned the complete reliance on EMH to explain and predict the market movement. The 1990s witnessed a major shift from the chart and time-series-based investment/market behaviour studies to studies using psychology frameworks to explain market movement anomalies (Singh et al., 2021). These studies have stressed the irrational decisions resulting in herd behaviour (Chang et al., 2000) of the investors, like Monday irrationality (Kamara, 1997) and weekend effect (Abraham & Ikenberry, 1994; Jaffe & Westerfield, 1985). It is also proved that investors often make irrational decisions under the influence of overconfidence (Kamara, 1997). Irrational decisions are fuelled by talks (word of mouth) and media (Shiller, 2002). It may be observed that the investors are manipulated and influenced by a plethora of factors other than investment-specific information.

On the contrary, this dark triad literature emphasizes that personalities with traces of psychopathy, narcism and Machiavellianism are themselves manipulators (Sekścińska & Rudzinska-Wojciechowska, 2020). In addition, past research indicates that the personality variables of dark triads influence rationality in decision-making. For instance, Osumi and Ohira (2010) opine that psychopathy can be rational even to accept unfair offers in some social situations. This is mainly due to insensitivity to unfairness.

A similar observation was made by Geis (1970) about Machiavellianism. In a Con Game, it is found that individuals with high Machiavellianism were better at convincing others. At different levels of the game, they sought cooperation and made more rational decisions.

Byrne and Worthy (2013) associate narcissism with an excellent ability to deal with ambiguous and misleading information while taking decisions. They are quick in filtering misleading information to take effective decisions having long-term utility.

Since the investors with subclinical dark triad are less explored in investment studies, the goal of this study is to illuminate the topic.

Dark Triad and Risk-Taking Behaviour

The dark triad studies have focused on multiple issues to inspect the influence of an individual's personality on the risk-taking behaviour of individuals which is not necessarily restricted to financial and investment risk. A glimpse of extreme risk-taking can be found in several studies, namely illicit relationships (Adams et al., 2014), gambling (Biolcati et al., 2015), road raging (Britt & Garrity, 2006) and range of criminal acts, such as bullying, drug abuse, high degree of deception and so on (Azizli et al., 2016). The findings in these studies may not necessarily apply to risk-taking in financial and investment decisions. However, the finding of these studies can indicate the influence of personality type even in the field of behavioural finance.

In previous research, all three personality variables of the dark triad have not exhibited similar risk/investment preferences. In financial and investment decision-making literature, frequently ‘Dark Triad’ is referred to explain the propensity of risk-taking in investment and gambling. Of the three, narcissism and psychopathy explained a higher tendency to take investing, financial and gambling risks (Sekścińska & Rudzinska-Wojciechowska, 2020). This was consistent with the studies in other fields. For instance, Azizli et al. (2016) found that high risk-taking may lead to deception, criminality and anti-social tendency which was observed mainly in narcissistic and psychopathy personality types but not in Machiavellism.

In financial and investment decisions, risk is inherent. Therefore, several studies focused on risk behaviour in the presence of the dark side, but these findings may not be conclusive as the previous research indicates that risk-taking or risk aversion is not a consistent phenomenon. The tendency keeps changing (Hanoch et al., 2006). Though personality trait is consistent and subjected to fewer modifications (Conley 1984), the risk behaviour is not consistent. To draw conclusive evidence on the influence of personality on risk behaviour, we need substantial research evidence. In the context of the dark triad, similar evidence is needed. We can find scanty studies focusing on dark triad and investment decisions. In a recent study, Suchanek (2021) focused on dark triad and behavioural biases and suggested more studies are needed. Sekścińska and Rudzinska-Wojciechowska (2020) suggested high risk-taking investors with high narcissism and psychopathy scores stay in the long run. Our study focused on how successful they perceived.

