1Entrepreneurship Development Institute of India, Gandinagar, Gujarat, India

2Department of Policy Advocacy, Knowledge & Research, Entrepreneurship Development Institute of India, Gandinagar, Gujarat, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This article is a systematic review and a critical examination of 61 journal articles (published from 1996 to 2019) on the family business internationalisation (FBI). The purpose of this article is to identify the key factors that have an impact on the FBI. The result of a systematic review of factors affecting the growth of FBIs is presented and utilises both the Australian Business Deans Council ranking and H-index to objectively demonstrate all the factors that can have an impact on family business to internationalise. The key findings reveal a total of five factors out of 108 factors, which were mentioned in minimum of four papers. Using the most influential articles identified in the analysis, the article concludes with six factors family ownership, role of networks, mindset of the family founder, cross-generational involvement, family involvement which needs to be controlled by family business if they want to achieve internationalisation.

Literature review, family business (FB), internationalisation, factors, family business internationalisation (FBI)

Introduction

According to Sciascia et al. (2010), family business internationalisation (FBI) is becoming a hot issue in the academic community. It is becoming increasingly important for financial institutions to expand their operations outside of local markets as the global economy becomes more interconnected. The FBI may be distinct from that of a business with a different form of ownership (Fernández & Nieto, 2006; Graves & Thomas, 2004, 2006; Johanson & Vahlne, 2009). As a result, it’s critical to isolate family businesses (FBs) from other forms of businesses when considering internationalisation.

About 20 years ago, the early study on the FBI was published in academic publications; now is the moment to examine the past and make any necessary improvements for the future. The following research questions will be addressed in this article: (a) What significant factors impact the FBI? (b) Which theories and approaches are used to globalise FBs? The solutions to these questions will be uncovered following an examination of prevalent scholarly publications.

Despite the increasing volume of information on the FBI, this undeveloped topic lacks compelling knowledge that connects the disparate findings of earlier research. To overcome this issue, 61 English-language, peer-reviewed journal articles published between 1991 and 2019 and originating from peer-reviewed journals were evaluated in depth. It is well established that this subject is thematically and methodologically heterogeneous, fractured and incoherent, and that it encompasses multiple periodicals. Due to this impracticality, a systematic approach to article selection and a narrative review are utilised to perform a literature review. Baumeister and Leary (1997) said that narrative review is particularly suited for connecting disparate disciplines of research in order to synthesise the literature efficiently.

After analysing the chosen literature, it is determined that the findings that impact family ownership and other elements of internationalisation are vastly dissimilar. Despite the fact that some scholars contend that family ownership and engagement have a good effect on internationalisation (Carr & Bateman, 2009; Zahra, 2003), others contend that family ownership hinders the internationalisation process (Graves & Thomas, 2006; Fernández & Nieto, 2005). Several essential factors support the FBI, whilst others hinder the process.

This article makes a stronger contribution. An extensive review of the field is provided at the outset of this research. The first comprehensive summary of studies on FBI was given by Kontinen and Ojala (2010). This study piece is an examination of the papers released up until 2019 and is a continuation of the systematic inquiry. Since there has been a significant growth in study in this area since that time, this analysis offers a more thorough analysis of the variables affecting the FBI.

The remainder of this article is organised as follows: Following the description of how the literature is picked, the overall conclusions of the entire sample are charted. Following is a summary of the results contained in the literature sample. The article concludes with concluding remarks and suggestions for future research based on the results of the thematic analysis used to identify the important components.

Methodology

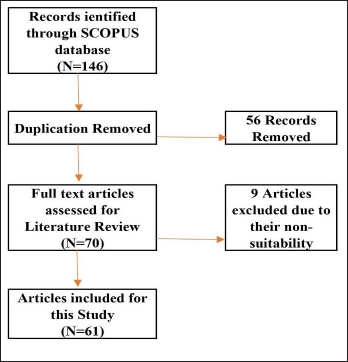

This article’s systematic literature review method is based on PRISMA. In this review, the SCOPUS database was employed. SCOPUS contains the majority of studies pertaining to family businesses. The keywords were determined based on our past knowledge and group brainstorming. The literature required for the purpose of our research is chosen using a systematic selection procedure comparable to that of David and Han (2004) and Newbert (2007), but with variations.

The selection norms are the following:

Exclusion criteria included the absence of an Australian Business Deans Council (ABDC) ranking, papers lacking FBI features and publishing type (anonymous publications and book reviews). Then, 70 papers were deemed eligible after being filtered by the aforementioned criteria, and after reviewing the entire texts, 61 articles were selected for evaluation. The PRISMA flowchart in Figure 1 illustrates step-by-step removal and inclusion of SCOPUS papers. The authors analysed the content of all selected articles using a predetermined classification method. The data are represented by the following headings:

Huge attention and research efforts have been made over the last 20 years. Until now, policymakers, practitioners and academics have been completely oblivious to how the FBI process began and progressed. It’s fascinating to learn about the important elements that influence the internationalisation process, as well as what resources need be purchased and what methods should be implemented to accelerate the process. The table-by-table findings of the literature review are quoted in the next paragraphs.

