1Delhi Technological University, Delhi, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

All the sectors of the economy strive to get the limited finances that are available in the economy. The financial environment of the economy should ensure that restricted funds are available for firms that can make the best possible use of them. In that scenario, all firms on the verge of bankruptcy or facing financial distress need to release their funds for use by efficient firms in the economy. The present study intends to assess the impact of financial reorganisation on the operating efficiency of Ellora Paper Mills Ltd. This private limited company manufactures a variety of colour paper in India.

The empirical study is based on secondary data extracted through the company’s Financial Statements using the CMIE-Prowess database for The Ellora Paper Mills Limited from 2007–2008 to 2022–2023. Altman’s z-score model was used to consider the level of sickness, and the regression model was applied to the various ratios, assessing profitability, liquidity, solvency, and efficiency for hypothesis testing with the help of SPSS.

The results indicate that the company’s operating efficiency improved significantly post-financial reorganisation. The study provides insight into how finance/funds need to be allocated/reallocated to firms to achieve the goal of economic sustainability through financial restructuring.

Financial reorganisation, operating efficiency, sustainability, paper manufacturing

Introduction

The performance of the various firms in the business environment is characterised by economic and financial stress. While economic stress is caused by competition, economic conditions, government control, etc., prolonged financial stress due to the absence of profits or returns leads to financial distress among firms. Financially distressed firms are characterised by poor operating performance and a sub-optimal capital structure, thus resorting to various measures to overcome the situation. Mergers, acquisitions, amalgamations, asset restructuring, and reorganisation are some of the measures the firms adopt.

Reorganisation or financial restructuring is a technique that is used by most organisations undergoing financial distress. It involves the change in an organisation’s capital structure, that is, the change in the Debt and Equity component of capital. The companies need to revisit their capital structure to ensure that it is at the optimal level. It also helps to create a positive financial environment for the firm.

All the sectors of the economy strive to get the limited finances that are available in the economy (Mugenda and Mugenda, 2003). Currently, the banking system in India is responsible for regulating and managing over 70% of the funds that flow through the financial sector in the country (Sharma et al., 2023). Traditional financial institutions, such as banks, often refrain from lending to entrepreneurs due to the high risks associated with their projects and the need for more collateral. Similarly, sophisticated investors like venture capitalists (VCs) have stringent criteria for investment. VCs typically fund only a few hundred companies each year (Baid & Baid, 2022). The financial environment of the economy should ensure that restricted funds are available for firms that can make the best possible use of them. In that scenario, all firms on the verge of bankruptcy or facing financial distress need to release their funds for use by efficient firms in the economy.

Ellora Paper Mills Limited: An Overview

Ellora Paper Mills Limited is a Public Company incorporated on 14 November 1974 in Calcutta. It is classified as a non-government company.

The company was originally promoted by Satyanarayan Kedia and Sitaram Kedia of Ajanta Paper & General Products Pvt Ltd. The company manufactures writing paper, printing paper, kraft paper, and packing paper—Vishwanath Kedia of Nitin Castings Ltd, and Bajranglal Dalmia of M/s. Prahladrai Dalmia & Sons joined as co-promoters in 1976. M/s. Prahladrai Dalmia & Sons became the present promoters of the Company in 1977 when Kedias of Nitin Castings Ltd took up the share of Kedias of Ajanta Paper & General Products. The company had a working capacity of 13,200 tonnes per annum. In 1988, the Company came under the provisions of the Sick Industrial Companies (Sp. Provisions) Act, 1985, and as per the requirement, a reference to the Board for Industrial and Financial Reconstruction was made. In 1993, the performance of the Company was severely impacted by the prolonged strike by the workers. The Company introduced a four crore modernisation plan spanned out over a period of two years to reduce cost reduction and improve quality in 1997. In 2007 and 2008, the company paid a dividend of 12% and 10%, respectively. Ellora Paper Mills Ltd shifted its Registered office from Kolkata to Ahmedabad in 2016. On 19.07.2017, Ellora Paper Mills got a notice from NCLT (Mumbai Bench) to begin the Insolvency Resolution process. (Quarterly newsletter for July–September 2017, IBBI)

The Ellora Paper Mills Limited had been in bankruptcy for several years. This study attempts to reflect that not all companies in the public sector are performing financially well. It examines the firm’s operating performance after inducing financial restructuring. The present study attempts to add to the existing body of knowledge and literature on the influence of financial restructuring on operating performance. The study is arranged as follows: the second section covers a Review of past studies, the third section covers Research Methodology, and the fourth section covers the results and discussion. The summary of results is given in the fifth section.