Dataset and Methodology

The goal of this study is to understand the influence of personality type on investment preference given dark triad personality variables. Further, the article inspects the influence of the dark triad personality and its constituents on perceived success as investors. The following section details the method of data collection, the scale used on the respondents and the methodology of data analysis.

Data Collection

The pilot study was administered to 87 respondents through offline mode. The questionnaire was administered to those individuals who invest in mutual funds, Indian stock markets, bonds and safe investment avenues like bank deposits and saving schemes, etc. Filter questions were also placed in the questionnaire to check this. Several stock broking companies were approached to find suitable respondents for this study.

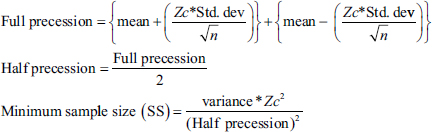

All 87 were found fit for further analysis. Reliability and validity analysis was performed on this data. The Cronbach’s alpha was greater than the satisfactory level of 0.70. Based on the pilot study, the sample size was determined using the precision method. This method is better suited for the calculation of sample sizes for survey-based studies (Verma & Verma, 2020).

where Zc = Z value for 95% confidence interval,

n is the sample of the pilot study.

Based on the above calculation, the sample size was found to be 218. As a part of the main study, the questionnaire was administered to 239 retail investors, in September 2021.

The criteria were set that, all individuals were investors in any of the securities, that is mutual funds, bonds, equity and bank fixed deposits. The survey was conducted using both offline mode and online mode (google forms were used). From the total of 239 responses, 6 questionnaires were partially completed, 2 questionnaires, each had 1 item, which was answered twice and 4 questionnaires had a single answer marked for all the items, and because of these reasons total of 12 respondents were rejected. Hence, only 227 responses were qualified for further study.

Dinić et al. (2019) suggest that dark triad gained popularity due to simplified tools. They observe that since 2002 multiple studies have added other dark aspects to extend the triad to sadism, spitefulness, greed, dependency and perfectionism. Simple tools were developed by Jonason and Webster (2010), Dark Triad Dirty Dozen (DTDD) and Short Dark Triad (SD3) by Jones and Paulhus (2014). This study considered the SD3 measurement tool. SD3 is an empirically tested scale to measure dark triad personality traits (Siddiqi et al., 2020).

The survey instrument used in this study consists of 38 items which were divided into three sections. The first section consisted of six demographic questions. Five questions in the second section are about the financial and investment assessment questions, and the third section had 27 questions regarding the dark triad. SD3 contains nine items each to measure narcissism, Machiavellianism and psychopathy. The SD3 instrument is the most comprehensive and widely used tool to measure the dark triad (Siddiqi et al., 2020), hence it has been adopted in this study.

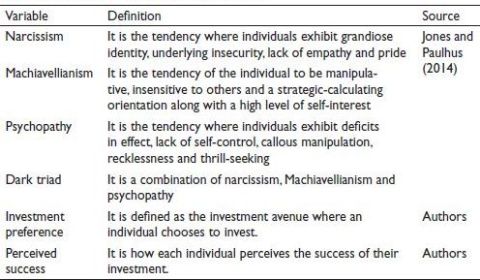

Table 1. Variable Name, Definition and Sources.

The variable used in this study is narcissism, Machiavellianism, psychopathy and dark triad, which are independent variables, and investment preference and perceived success are dependent variables. The source and definition of each variable are shown in Table 1.

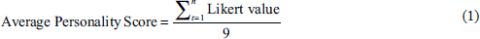

A 5-point Likert scale was used to measure all personality items. A score of personality was calculated as the mean score of individual responses for each item of the dark triad using Equation (1). Higher scores indicate a higher level of possessing that particular trait (Lopes & Yu, 2017).

Similarly, the dark triad’s personality score was calculated as the mean score of average personality scores of narcissism, Machiavellianism and psychopathy (Suchanek, 2021). Further, the investors were also classified into high, average and low narcissism, Machiavellianism, psychopathy and dark triad.