Figure 1. Prisma Flow Diagram.

Table 1 details the 61 studies that we have used for our systematic literature review (SLR), including their data collecting technique, study type (quantitative or qualitative), nation, industry, sample size, number of citations, ABDC category and H-index. Table 1 will help you understand the type of data collection method they used to reach this conclusion, the context in which the research was conducted, any specific industry if the research was conducted industry-specifically, the samples they collected for their research and the findings of their research.

In addition, the top 10 papers by total number of citations are displayed. Gallo and Sveen (1991); Fernández and Nieto (2005); Gallo and Pont (1996); Kontinen and Ojala (2010); Graves and Thomas (2006); Davis and Harveston (2000); Scisscia et al. (2012); Pukall and Calabr (2014); Okoroafo (1999); and Claver et al. (1999) are the authors of the top ones (2009). This will aid in identifying the top 10 publications containing significant research on the specified topic. The influence of these 10 works is the greatest; hence, the number of citations must be specified. This will also aid in identifying the primary writers whose research has a bearing on this topic.

The selected articles have opted for qualitative, quantitative and literature review approaches. A total of 65% of the 61 chosen papers utilised quantitative analysis, while 13% utilised single or multiple case study analysis. Ten papers were literature reviews, with two utilising systematic literature reviews and one employing a hybrid technique. This demonstrates that this topic of study is not new and that it must be condensed to make a substantial addition to the existing literature. The majority of research has been conducted within the past 3 years (22 out of 61). This demonstrates the significance of this study field in the present day. In addition, these publications have received little citations due to the limited time they have for the same.

As data collecting methods, secondary data collection and survey questionnaires predominated. In fact, 17 papers relied only on survey data, while 16 relied on secondary data sources. Seven of the eight qualitative publications utilised interviews and secondary data sources. The data set used to analyse the FBI was compiled from 18 nations, 11 of which are in Europe. More data were gathered in Spain (12 databases), the United States (9 databases), Germany (7 databases), Italy (5 databases) and Taiwan (5 databases).

The survey sample sizes ranged from 82 to 9731 businesses. In studies employing qualitative research methodologies, the number of instances ranged from one to eight. Twelve examples of the 22 articles that examined manufacturing enterprises and businesses from a variety of industries comprised the 22 articles evaluated. This recommended that non-manufacturing industry-specific studies are necessary, given the possibility of disparities between manufacturing and service businesses.

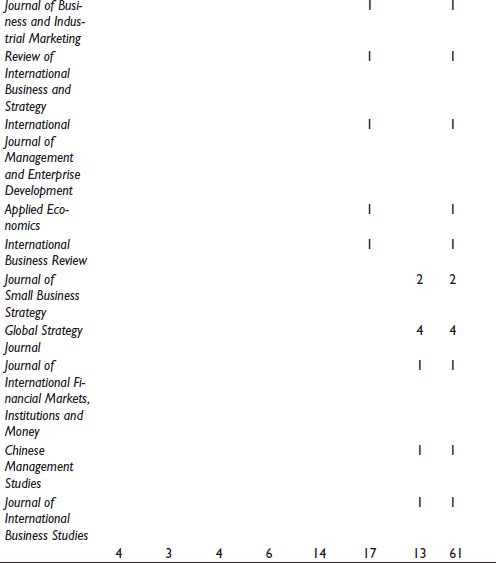

The ABDC ranking and H-index will assist the researchers in determining which journal is the most widely read in this specific topic. As the criterion for selection was ABDC ranking, it is also displayed for each of the 61 selected papers. This will assist justify the selection of research publications for our study. The majority of the selected articles are A-category (31 articles), followed by B-category (7 articles) and C-category (22 articles).

Table 2 depicts the internationalisation-related ideas employed in the examined studies. Socioemotional wealth theory has been utilised in 14 publications. In 11 studies, the Uppsala model of internationalisation was employed. The resource-based perspective on internationalisation was implemented in six research based on management competencies. Despite being the most important aspect in FBI, the network theory of internationalisation was employed in only two research works. Numerous papers have shown internationalisation briefly in their study, albeit without employing internationalisation theories in their conceptual frameworks. Given the complexity of the internationalisation process, there is a need for research that adopts a more comprehensive perspective (Bell et al., 2003; Johanson & Vahlne, 2003). Only one article utilised Dunning’s eclectic paradigm.

