1 Department of Business Management and Commerce, GNDU, RC-Gurdaspur, Punjab, India

2 Guru Nanak Dev University, University School of Financial Studies, Amritsar, Punjab, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This study is based on a sample of 613 respondents chosen using judgement cum convenience sampling to understand the gold-buying behaviour of individual investors. The paper attempts to explore the various attributes that investors consider important while investing in gold. Six underlying factors of importance are extracted, namely, family and cultural influence, diversification properties, safe haven properties, financial security, wealth preservation and liquidity. The influence of family and culture is evident from the results, with buying at weddings and festivals being a major reason to purchase gold, followed by investment purposes. Furthermore, the attitude of investors towards the imposition of taxes and tariffs on gold by the government is found to be negative, which could adversely affect investment in gold. Taking the findings into consideration, regulatory authorities could devise strategies to formulate a comprehensive gold policy to help gold contribute more to the exchequer instead of adversely affecting the current account.

Investors, gold, investment, liquidity, factors

Introduction

Gold is the most sought-after metal in the world, not merely as a commodity but as an investment avenue. It possesses unique rationales and persona, symbolising power and wealth due to its physical properties and scarcity. Historically, gold has played a central role in international financial systems and civilisations. Despite a decade of declining returns that blurred its enduring legend, gold prices have significantly increased in recent years. Gold constitutes a significant portion of the reserves of leading countries’ national banks (Elfakhani et al., 2009). This yellow metal has a long record as a commodity, a store of value, wealth, part of culture and as financial media. Gold is easy to follow, enjoying higher liquidity among several investment alternatives (Singh & Joshi, 2019). It has a long history as an investment avenue and a promising future for investors seeking to minimise their tax liabilities (Van Tassel, 1979).

In the current scenario, where recession grips countries, the comeback of gold as a safe haven asset has strengthened investor confidence. Geopolitical stress, volatile markets, unpredictable securities markets, inflationary fears, depreciating currencies and fluctuating oil prices have inclined investors towards this traditional metal—Gold (O’Connell, 2007).

Gold is deeply interwoven within the traditions and customs of India, utilised in adornments, coinage and electronics. It plays a significant role in Indian religious festivals and weddings, where it symbolises wealth and tradition (Verma & Sharma, 2014). This inclination towards gold has led to a rise in imports to meet growing rural and urban demand. In 2017, gold imports in India stood at 855 tonnes, with 562.7 tonnes accounted for by jewellery demand (WGC, 2017), indicating revived growth. The total gold stock in India is estimated at 23,000–24,000 tonnes.

The rest of the paper is structured as follows: the second section covers a brief literature review regarding the factors that may affect investor perceptions while investing in gold. The third section highlights the literature gap and motivation behind the study. The fourth section outlines the objectives of the paper. The fifth section covers the research methodology used for the study. The analysis and discussion are presented in the sixth section. The seventh section presents conclusion and managerial applications of the study, and the eighth section reveals the limitations and suggestions for further research.

Literature Review

Despite the fact that gold is no longer a long-standing anchor in the international monetary system, it continues to allure investors. A plethora of research has focused on gold as a store of value, safe haven, money and investment avenue (Allese, 2008; Batten et al., 2010; Baur & Lucey, 2010; Blose, 2010; Capie et al., 2005; Jastram, 1977; Mishra, 2014; O’Connor et al., 2015; Starr & Tran, 2008; Vaidyanathan, 1999; Van Tassel, 1979). Van Tassel (1979) and Singh and Joshi (2019) found that gold is a safe means of beating inflation, a store of value, helps in minimising tax and enjoys better liquidity than many other financial assets.

There are numerous reasons for the rising demand for gold, one of which is the rehypothecation of commodities such as copper and gold as collateral security against loans, aiding in carrying trade. The fact that gold is denominated in dollars has established it as a hedge against dollar risk in China (Kaminska, 2011).

One of the earlier studies in this field, conducted by Jastram (1977), found that gold is an effective inflation-deflation hedge. Van Tassel (1979) also concluded that gold, as a commodity, would be in demand in the future due to its status as an exhaustible resource and a long-term inflation hedge. Further studies by Chua and Woodward (1982), Blose (1996), Mani and Vuyyuri (2003), Starr and Tran (2008) and Singh and Joshi (2019) confirmed these results.