The respondents were asked to express their preferred investment avenues (mutual funds, equity, bond and safe investment avenues like bank deposits and saving schemes). Based on their investment preference, they are segregated into three main groups, namely high, average and low-risk investors. Equity preferred investors are high-risk investors, mutual fund investors are average-risk investors and bond investors are low-risk investors. Similarly, investors were asked to rate their level of perceived success, based on their investment decisions. Based on their perceived success they were grouped into unsuccessful, average successful and very successful.

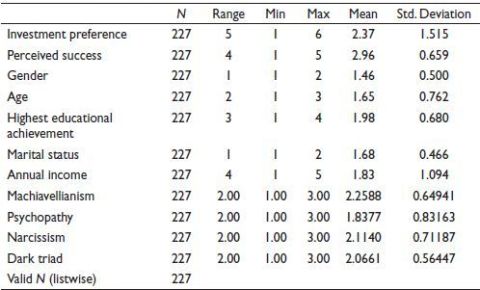

Table 2. Descriptive Statistics.

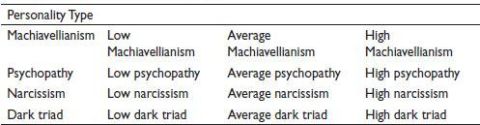

Table 3. Different Levels of Personality.

Table 2 shows the descriptive statistics of dark triads, investment preference and perceived success, that were computed. Subsequently, multinomial regression was applied and implemented. Multinomial regression analysis is appropriate in the case when numerous dependent variables are in categorical data and a single predictor variable (Bayaga, 2010). Hence, it is an apt method of analysis. Table 2 also shows the total number of responses included in this study (N = 227). Machiavellianism, psychopathy, narcissism and dark triad are the categorical data. Table 3 shows different levels of classification of personality for each category.

Based on the scores computed, the personality types are identified as shown in Table 3.

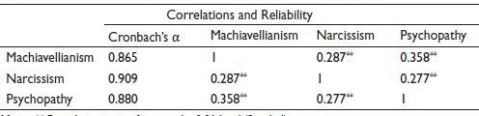

Table 4 shows the correlation between the dark triad, which is significant and moderately correlated. The reliability of the items which is measured using Cronbach’s α is well above the acceptable value (α > 0.70). The next section discusses the output of multinomial logistics regression analysis between the dark triad and investment preference, and the dark triad and perceived success on investment.

Table 4. Correlations, Reliability and Validity Among the Dark Triads.

Note: **Correlation is significant at the 0.01 level (2-tailed).

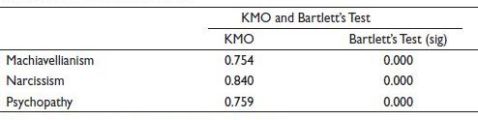

Table 5. KMO and Bartlett’s Test.

Note: **Correlation is significant at the 0.01 level (2-tailed).

Table 5 shows the Kaiser–Meyer–Olkin Measure (KMO) and Bartlett’s Test of sphericity statistics. KMO is a test for sample adequacy, which determines whether the sample is adequate to perform factor analysis. KMO is greater than 0.7 for all three traits. Bartlett’s Test of sphericity checks for normality of the multiple variables and examines if the correlation forms an identity matrix. Since Bartlett’s Test is significant, factor analysis could be performed.

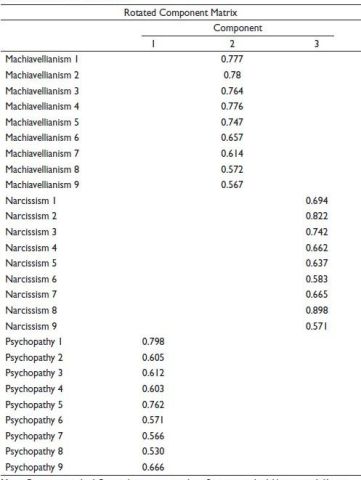

Table 6 shows the factor analysis result. The Varimax rotation was used to determine the rotated component matrix. The matrix clearly shows the three distinct groupings based on the trait. Each item measured its respective trait. The factor loading was all greater than the satisfactory level of 0.5. All the items were found to have a good level of factor loadings.