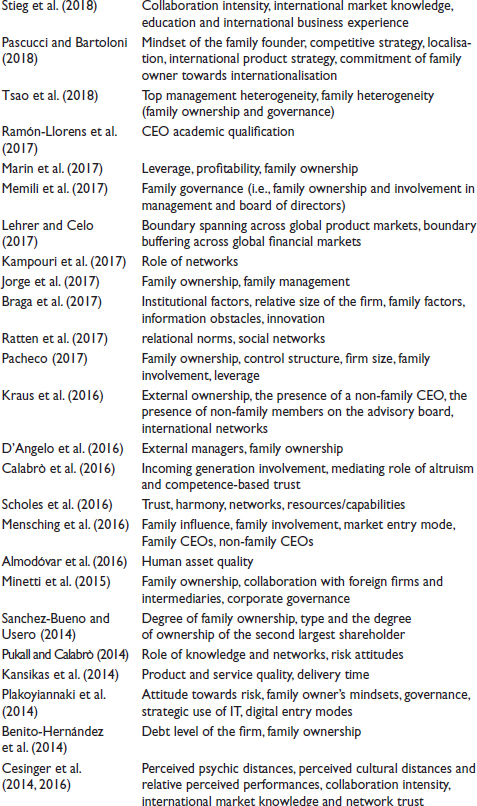

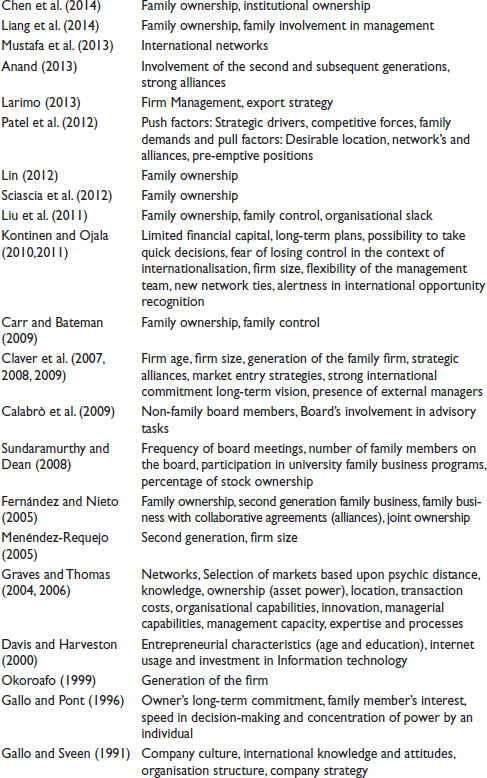

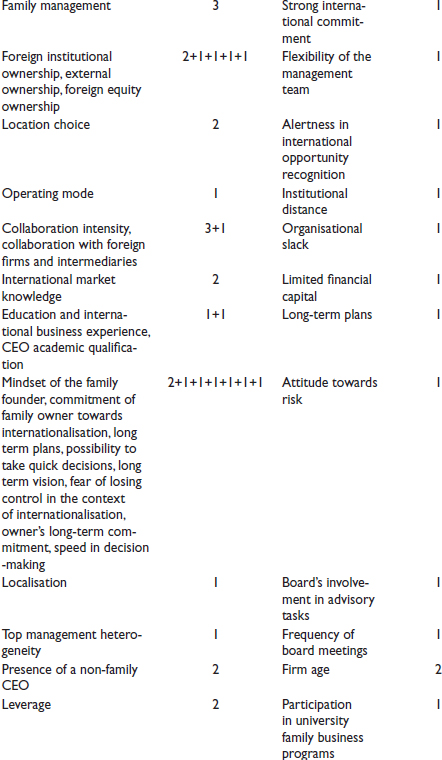

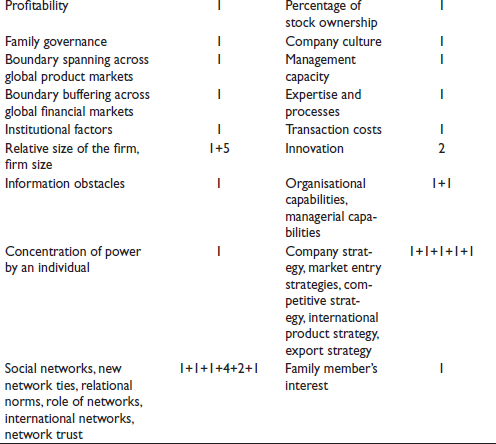

Table 3 displays the criteria cited in each of the 61 studies that were chosen after careful consideration. These 61 articles focus mostly on elements that might have a favourable or negative impact on the globalisation of FBs. This helps to understand the influence of many factors on the FBI. All of these variables, which are responsible for the FBI, must be investigated in depth. All of these variables might eventually serve as the foundation for any FB.