Gold is also considered a safe haven asset for equity indices in different phases of the COVID-19 pandemic crisis, corresponding to the timing of fiscal and monetary stimuli to support the weakened economy (Akhtaruzzaman et al., 2021). Another reason for the increasing demand for gold worldwide is its higher returns and a negative correlation with the securities market, making it a powerful component in investment portfolios (Van Tassel, 1979). Carter et al. (1982) and Faff and Chan (1998) presented evidence of uncorrelated gold prices and the stock market. A study by Pandey (2023) found that gold prices have a substantial impact on sectoral indices in the Indian stock market, particularly the auto and information technology sectors, which exhibit short-run causality with gold prices.

Gold helps diversify portfolios and can be used as a hedging tool during crises (Gaur & Bansal, 2010; Kaliyamoorthy & Parithi, 2012; Sumner et al., 2010). It is used as an investment asset class by investors (Jain & Biswal, 2016). In terms of hedging effectiveness, gold is the most effective hedge for the stock indices of France, Germany, Italy, Japan, the United Kingdom, the United States and the MSCI G7 index (Shahzad et al., 2020). It is one of the oldest ways to store wealth and is traded widely around the globe. O’Connor et al. (2015) stated that the main sources of demand for jewellery in Asia are sociocultural factors, with the biggest markets for gold jewellery being India and China. Following the financial crisis of 2008, the demand for gold in Western countries also increased due to soaring gold prices and increased apprehension in financial markets. However, Tran et al. (2017) found that the interventions of central banks and their regulations create instabilities in the gold market. Verghese and Chin (2022) found that investors’ behavioural belief and control belief significantly and positively affect their respective attitudes towards behaviour and perceived behavioural control, thereby influencing their intention to purchase bullion.

Research Gap and Motivation

Gold is considered a store of value and wealth, and India is a major player in the gold trade. There is an urgent need to study the factors affecting gold investment in India, as existing studies often focus on gold jewellery rather than gold as an investment avenue, usually within specific local areas. It is also evident that previous research has proceeded without a standardised and valid measure of the construct from an investors-based perspective. Considering the significance of gold in the investment portfolio, the study attempts to bring out the factors influencing the attitudes of gold investors. Earlier studies focus on the various characteristics of gold and its relationship with various macroeconomic determinants. However, little research has been conducted on the attitude of investors towards gold as an investment avenue. Therefore, it is necessary to develop an understanding of the factors that investors consider, alongside gold prices, when investing in gold. In the present study, an attempt has been made to identify the factors that induce investors to invest in gold.

Objectives of the Study

The review of the literature indicates that several studies have examined gold as an investment option, but few have explored the factors that influence the investment decisions of gold buyers. The cited literature focuses more on the factors affecting the price of gold rather than the investment behaviour of investors in gold. Limited attempts have been made to identify the important underlying factors of gold investment, their relative importance and the general attitude of investors towards gold as an investment. The present study addresses these limitations. The objective of this study is to understand the general attitude and behaviour of individual investors towards gold as an investment. The study also attempted to identify the underlying factors that motivate investors to buy gold.

Methodology

The study is based on primary data collected through a well-structured and pretested questionnaire. An exploratory research approach was adopted to identify the relevant variables, and a structured questionnaire was prepared by reviewing the literature (e.g., Baur & Lucey, 2010; Capie et al., 2005; Dempster, 2006; Hillier et al., 2006; McCown & Zimmerman, 2007; Michaud et al., 2006; Pulvermacher, 2004; Starr & Tran, 2008; Van Tassel, 1979). Discussions and interactions with investors and financial analysts specialising in gold investment also informed the questionnaire design.

The questionnaire was divided into two major parts. Section A employed a 5-point Likert scale ranging from 5 (strongly agree) to 1 (strongly disagree) to assess statements related to the investment attributes of gold. Section B covered demographic information. The preliminary draft of the questionnaire was pretested with 60 investors through personal in-depth interviews, which led to improvements in the questionnaire and a reduction in the number of statements from 48 to 30.