The multinomial logistics regression analysis between dark triad and investment preference has been applied by considering the dark triad as a categorical variable, to understand how different levels of dark triad influence investment preference, and then by considering the dark triad and perceived success on investment, to understand the influence of the dark triad on perception on the success of the investment.

Findings

The following sections describe the findings of multinomial logistic regression. The findings have been presented in two parts. The first is how different levels of personality influence risk-taking behaviours, through investment preference, and the latter is how the levels of personality influence their perceived level of success.

Table 6. Factor Analysis Result.

Note: Extraction method: Principal component analysis. Rotation method: Varimax with Kaiser normalization. aRotation converged in six iterations.

The Dark Triad and Investment Preference

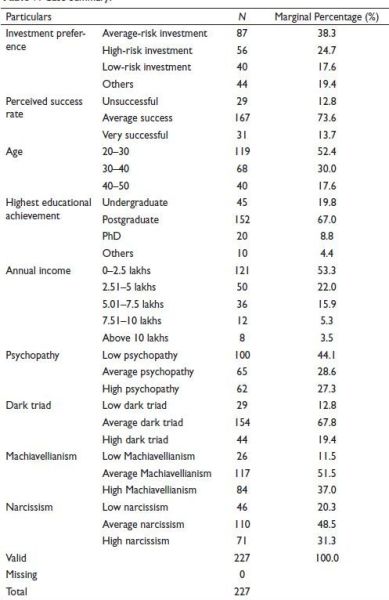

Multinomial logistic regression was applied by considering the dark triad, age, education and annual income as independent variables and investment preference as the dependent variable. Table 7 shows the case summary of the variables and data. This also shows the number of respondents in each category along with their total percentages.

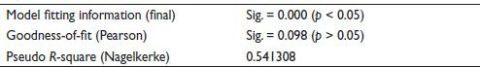

Table 8 shows the value of model fitting, goodness-of-fit and pseudo R-square model fitting information, indicating whether the variables added statistically significantly improve the model compared to the intercept alone. Since the p-value is below 0.05, the variables were added to improve the model. Goodness-of-fit (Pearson) indicates whether the data fits the model well. Since the p-value = 0.098 (p > 0.05), the data fits the model very well. Nagelkerke pseudo R-square is 0.541308, which means that all the independent variables considered in this analysis can explain the 54.1% variance in the dependent variable. The next section discusses the factors which influence various levels of investment preference.

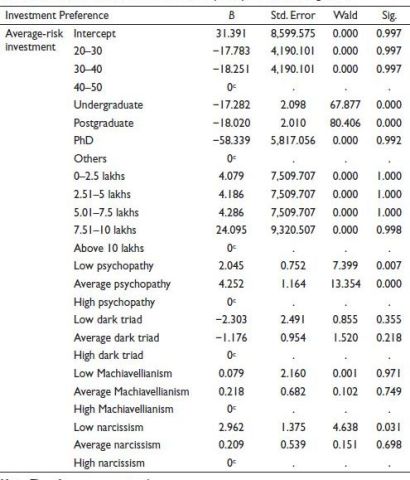

Predictor Variables and General Propensity to Take Average Risk

By considering age, education and income, along with the different levels of the dark triad, understanding its influence on the average risk taker is found. Output in Table 9 is interpreted as follows.

Individuals who are undergraduate and postgraduate prefer not to invest in risky market securities. Rather, they prefer to invest in other investments, such as bank deposits, saving schemes and so on (undergraduates, 17.28 times and post graduates 18.02 times more than average-risk investment). This means that postgraduate investors are more risk-averse than graduate investors. Other education qualifications, age and annual income tend to have no significant impact on average-risk investments.