Table 4 is the centre piece of our research since it contains all of the variables in a single location. It demonstrates how numerous variables hinder or facilitate the FBI. This also aids comprehension of how different research have focused on contrasting aspects to demonstrate their impact on FBI.

The articles which did not use internationalisation theories, the largely used agency theory (9 articles), stewardship theory (6 articles) and social capital theory (3 articles). Additionally, theory of resources and capabilities, transaction cost theory, pecking order theory and network theory were employed (2 articles each). Institutional theory, upper-echelon theory, strategic decision process theory, stagnation theory, stage model theory, organisational capabilities perspective, willingness and ability framework, global niche business model and gravity model were also utilised (1 article each). Overall, it suggests that amalgamations of quite a few theories, with the exception of internationalisation theories, dominated studies on FBI. This might be considered a research gap that prompted the present investigation. Though, these prior researches make the study of FBI disjointed, and the assessment of findings challenging. All in all, the formation and the reasoning of the theoretical frameworks used were contentious: There was lack of relevant account of the theories that were seen as vital, and there was often no explanation of whether the framework enforced was built on ‘theories’ or whether the foundation was laid on perspectives. Moreover, the theory tended to be ineffectively used in the substantial study of the data.

Annexure 1 and Table 2 portray the distribution of articles. There are nine articles on FBI from the Journal Family Business Review.

Annexure 2 displays several factors and the number of articles in which they have been referenced in order to identify the most influential elements on the FBI. The next stage is to identify the elements that have the greatest influence on the FBI. To accomplish so, we must identify the elements that have been stated by researchers at various times. This table displays the various elements and the frequency with which they are cited in various publications.

The factors that appear in the majority of studies demonstrate their prominence in comparison to other variables. Consequently, these elements may be generalised based on their recurrence. In contrast, the characteristics that were just described in a single publication are more context-dependent and cannot be generalised to the whole research field.

The theme that has formed after assessing all key components is shown in Table 4. The final phase is to identify significant elements by identifying repeated factors stated in at least six separate publications. After that, these aspects are put together in order to establish a common theme.

The topics that emerged from the thematic analysis were family ownership, the role of networks, the family founder’s mindset, cross-generational involvement and family involvement. These five characteristics were shown to have the greatest influence on the FBI. Therefore, all researchers and FBs must examine these variables as the foundational components. They must be given serious consideration since they might inhibit or help the FBI.

Discussion

After conducting a literature analysis, we have identified around 108 elements that can have an effect on the FBI. We are attempting to highlight crucial characteristics that the majority of researchers have deemed relevant. We determined the following six elements, which we refer to as ‘key factors’.

Family Ownership

Fernández and Nieto (2005) explain a negative association between family ownership and internationalisation, as assessed by export activity. Sanchez-Bueno and Usero (2014) and Benito-Hernández et al. (2014) support the views of Fernández and Nieto that the degree of family ownership has a negative effect on the degree of international diversification, and Liu et al. (2011) discovered that the family ownership affects the international involvement of high-tech firms. Claver et al. (2007) demonstrate an inverted U-shaped relationship, that is, a non-linear relationship between family ownership and international entrepreneurship; this suggests that international entrepreneurship is maximised when family ownership levels are moderate, whereas Liang et al. (2014) suggest that family ownership depicts a U-shaped relationship with regard to internationalisation.

According to Tsao et al. (2018), family ownership is highly connected with international tendency. Lin (2012) finds a direct link between family ownership and MNC internationalisation velocity, as well as an indirect link between family ownership and internationalisation scope and rhythm. According to Minetti et al. (2015), family ownership improves the likelihood of enterprises exporting, implying that family ownership has an impact on a firm’s internationalisation process. Jorge et al. (2017) backed up Minetti, Murro and Zhu’s argument that family ownership is linked to family company internationalisation. Family ownership and control individualistically explain the breadth of family SMEs, according to D’Angelo et al. (2016). Internationalisation may be maximised if both the management team and the ownership structure are open to outside input. It is only possible to increase internationalisation. According to Evert et al. (2018), increasing family ownership reduces the likelihood of initial international entrance. Chen et al. (2014) disagree with previous findings, claiming that FB would internationalise if there is a high level of family ownership. Ray et al. (2018) backed up Chen, Hsu and Chang’s findings that businesses dominated by family owners do not choose internationalisation owing to high ownership. Marin et al. (2017) discovered that FBs with a higher level of family engagement in their ownership performed better in their internationalisation process.