Data were collected from investors in major cities of Northern India, namely Amritsar, Jalandhar, Ludhiana, Chandigarh, Gurugram and Noida. The non-probabilistic judgement cum convenience sampling was used to select the broking firm and further investors were selected from the list provided by brokers to collect data. Since it was not feasible to enlist entire individual investors investing in the gold market from the above-mentioned cities, a list of individual gold investors was prepared with the help of brokers, and after that a sample of investors was selected from the list. The lists included the names and contact numbers of the individuals. It is worth mentioning that the individual investors were residents of the cities surveyed and the study is confined to the octroi limits of the mentioned cities. The field survey was conducted from May 2019 to October 2019. For data collection, investors were to be selected in equal proportion from each of the cities mentioned above. Nearly 115 investors were contacted in each city to achieve the desired sample of 700; however, 613 complete responses were received and further used for analysis purposes. Incomplete questionnaires, where respondents left some questions blank, were discarded from the analysis. The study focuses on the motivating factors behind the purchase of gold as an investment, with the analysis confined to a sample of investors only. The demographic profile of the selected investors is shown in Table 1 in the annexure.

Multivariate factor analytic technique was used to identify the factors that may influence the investors’ decision while investing in gold and the analysis was conducted using the Statistical Package for Social Sciences (SPSS) version 25.

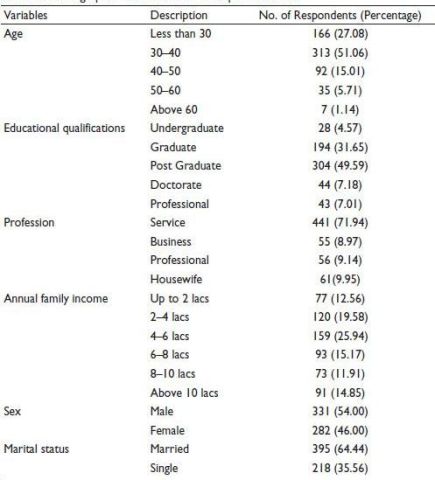

Table 1. Demographic Characteristics of Sampled Investors.

Analysis and Discussion

Demographic Profile of Respondents

The demographic profile of the respondents is presented in Table 1. It shows that 51.06% of the respondents are in the age group of 30–40 years, with 54% being male and 46% female. Additionally, 49.59% of respondents are postgraduates, 64.44% are married, 71.94% are salaried persons and 25.94% have an annual family income of 4 to 6 lakh. (See Table 1)

General Attitude of Investors Towards Gold Investment

Sources of Information.

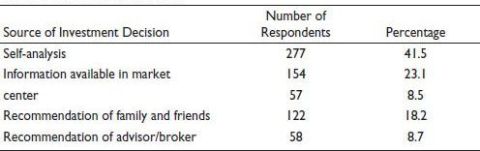

The sources of information for the purchase of gold are given in Table 2. As regards the investment behaviour of consumers, it is seen that 41.5% of the respondents themselves take investment decisions. The results depict that the investors rely on Self-analysis of the information received from various sources for investing in gold with 41.5% of the respondents choosing it followed by availability of market information (23.1%), the recommendation of family members and friends (18.2%), the recommendation of the advisor/broker (8.7%) and the comments of experts (8.5%). In our study, it is clear that instead of depending on a single source of information investors analyse the information collected from all available sources themselves for making investment decisions (Table 2).

Purpose of Buying Gold

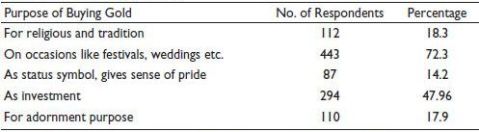

Table 3 enumerates the justifications for buying gold. 294 respondents, or 47.96%, out of the 613 respondents said they buy gold as an investment. 72.3% of respondents said they like to buy gold on special occasions, while 18.3% do it for religious or customary reasons, 17.94% for adornment or self-satisfaction, and 14.2% as a status symbol. Consequently, 294 investors, or 48% of all investors, are likely to prefer buying gold as an investment, and the remainder 319 investors buy gold for non-investment related reasons, like status symbols, customs, or religious reasons etc.