Individuals who are characterized by low psychopathy and average psychopathy prefer to invest in average-risk investments, 2.045 times and 4.252 times, respectively, than other investments. It can be further noted that as the psychopathy level of investors increases, investors become more risk-takers. Low narcissism individuals prefer to invest 2.96 times more in average-risk investments than other investments. Another level of narcissism, Machiavellianism and dark triad was found to have no significant impact on preference to invest in average-risk investments.

Predictor Variables and General Propensity to Take High Risk

Table 10 discusses the propensity of individuals to take high risks. The individuals who earn between 0 and 7.5 lacs (three groups) prefer not to invest in risky market securities. Rather, they prefer to invest in other investments, such as bank deposits, saving schemes and so on (0–2.5 lakhs—15.98 times, 2.51–5 lakhs—16.08 times and 5.01–7.5 lakhs—14.028 times more than high-risk investment). This means that as an individual’s income increases, their capacity to take risks increases marginally. Education qualifications and age tend to have no significant impact on high-risk investments.

Table 7. Case Summary.

Table 8. Model Fitting, Goodness-of-Fit and Pseudo R-Square.

Table 9. Predictor Variables and General Propensity to Take Average Risk.

Note: The reference category is others.

Table 10. Predictor Variables and General Propensity to Take High Risk.

.jpg/10_1177_ijim_221148865-table10(2)__403x480.jpg)

Note: The reference category is others.

Individuals who are characterized by average psychopathy prefer to invest in high-risk investments, 2.77 times more than other investments. Low narcissism individuals prefer to invest 2.64 times more in high-risk investments than other investments. Another level of narcissism, Machiavellianism and the dark triad were found to have no significant impact on preference to invest in average-risk investments.

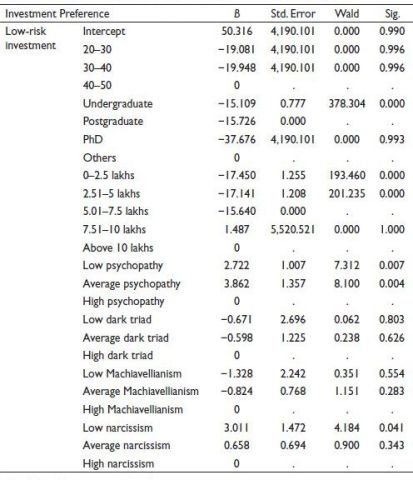

Table 11. Predictor Variables and General Propensity to Take Low Risk.

Note: The reference category is others.

Predictor Variables and General Propensity to Take Low Risk

Table 11 discusses the propensity of individuals to take low risks. The individuals who earn between 0 and 5 lakhs (two groups) prefer not to invest in low-risk market securities. Rather, they prefer to invest in other investments, such as bank deposits, saving schemes and so on (0–2.5 lakhs, 17.45 times, 2.51–5 lakhs 17.14 times more than high-risk investments). This means that as an individual’s income increases their capacity to take risks increases marginally, but this increase in preference for investing in low-risk investments is restricted only to non-income tax income group. Undergraduate respondents also prefer not to invest in low-risk market securities. Rather, they prefer to invest in other investments, such as bank deposits, saving schemes and so on (undergraduates, 15.109 times more than low-risk investments).

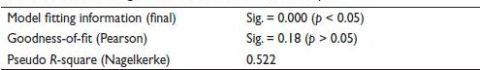

Table 12. Model Fitting, Goodness-of-Fit and Pseudo R-Square.

Individuals who are characterized by low and average psychopathy prefer to invest in low-risk investments, 2.77 times and 3.862 times, respectively, more than other investments. Low narcissism individuals prefer to invest 3.011 times more in high-risk investments than other investments. Another level of narcissism, Machiavellianism and the dark triad was found to have no significant impact on preference to invest in average-risk investments.