Role of Networks

Graves and Thomas (2004) claim that FB prefer not to interact with other enterprises. Access to resources and competencies essential for internationalisation, as well as access to foreign relationships and market expertise, are both favourable factors on family company internationalisation. According to Coviello and McAuley (1999), networks are critical in the process of FBI, and the inclination to internationalise is reliant on the set of network links. According to Mustafa et al. (2013), worldwide networks are the driving force behind Singaporean family enterprises’ internationalisation. Scholes et al. (2016) also support the idea that networks help small FBs to internationalise. According to the findings, social networks and relational norms are important for increasing FB international performance (Ratten et al., 2017). International chances are acknowledged by developing new formal networks rather than family or informal networks, according to Kontinen and Ojala (2011). According to Cesinger et al. (2016), high network trust aids in the FBI. International networks were discovered to have a beneficial association with the FBI (Kraus et al., 2016). Memili et al. (2017) discovered that internationalisation and family ownership had an inverted U-shaped connection. Fang et al. (2018) conducted research to better understand how different sorts of family owners affect internationalisation. Based on the updated Uppsala model (Pukall & Calabr, 2014), an integrative theoretical model was created, incorporating the frameworks of network view and SEW. The findings back with previous research by Kampouri et al. (2017) that found a link between network role and internationalisation process.

Mindset of the Family Founder

According to Pascucci and Bartoloni (2018), a founder’s attitude towards FBI is determined by his or her devotion. The author’s findings reflect previous research showing the attitude of the family founder is critical in the internationalisation process. If the entrepreneur takes a worldwide strategy, the degree of internationalisation is favoured since it affects the scale and time dimension of the company. According to Gallo and Pont (1996), FBI is driven by the owner’s long-term commitment and rapidity in making decisions. Plakoyiannaki et al. (2014) discovered that the attitudes of family owners had an impact on international paths. Claver et al. (2009) found that long-term vision is linked to entrance modalities that need more international commitment. Fear of losing control and long-term planning are variables impacting FBI, according to Kontinen and Ojala’s (2010) research.

Cross-generational Involvement

According to Okoroafo (1999), there is a lower likelihood of a FB becoming worldwide if it is not done in the first and second generations. Foreign market entry should be more aggressive for first- and second-generation FB owners. According to Menéndez-Requejo (2005), if a FB is in its second generation, it has a better chance of becoming internationalised. Fernández and Nieto (2005) agree with Menéndez-Requejo’s findings that the presence of the second and subsequent generations in the family SME encourages international engagement. According to Claver et al. (2007), the emergence of FB has a substantial impact on the formation of worldwide strategic alliances. According to Anand (2013), the key cause for FBs worldwide development is the engagement of the second and following generations in management decision-making. According to Calabrò et al. (2016), the engagement of future generations influences the decision to utilise and explore foreign prospects. Internationalisation is aided by cross-generational engagement in the firm, according to Dou et al. (2019).

Family Involvement

Family engagement in management has an inverted U-shaped association with the chance of internationalisation, according to Liang et al. (2014). Memili et al. (2017), on the other hand, found that the first two had a U-shaped association. Family engagement lowers the chances of first-time foreign admission (Evert et al., 2018). According to Mensching et al. (2016), the greater the family engagement in active management, the more successful the internationalisation plan will be. According to Pacheco (2017), family engagement has both a negative and positive impact on internationalisation. According to De Massis et al. (2018), family engagement plays a role in the junction of international business and family firm heterogeneity.

Synthesis

Based on a thorough literature study, the theme analysis in this research tried to assess the factors that have a significant influence on FBI: (1) review of previous research, (2) H-index and ranking system (ABDC) and (3) thematic analysis to identify emergent themes from the many variables were all used in the study and assessment of factors.

To begin, all articles pertaining to FBI were gathered from the relevant source SCOPUS, which includes key research in SMEs. Following that, these publications went through a series of processes to ensure that only the most relevant studies were selected for our systematic literature review. Second, the articles were assigned according to their H-index and ABDC score. We came up with 61 papers out of a total of 146 papers after a lengthy screening procedure. These 61 publications were given important details such as the paper’s methodology, the nation in which the study was conducted, the industry referenced in the research, sample size, data gathering technique, citations, H-index and ABDC rank. Finally, we mentioned the top 10 publications with the most effect on this topic.

Finally, thematic analysis was used to group elements into five categories: family ownership, network role, family founder mindset, cross-generational involvement and family involvement. We used three tables to conduct our investigation. The first table listed the factors from all of the papers that had been chosen. The second table listed all of the variables along with the number of publications in which they were discussed. The third and final table aids in the selection of five elements that have the greatest overall influence. Furthermore, we devised five distinct themes. Only by properly monitoring these six important aspects in FB will they be able to accomplish FBI.

Implications and Future Research

Many studies have been conducted in order to better understand the elements that influence FBI. Nonetheless, there was a lack of factor compilation, and the corpus of information failed in providing the most important elements. This research bridged the gap, with the findings of this publication contributing by pinpointing significant factors in that body of work.