Literature Review

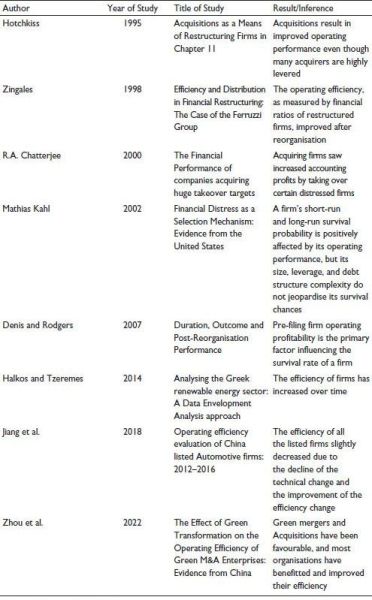

Financial restructuring has been a means to achieve better performance for financially unviable firms (Siro, 2013). It is a mechanism to rework the firm’s capital structure to enable it to be in a better financial position (Ahmed and Govind, 2018). Hotchkiss (1995), in his study titled ‘Acquisition as means of restructuring firms in Chapter 11’, surveyed 55 acquisitions and found that the firms merged with bankrupt targets significantly improved the operating performance. So, a financial initiative to improve the operating performance of the firms provided positive results. Penati and Zingales (1998) conducted a study on the Ferruzzi Group titled ‘Efficiency and Distribution in Financial Restructuring: A Case of the Ferruzzi Group’ in which they analysed the distributional and efficiency consequences of financial restructuring. The payoffs to the creditors were compared with those they would have obtained without any restructuring mechanism. It was concluded that there was distributional gain to the creditors, and the firm’s operating efficiency, as measured by the ratios, improved after reorganisation. The study also emphasised the importance of allocation of control in financial restructuring. Chatterjee et al. (1996), in his study titled ‘The Financial Performance of Companies Acquiring Huge Takeover Targets’, focused on large taken-over companies from 1977–1990 and studied their financial performance and accounting profit. The study focused on the Cumulative Abnormal Returns (CARs) of the firms and concluded that acquiring firms saw an increase in accounting profit by taking over distressed firms. It was followed by a study by Mathias Kahl in 2002, which concluded that the firm’s long-run and short-run operating performance is affected by its profitability, not size, leverage and debt structure. A summary of a few past studies is shown in Table 1.

Table 1. Previous Studies on Financial Restructuring.

Source: Altman et al. (2017).

Later, the studies started focusing on sustainability and its importance in prioritising which firms to restructure. Halkos and Tzeremes (2014) surveyed Greece’s renewable energy and concluded that restructuring increased the firm’s profitability in the energy sector over time. Lingling and Wenqi (2022) studied the effect of green transformation on the operating efficiency of firms that underwent green mergers and acquisitions and concluded that it had a positive impact.

Research Objective

The current study focuses on assessing the operating efficiency of Ellora Paper Mills Ltd after undertaking financial restructuring. The study period spans from 2007–2008 to 2022–2023, that is, 15 years.

Hypothesis Development

The null hypothesis and alternate hypothesis developed for the current study are as follows-

Null hypothesis H0: Financial restructuring does not improve the profitability, liquidity, turnover and operating efficiency of Ellora Paper Mills Ltd.

Alternate Hypothesis H01: Financial restructuring improves the profitability of Ellora Paper Mills Ltd.

H02: Financial restructuring improves the liquidity of Ellora Paper Mills Ltd.