The Dark Triad and Perceived Success Rate

Multinomial logistic regression was applied by considering the dark triad, age, education and annual income as the independent variable and perceived success rate as the dependent variable. Based on how individual investors perceive their success in investments, they are classified into unsuccessful, average successful and very successful.

Table 12 shows the value of model fitting, goodness-of-fit and pseudo R-square model fitting information, indicating whether the variables added statistically significantly improve the model compared to the intercept alone. Since the p-value is below 0.05, the variables were added to improve the model. Goodness-of-fit (Pearson) indicates whether the data fits the model well. Since the p-value = 0.098 (p > 0.05), the data fits the model very well. Nagelkerke pseudo R-Square is 0.522, which means that all the independent variables considered in this analysis can explain the 52.20% variance in the dependent variable. The next section discusses the factors which influence various levels of perceived success rate.

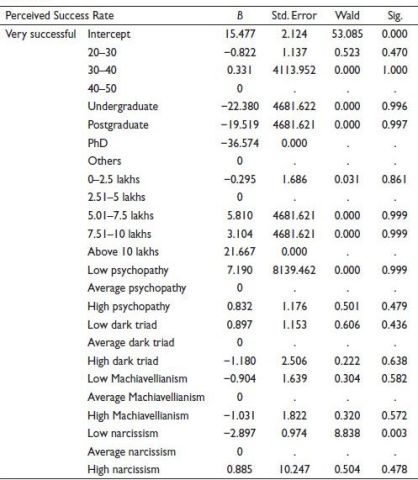

Predictor Variables and Propensity to Perceive Investment as Very Successful

Table 13 discusses the propensity of individuals to perceive their investment as very successful. Individuals with high narcissism perceive themselves to be unsuccessful, 2.897 times more than perceiving themselves as average successful. No other personality type was found to have a significant impact.

Table 13. Predictor Variables and Propensity to Perceive Investment as Very Successful.

Note: The reference category is: Unsuccessful.

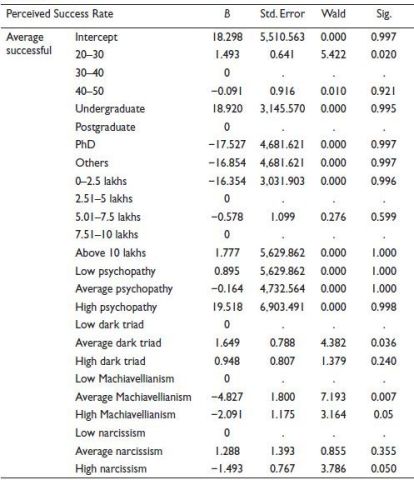

Predictor Variables and Propensity to Perceive Investment as Average Successful

Table 14 discusses the propensity of individuals to perceive their investment as average successful.

The individuals who are between 20 and 30 years of age perceive themselves to be average successful, 1.43 times more than they perceive as unsuccessful.

Individuals who are characterized by the average dark triad perceive themselves to be average successful 1.64 times more than others unsuccessful. On the contrary average and high, Machiavellianism perceives themselves to be unsuccessful, 4.827 and 2.091 times more than perceiving themselves as average successful. Even individuals with high narcissism perceive themselves to be unsuccessful, 1.493 times more than perceiving themselves as average successful.

Table 14. Predictor Variables and Propensity to Perceive Investment as Average Successful

Note: The reference category is: Unsuccessful.

Discussion and Conclusion

The literature in behavioural finance reinforced the point that the personality of investors has always been one of the key influencers on financial decision-making. One of the categories of personalities is the dark triads, which are the group of psychopathy, Machiavellianism and narcissism, often called negative personality traits (Alsheikh Ali, 2020). In this study, the relation between the dark triads and investment preference and perceived risk perception was explored.

First, a significant relationship between psychopathy, narcissism and risk was found. Individuals with these traits tend to be risk-takers. This substantiates the findings of Sekścińska and Rudzinska-Wojciechowska (2020). A partially similar result was obtained by Kornilova (2017) concerning psychopathy influencing risk. Contrary to findings of Kornilova (2017), no significant relationship between Machiavellianism and risk was found. The dark triad was also not found to have any significant impact on risk.