Many review studies on the FBI have attempted to summarise and synthesise the contradicting opinions, according to Kontinen and Ojala (2010) and Pukall and Calabro (2014). Because they lack meta-analytical skills, these research pieces are unprofessional in offering definite closure. This problem can only be answered by employing meta-analytic approaches to collate data on the FBI from a variety of studies and nations, resulting in a more comprehensive and concise understanding than any one study (data set) can provide. Furthermore, research must address two major concerns: the absence of measurement equivalence for both the FB and internationalisation constructs, as well as the lack of contextualisation of theories utilised to analyse FBI in previous studies.

The influence of family management heterogeneity on FBI should be investigated. Future research should look at the combined and independent effects of family engagement in business management and ownership. Future research should distinguish between different types of internationalisations for different FBs, such as whether they purposefully build networks for the aim of internationalisation or if they internationalise because of existing networks. A detailed investigation of the learning process that occurs during networking activities for internationalisation on the factors and effects of international opportunity recognition of FBs is also required. In the future, the researchers may consider other interpersonal elements that influence internationalisation, such as family values and interactions among family members. The risk preferences of the owner/manager may also be investigated to see whether they mediate. The study might also look at whether risk preferences of owners/managers influence the relationship between family ownership and internationalisation efforts. A full examination of family and ownership arrangements, as well as their impact on various types of internationalisations, would be intriguing.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Almodóvar, P., Verbeke, A., & Rodríguez-Ruiz, Ó. (2016). The internationalization of small and medium-sized family enterprises: The role of human asset quality. Journal of Leadership & Organizational Studies, 23(2), 162–174.

Anand, R. (2013). Internationalisation of the small and medium family firm in Japan. International Journal of Business and Globalisation, 11(2), 117–135.

Baumeister, R. F., & Leary, M. R. (1997). Writing narrative literature reviews. Review of General Psychology, 1(3), 311–320.

Bell, J., McNaughton, R., Young, S., & Crick, D. (2003). Towards an integrative model of small firm internationalisation. Journal of International Entrepreneurship, 1(4), 339–362.

Benito-Hernandez, S., Lopez-Cozar-Navarro, C., & Priede-Bergamini, T. (2014). Factors determining exportation and internationalization in family businesses: The importance of debt. South African Journal of Business Management, 45(1), 13–25.

Braga, V., Correia, A., Braga, A., & Lemos, S. (2017). The innovation and internationalisation processes of family businesses. Review of International Business and Strategy, 27(2), 231–247.

Calabrò, A., Brogi, M., & Torchia, M. (2016). What does really matter in the internationalization of small and medium-sized family businesses? Journal of Small Business Management, 54(2), 679–696.

Calabrò, A., Mussolino, D., & Huse, M. (2009). The role of board of directors in the internationalisation process of small and medium sized family businesses. International Journal of Globalisation and Small Business, 3(4), 393–411.

Carr, C., & Bateman, S. (2009). International strategy configurations of the world’s top family firms. Management International Review, 49(6), 733–758.

Cesinger, B., Hughes, M., Mensching, H., Bouncken, R., Fredrich, V., & Kraus, S. (2016). A socioemotional wealth perspective on how collaboration intensity, trust, and international market knowledge affect family firms’ multinationality. Journal of World Business, 51(4), 586–599.

Chen, H. L., Hsu, W. T., & Chang, C. Y. (2014). Family ownership, institutional ownership, and internationalization of SMEs. Journal of Small Business Management, 52(4), 771–789.

Claver, E., Rienda, L., & Quer, D. (2007). The internationalisation process in family firms: Choice of market entry strategies. Journal of General Management, 33(1), 1–14.

Claver, E., Rienda, L., & Quer, D. (2008). Family firms’ risk perception: Empirical evidence on the internationalization process. Journal of Small Business and Enterprise Development, 15(3), 457–471.

Claver, E., Rienda, L., & Quer, D. (2009). Family firms’ international commitment: The influence of family-related factors. Family Business Review, 22(2), 125–135.

Coviello, N. E., & McAuley, A. (1999). Internationalisation and the smaller firm: A review of contemporary empirical research. MIR: Management International Review, 39(3), 223–256.

D’Angelo, A., Majocchi, A., & Buck, T. (2016). External managers, family ownership and the scope of SME internationalization. Journal of World Business, 51(4), 534–547.

David, R. J., & Han, S. K. (2004). A systematic assessment of the empirical support for transaction cost economics. Strategic Management Journal, 25(1), 39–58.

Davis, P. S., & Harveston, P. D. (2000). Internationalization and organizational growth: The impact of internet usage and technology involvement among entrepreneur-led family businesses. Family Business Review, 13(2), 107–120.

De Massis, A., Frattini, F., Majocchi, A., & Piscitello, L. (2018). Family firms in the global economy: Toward a deeper understanding of internationalization determinants, processes, and outcomes. Global Strategy Journal, 8(1), 3–21.