H03:Financial restructuring improves the turnover position of Ellora Paper Mills Ltd.

H04:Financial restructuring improves the operating efficiency position of Ellora Paper Mills Ltd.

Data and Methodology

Data Source

The data was collected for 15 years, from 2007–2008 to 2002–2023. The ratios required to measure financial restructuring and operating performance have been extracted from CMIE-Prowess.

Research Methodology

The study has been conducted by analysing the impact of financial restructuring on the firm’s operating performance.

The study uses Altman’s z-score model to predict the firm’s risk of bankruptcy. A simple linear regression model (Equation 1) indicated the company’s operating performance. The prediction was made based on the effect of the financial restructuring on the firm’s economic performance.

Linear regression model

(1)

(1)

where

x1 = Financial restructuring; e = Error term; β0 = Intercept, β1 = Coefficient of x1.

The financial restructuring of the firm has been measured through two ratios: total debt to total assets (TDTA) and debt–equity ratio (DER).

Operating performance has been assessed in terms of profitability (Return on Assets, i.e., ROA), Liquidity (Current Ratio, i.e., CR), Efficiency (Working capital to total Assets, i.e., WCTA) and Turnover (Sales to Total Assets, i.e., SALETR).

Altman’s Z-score Model

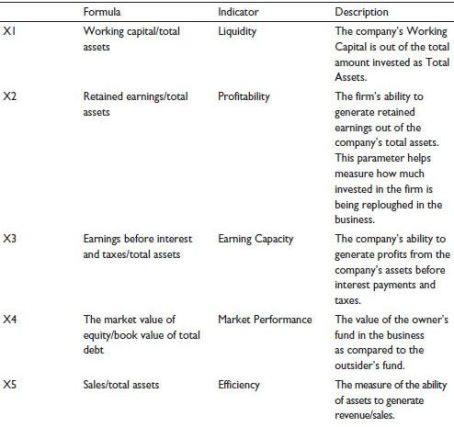

The study first tries to assess the financial performance of the firm Ellora Paper Mills Ltd using the method provided by Altman Edward in 1968. The technique, known as Altman’s z-score model, states that specific ratios have predictive power to predict a firm’s bankruptcy and financial distress. Altman suggested five ratios in his model. The ratios used in Altman’s model are shown in Table 2.

Table 2. Altman’s Z-score Model.

Source: Altman et al. (2017).

Equation (2) defines the Altman’s z-score formula.

(2)

(2)

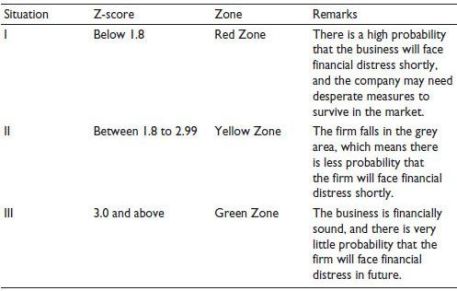

Based on the z-score obtained by a particular firm, Altman’s model helped to identify if a specific firm is heading towards bankruptcy. The guidelines for reading Altman’s z-score are provided in Table 3.

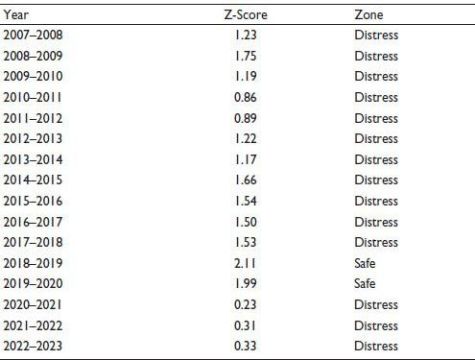

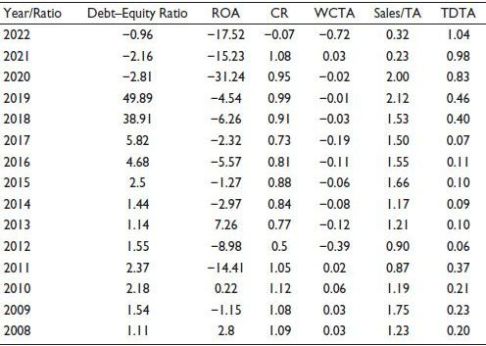

Z-scores were calculated for 15 years for Ellora Paper Mills Ltd. The results obtained are shown in Table 4.