When success perception was considered as the dependent variable, Machiavellianism, narcissism and dark triad did have a significant impact. The perception of the individual with these traits was more towards being unsuccessful. Individuals with a dark triad tend to be more greedy (Sekhar et al., 2020). The expectations from the investment are influenced by dispositional greed, which makes individuals perceive that their investments are unsuccessful, which is evaluated by dispositional greed.

The findings of this study can be applied in a real-life context in designing a portfolio for individuals who exhibit dark triads. The financial managers can create a portfolio based on the dark triad with individual investor alignment.

Future studies can look into risk-taking behaviours in a different financial decision-making context. The study can be further expanded to understand if the individuals with dark triad personalities also experience the cycle of market emotion and its impact on financial decisions. Alternatively, Daniel and Titman (1999) note that irrational investors have little impact on market movements. On the contrary, they observe that traders and arbitrageurs are rational and have more impact on the market. More studies on traders and arbitrageurs are needed. The perceived success variable can be explored further as overconfidence bias, to understand whether the dark triad trait individual is prone to such predispositions. This study can also be simulated given a diverse profession as one of the independent variables.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Abraham, A., & Ikenberry, D. L. (1994). The individual investor and the weekend effect. The Journal of Financial and Quantitative Analysis, 29(2), 263–277.

Adams, H. M., Luevano, V. X., & Jonason, P. K. (2014). Risky business: Willingness to be caught in an extra-pair relationship, relationship experience, and the dark triad. Personality and Individual Differences, 66, 204–207.

Alsheikh Ali, A. S. (2020). Delinquency as predicted by dark triad factors and demographic variables. International Journal of Adolescence and Youth, 25(1), 661–675. https://doi.org/10.1080/02673843.2020.1711784

Azizli, N., Atkinson, B. E., Baughman, H. M., Chin, K., Vernon, P. A., Harris, E., & Veselka, L. (2016). Lies and crimes: Dark triad, misconduct, and high-stakes deception. Personality and Individual Differences, 89, 34–39. https://doi.org/10.1016/j.paid.2015.09.034

Baker, H. K., & Ricciardi, V. (Eds.). (2014). Investor behavior- The Psychology of financial planning and investing. Wiley. https://doi.org/10.16309/j.cnki.issn.1007-1776.2003.03.004

Bayaga, A. (2010). Multinomial logistic regression: Usage and Application in risk analysis. Journal of Applied Quantitative Methods, 5(2), 288–297.

Biolcati, R., Passini, S., & Griffiths, M. D. (2015). All-in and bad beat: Professional poker players and pathological gambling. International Journal of Mental Health and Addiction, 13, 19–32.

Britt, T. W., & Garrity, M. J. (2006). Attributions and personality as predictors of the road rage response. British Journal of Social Psychology, 45, 127–147.

Byrne, K. A., & Worthy, D. A. (2013). Do narcissists make better decisions? An investigation of narcissism and dynamic decision-making performance. Personality and Individual Differences, 55(2), 112–117.

Chang, E. C., Cheng, J. W., & Khorana, A. (2000). An examination of herd behaviour in equity markets: An international perspective. Journal of Banking and Finance, 24, 1651–1679.

Conley, J. J. (1984). The hierarchy of consistency: A review and model of longitudinal findings on adult individual differences in intelligence, personality and self-opinion. Personality and Individual Differences, 5(1), 11–25. https://doi.org/10.1016/0191-8869(84)90133-8

Daniel, K., & Titman, S. (1999). Market efficiency in an irrational world. Financial Analysts Journal, 55(6), 28–40. https://doi.org/10.2469/faj.v55.n6.2312

Dini?, B. M., & Jevremov, T. (2021). Trends in research related to the Dark Triad: A bibliometric analysis. Current Psychology, 40(7), 3206–3215.