Dou, J., Jacoby, G., Li, J., Su, Y., & Wu, Z. (2019). Family involvement and family firm internationalization: The moderating effects of board experience and geographical distance. Journal of International Financial Markets, Institutions and Money, 59, 250–261.

Evert, R. E., Sears, J. B., Martin, J. A., & Payne, G. T. (2018). Family ownership and family involvement as antecedents of strategic action: A longitudinal study of initial international entry. Journal of Business Research, 84, 301–311.

Fang, H., Kotlar, J., Memili, E., Chrisman, J. J., & De Massis, A. (2018). The pursuit of international opportunities in family firms: Generational differences and the role of knowledge-based resources. Global Strategy Journal, 8(1), 136–157.

Fernández, Z., & Nieto, M. J. (2005). Internationalization strategy of small and medium-sized family businesses: Some influential factors. Family Business Review, 18(1), 77–89.

Ferna?ndez, Z., & Nieto, M. J. (2006). Impact of ownership on the international involvement of SMEs. Journal of International Business Studies, 37(3), 340–351.

Gallo, M. A., & Pont, C. G. (1996). Important factors in family business internationalization. Family Business Review, 9(1), 45–59.

Gallo, M. A., & Sveen, J. (1991). Internationalizing the family business: Facilitating and restraining factors. Family Business Review, 4(2), 181–190.

Graves, C., & Thomas, J. (2004). Internationalisation of the family business: A longitudinal perspective. International Journal of Globalisation and Small Business, 1(1), 7–27.

Graves, C., & Thomas, J. (2006). Internationalization of Australian family businesses: A managerial capabilities perspective. Family Business Review, 19(3), 207–224.

Hennart, J. F., Majocchi, A., & Forlani, E. (2019). The myth of the stay-at-home family firm: How family-managed SMEs can overcome their internationalization limitations. Journal of International Business Studies, 50(5), 758–782.

Ilhan-Nas, T., Okan, T., Tatoglu, E., Demirbag, M., Wood, G., & Glaister, K. W. (2018). Board composition, family ownership, institutional distance and the foreign equity ownership strategies of Turkish MNEs. Journal of World Business, 53(6), 862–879.

Jimenez, A., Majocchi, A., & Piana, B. D. (2019). Not all family firms are equal: The moderating effect of family involvement on the political risk exposure of the foreign direct investment portfolio. Preliminary evidence from Spanish multinational enterprises. Thunderbird International Business Review, 61(2), 309–323.

Johanson, J., & Vahlne, J. E. (2003). Business relationship learning and commitment in the internationalization process. Journal of International Entrepreneurship, 1(1), 83–101.

Jorge, M., Couto, M., Veloso, T., & Franco, M. (2017). When family businesses go international: Management sets the path. Journal of Business Strategy, 38(1), 31–38.

Kampouri, K., Plakoyiannaki, E., & Leppäaho, T. (2017). Family business internationalisation and networks: emerging pathways. Journal of Business & Industrial Marketing, 32(3), 357–370.

Kano, L., & Verbeke, A. (2018). Family firm internationalization: Heritage assets and the impact of bifurcation bias. Global Strategy Journal, 8(1), 158–183.

Kansikas, J., Huovinen, J., & Hyrsky, K. (2014). Family firm prerequisites for international business operations: A production and marketing capabilities approach. World Review of Entrepreneurship, Management and Sustainable Development, 10(4), 435–448.

Kontinen, T., & Ojala, A. (2010). The internationalization of family businesses: A review of extant research. Journal of Family Business Strategy, 1(2), 97–107.

Kontinen, T., & Ojala, A. (2011). International opportunity recognition among small and medium-sized family firms. Journal of Small Business Management, 49(3), 490–514.

Kraus, S., Mensching, H., Calabrò, A., Cheng, C. F., & Filser, M. (2016). Family firm internationalization: A configurational approach. Journal of Business Research, 69(11), 5473–5478.

Larimo, J. (2013). Small and medium-size enterprise export performance: Empirical evidence from Finnish family and non-family firms. International Studies of Management & Organization, 43(2), 79–100.

Lehrer, M., & Celo, S. (2017). Boundary-spanning and boundary-buffering in global markets. Review of International Business and Strategy, 27(2), 161–179.

Liang, X., Wang, L., & Cui, Z. (2014). Chinese private firms and Internationalization: Effects of family involvement in management and family ownership. Family Business Review, 27(2), 126–141.

Lin, W. T. (2012). Family ownership and internationalization processes: Internationalization pace, internationalization scope, and internationalization rhythm. European Management Journal, 30(1), 47–56.