Table 4 exhibits the value of the Altman z-score model of The Ellora Paper Mills Ltd from 2007–2008 to 2022–2023. The firm went through a period of financial distress until it went for restructuring in 2017–2018. A further look at Table 4 shows that the financial health of Ellora Paper Mills Ltd was in a distress zone after undergoing restructuring except for two years following restructuring in 2018–2019. For the rest of the period, the score has been below 1.80, indicating poor financial health. This shows that the firm was heading towards financial distress, which signalled bankruptcy soon. On 19th July 2017, the company was put under the Insolvency Resolution process. On 26 June 2018, the company’s resolution plan was approved, and the firm underwent financial restructuring, thereby bringing about a change in the capital structure of the firm. After undergoing restructuring, the firm saw an improved performance for two years, but the z-score of the firm after that signalled a state of distress. Therefore, the company was required to improve its liquidity, profitability and efficiency to improve its economic performance.

Table 3. Altman’s Z-score Guidelines.

Source: Sharma and Patra (2021).

Table 4. Altman Z-score Values of Ellora Paper Mills Ltd.

Testing of Hypothesis

A simple linear regression model assessed the firm’s financial performance as expressed in Equation (1). The prediction was made by evaluating the impact of financial restructuring on the firm’s financial performance.

Financial restructuring of the firm has been measured through the two ratios, that is, TDTA and DER

Operating performance has been assessed in terms of profitability (Return on Assets, i.e., ROA), Liquidity (Current Ratio, i.e., CR), Efficiency (Working capital to total Assets, i.e., WCTA) and Turnover (Sales to Total Assets, i.e., SALETR).

Analysis of Results

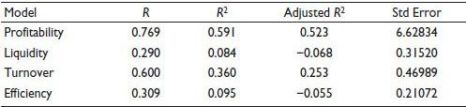

A thorough analysis of results in terms of studying the impact of financial restructuring on the firm’s operating performance was done to understand the relationship between the two. The firm’s operating performance can be measured in terms of positive profitability, liquidity, turnover and efficiency improvement. The summarised results are shown in Table 5.

Table 5 indicates that the model coefficient of determination (adjusted R2) was 0.591, 0.084, 0.360 and 0.095 for profitability, liquidity, turnover and efficiency, respectively.

The firm’s operating performance variance is explained by its profitability and turnover. It means that a firm should focus on improving its sales and profits to see a change in its operating performance.

Table 5. Model Summary.

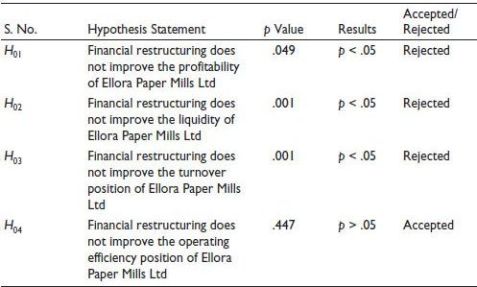

Table 6. Summary of Results (at 5% Level of Significance).

The summarised results of the study concerning the acceptance/rejection of the hypothesis are depicted in Table 6. The hypothesis statement regarding no impact of financial restructuring on liquidity, profitability, turnover and efficiency of the firm stands rejected as the findings suggest that financial restructuring does improve the liquidity (p = .001), profitability (p = .049) and turnover (p = .001) of Ellora Paper Mills Ltd. However, there is no significant effect on the firm’s operating efficiency (p = .447).

Conclusion

The current study involves assessing the impact of financial restructuring on the firm’s operating performance, The Ellora Paper Mills Ltd.