Geis, F. L. (1970). The con game. In R. Christie & F. Geis, Studies in machiavellianism (pp. 130–160). Academic Press.

Hanoch, Y., Johnson, J. G., & Wilke, A. (2006). Domain specificity in experimental measures and participant recruitment: An application to risk-taking behavior. Psychological Science, 17(4), 300–304. https://doi.org/10.1111/j.1467-9280.2006.01702.x

Jaffe, J., & Westerfield, R. (1985). The week-end effect in common stock returns: The international evidence. The Journal of Finance, 40(2), 433–454.

Jonason, P. K., & Webster, G. D. (2010). The dirty dozen: A concise measure of the dark triad. Psychological Assessment, 22(2), 420–432. https://doi.org/10.1037/a0019265

Jones, D. N., & Paulhus, D. L. (2014). Introducing the Short Dark Triad (SD3): A brief measure of dark personality traits. Assessment, 21(1), 28–41. https://doi.org/10.1177/1073191113514105

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291.

Kahneman, D., & Tversky, A. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.s

Kamara, A. (1997). New evidence on the Monday seasonal in stock returns. The Journal of Business, 70(1), 63–84.

Kornilova, T. (2017). Role of the Dark Triad traits and attitude towards uncertainty in decision-making strategies in managers. Social Sciences, 6(6), 187. https://doi.org/10.11648/j.ss.20170606.17

Lopes, B., & Yu, H. (2017). Who do you troll and Why: An investigation into the relationship between the Dark Triad Personalities and online trolling behaviours towards popular and less popular Facebook profiles. Computers in Human Behavior, 69–76. https://doi.org/10.1016/j.chb.2017.08.036

Osumi, T., & Ohira, H. (2010). The positive side of psychopathy: Emotional detachment in psychopathy and rational decision-making in the ultimatum game. Personality and Individual Differences, 49(5), 451–456.

Paulhus, D. L, & Williams, K. M. (2002). The Dark Triad of personality: Narcissism, Machiavellianism, and psychopathy. Journal of Research in Personality, 36, 556–563.

Sekhar, S., Uppal, N., & Shukla, A. (2020). Dispositional greed and its dark allies: An investigation among prospective managers. Personality and Individual Differences, 162(March), 110005. https://doi.org/10.1016/j.paid.2020.110005

Sek?ci?ska, K., & Rudzinska-Wojciechowska, J. (2020). Individual differences in Dark Triad Traits and risky financial choices. Personality and Individual Differences, 152(August 2019), 109598. https://doi.org/10.1016/j.paid.2019.109598

Shiller, R. J. (2002). From efficient market theory to behavioral finance (Cowles Foundation Discussion Papers No 1385). Cowles Foundation for Research in Economics. Yale University. https://EconPapers.repec.org/RePEc:cwl:cwldpp:1385

Siddiqi, N., Shahnawaz, M. G., & Nasir, S. (2020). Reexamining construct validity of the Short Dark Triad (SD3) scale. Current Issues in Personality Psychology, 8(1), 18–30. https://doi.org/10.5114/cipp.2020.94055

Singh, J. E., Babshetti, V., & Shivaprasad, H. N. (2021). Efficient market hypothesis to behavioral finance: A review of rationality to irrationality. Materials Today: Proceedings. https://doi.org/10.1016/j.matpr.2021.03.318

Slovic, P. (1972). Psychological study of human judgment?: Implications for investment decision making. The Journal of Finance, 27(4), 779–799.

Suchanek, M. (2021). The dark triad and investment behavior. Journal of Behavioral and Experimental Finance, 29, 100457. https://doi.org/10.1016/j.jbef.2021.100457

Verma, J. P., & Verma, P. (2020). Determining sample size and power in research studies. In Determining sample size and power in research studies. Springer Singapore. https://doi.org/10.1007/978-981-15-5204-5