Liu, Y., Lin, W. T., & Cheng, K. Y. (2011). Family ownership and the international involvement of Taiwan’s high-technology firms: The moderating effect of high-discretion organizational slack. Management and Organization Review, 7(2), 201–222.

Marin, Q., Hernández-Lara, A. B., Campa-Planas, F., & Sánchez-Rebull, M. V. (2017). Which factors improve the performance of the internationalization process? Focus on family firms. Applied Economics, 49(32), 3181–3194.

Memili, E., Misra, K., Chrisman, J. J., & Welsh, D. H. (2017). Internationalisation of publicly traded family firms: A transaction cost theory perspective and longitudinal analysis. International Journal of Management and Enterprise Development, 16(1–2), 80–108.

Menendez-Requejo, S. (2005). Growth and internationalisation of family businesses. International Journal of Globalisation and Small Business, 1(2), 122–133.

Mensching, H., Calabrò, A., Eggers, F., & Kraus, S. (2016). Internationalisation of family and non-family firms: A conjoint experiment among CEOs. European Journal of International Management, 10(5), 581–604.

Minetti, R., Murro, P., & Zhu, S. C. (2015). Family firms, corporate governance and export. Economica, 82, 1177–1216.

Mustafa, M., Ramos, H. M., & Chen, S. (2013). Internationalisation pathways of small Singaporean family firms: A socio-cultural perspective. International Journal of Globalisation and Small Business, 5(4), 290–311.

Newbert, S. L. (2007). Empirical research on the resource-based view of the firm: An assessment and suggestions for future research. Strategic Management Journal, 28(2), 121–146.

Okoroafo, S. C. (1999). Internationalization of family businesses: Evidence from Northwest Ohio, USA. Family Business Review, 12(2), 147–158.

Pacheco, L. M. (2017). Internationalization vs family ownership and management: The case of Portuguese wine firms. International Journal of Wine Business Research, 29(2), 195–209.

Pascucci, F., & Bartoloni, S. (2018). Explaining the internationalisation pathways of family firms: a qualitative research. International Journal of Business and Globalisation, 20(4), 537–556.

Patel, V. K., Pieper, T. M., & Hair Jr, J. F. (2012). The global family business: Challenges and drivers for cross-border growth. Business Horizons, 55(3), 231–239.

Plakoyiannaki, E., Kampouri, A. P., Stavraki, G., & Kotzaivazoglou, I. (2014). Family business internationalisation through a digital entry mode. Marketing Intelligence & Planning, 32(2), 190–207.

Pukall, T. J., & Calabrò, A. (2014). The internationalization of family firms: A critical review and integrative model. Family Business Review, 27(2), 103–125.

Ramón-Llorens, M. C., García-Meca, E., & Duréndez, A. (2017). Influence of CEO characteristics in family firms internationalization. International Business Review, 26(4), 786–799.

Ratten, V., Dana, L. P., & Ramadani, V. (2017). Internationalisation of family business groups in transition economies. International Journal of Entrepreneurship and Small Business, 30(4), 509–525.

Ray, S., Mondal, A., & Ramachandran, K. (2018). How does family involvement affect a firm’s internationalization? An investigation of Indian family firms. Global Strategy Journal, 8(1), 73–105.

Sánchez-Bueno, M. J., & Usero, B. (2014). How may the nature of family firms explain the decisions concerning international diversification? Journal of Business Research, 67(7), 1311–1320.

Scholes, L., Mustafa, M., & Chen, S. (2016). Internationalization of small family firms: The influence of family from a socioemotional wealth perspective. Thunderbird International Business Review, 58(2), 131–146.

Sciascia, S., Mazzola, P., Astrachan, J. H., & Pieper, T. M. (2012). The role of family ownership in international entrepreneurship: Exploring non-linear effects. Small Business Economics, 38(1), 15–31.

Stieg, P., Cesinger, B., Apfelthaler, G., Kraus, S., & Cheng, C. F. (2018). Antecedents of successful Internationalization in family and non-family firms: How knowledge resources and collaboration intensity shape international performance. Journal of Small Business Strategy, 28(1), 14–27.

Sundaramurthy, C., & Dean, M. A. (2008). Family businesses’ openness to external influence and international sales: An empirical examination. Multinational Business Review, 16(2), 89–106.

Tsao, C. W., Wang, M. J., Lu, C. M., Chen, S. J., & Wang, Y. H. (2018). Internationalization propensity in family-controlled public firms in emerging markets. Journal of Small Business Strategy, 28(1), 28–37.

Wei, Y. C., & Tsao, C. W. (2019). Family influences in the internationalization of the top 1,000 Taiwanese enterprises. Chinese Management Studies, 13(1), 128–145.

Zahra, S. A. (2003). International expansion of US manufacturing family businesses: The effect of ownership and involvement. Journal of Business Venturing, 18(4), 495–512.