It highlights that financial restructuring positively affects the enterprise’s liquidity, profitability and turnover. The firm’s restructuring changes its debt–equity structure, writing off unpaid liabilities and rearranging the capital structure components to achieve better operating performance. Sick companies can improve their performance by restructuring and releasing the funds invested for better use. This would lead to a better utilisation of the limited financial resources available in the economy.

Implications of the Study

The study provides insight to policymakers regarding allocating funds to various industries and firms. The financial institutions can use the Altman z-score model to assess the firms in distress and then decide on the release of funds. Also, the management can determine the operating efficiency and the utilisation of funds for proper management.

Future Research

The study is limited in establishing the impact of financial restructuring on the firm’s operating performance. The reasons for the firm’s inefficiency in operations and financial performance can be further analysed based on the above discussion. Second, there is a scope for examining the possibility of the firm going into liquidation/restructuring and finding the critical indicators that can be used to predict the outcome before the firm reaches that situation of bankruptcy/restructuring.

Appendix A

Table A1. Financial Ratios of Ellora Paper Mills.

Source: CMIE-Prowess.

Acknowledgement

The authors are grateful to the journal’s anonymous referees for their beneficial suggestions for the quality of the paper. Usual disclaimers apply.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Pallavi Sethi  https://orcid.org/0000-0002-2968-1642

https://orcid.org/0000-0002-2968-1642

Ahmed, M. A. R., & Govind, D. (2018). An evaluation of the Altman Z-score model in predicting corporate bankruptcy for Canadian publicly listed firms. The Project is the Master of Science in Finance Program at Simon Fraser University, Fall.

Altman, E. I., Iwanicz-Drozdowska, M., Laitinen, E. K., & Suvas, A. (2017). Financial distress prediction in an international context: A review and empirical analysis of Altman’s Z-Score model. Journal of International Financial Management & Accounting, 28(2), 131–171. https://doi.org/10.1111/jifm.12053

Baid, C., & Baid, D. (2022). Funding failure: Determinants of persistence. IMIB Journal of Innovation and Management, 1(1). https://doi.org/10.1177/ijim.221085417

Chatterjee, S., Dhillon, U. S., & Ramírez, G. G. (1996). Resolution of financial distress: Debt restructurings via chapter 11, prepackaged bankruptcies, and workouts. Financial Management, 25(1), 5–18. https://doi.org/10.2307/3665899

Halkos, G., & Tzeremes, N. G. (2014). Public sector transparency and countries’ environmental performance: A nonparametric analysis. Resource and Energy Economics, 38(C), 19–37. https://EconPapers.repec.org/RePEc:eee:resene:v:38:y:2014:i:c:p:19-37

Hotchkiss, E. S. (1995). Postbankruptcy Performance and Management Turnover. The Journal of Finance, 50(1), 3–21. https://doi.org/10.2307/2329237

Mugenda, O. M., & Mugenda, G. A. (2003). Research methods: Quantitative and qualitative approaches. Act Press.

Penati, A., & Zingales, L. (1997). Efficiency and distribution in financial restructuring: The case of the Ferruzzi group. Chicago Booth Research Paper Series.

Sharma, M., & Patra, G. C. (2021). Prediction of financial distress in Indian firms using Altman Z-score model. The Journal of Contemporary Issues in Business and Government, 27, 4341–4348.

Sharma, P., Mishra, B. B., & Rohatgi, S. K. (2023). Revisiting the impact of NPAs on profitability, liquidity and solvency: Indian banking system. IMIB Journal of Innovation and Management. https://doi.org/10.1177/ijim.221148863

Siro, R. O. (2013). Effects of capital structure on the financial performance of firms listed on the NSE [Unpublished master’s thesis]. University of Nairobi.

Zhou, L., Li, W., Teo, B., & Khalidah, Md. (2022). The effect of green transformation on the operating efficiency of green M&A enterprises: Evidence from China. Journal of Asian Finance Economics and Business, 9, 299–310. https//doi.org/10.13106/jafeb.2022.vol9.no1.0299