Table 2. Sources of Information.

Table 3. Purpose of Buying Gold.

Note: Multiple responses are allowed so the total comes out to be more than 100%.

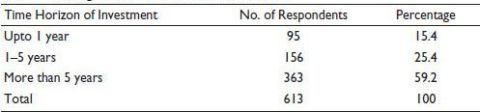

Table 4. Average Time Period of Investment in Gold.

Average Time Period of Investment in Gold

Table 4 reveals that more than half of the investors, that is, 59.2% of investors like to hold their investments for the long term, followed by 25.4% investors like to hold for medium term and lastly 15.4% of individual investors like to hold for less than a year. The results reveal that majority of investors hold gold for long term investment rather than for speculation (Table 4).

Attitude Reaction to Taxes (Tariff/Levies) on Gold

An attempt has been made to study the reaction of the investors towards changes in the tax structure (percentage of taxes) on gold. The change in tax structure directly brings variation in the price of gold. In order to study how changes in the price of gold due to changes in taxes influence their behaviour, their response with respect to the increase and decrease of taxes on the price of gold is sought. Table 5 and 6 depict the reaction of the investors when either the new range of taxes is imposed on gold, that is, their reaction to implementation of GST on gold and when there is hike in the existing rate of taxes, that is, increase in the custom duty on gold.

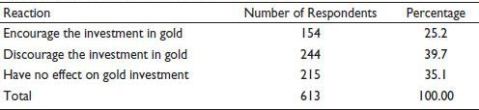

Reaction to Implementation of GST in Gold

Table 5 shows the attitude of the investors towards implementation of GST on gold revealing mixed reaction of the respondents. Majority of the respondents (39.7%) of respondents answered that it would discourage their gold investment, followed by 35.1% felt that it would not affect their investment in gold and 25.2% were of idea that it would encourage their investment in gold. The results reveal that the implementation of GST has not been welcomed by the investors and would have adverse impact on the investment in gold (Table 5).

Table 5. Reaction to Implementation of GST in Gold.

Table 6. Reaction to Increase in Import Duty on Gold.

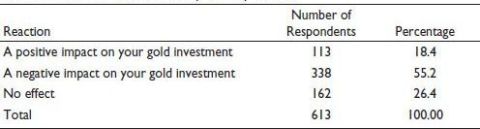

Reaction to Increase in Import Duty on Gold

Table 6 indicates the reaction of investors to increase in custom duty on gold. More than half of the respondents, that is, 55.2% of respondents thought that it would negatively impact their gold investment followed by 26.4% of the respondents’ responded that it would not affect their investment in gold and 18.4% felt that hike in import duty would positively influence their gold investment. The results reveal that hike in import duty would not been welcomed by the investors and would have adverse impact on the investment in gold. The results reveal that the increase in import duty on gold would have adverse impact on the investment in gold (Table 6).

Factor-Analytic Results

Factor analysis was employed to identify the significant factors influencing investors to purchase gold as an investment. The reliability and validity of the scale were tested to ensure the data was suitable for exploratory factor analysis.

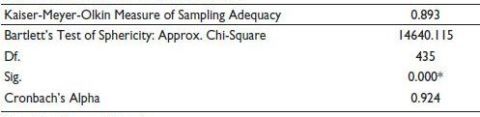

Reliability and Validity of the Scale.

The most widely used measure for diagnosing the reliability of the entire scale is Cronbach’s α. To assess the internal consistency of the entire scale, the reliability was checked using Cronbach’s α before applying factor analysis (Malhotra, 2008). Its value varies from 0 to 1, with the generally agreed-upon lower limit for Cronbach’s α being 0.70, although it may decrease to 0.60 in exploratory research (Hair et al., 2005). The overall Cronbach’s α for the 30 variables considered in the study was estimated at 0.924, as shown in Table 7, which can be regarded as adequate given the exploratory nature of the research.

Content validity is a systematic evaluation of the representativeness of the content of a scale for measuring the task at hand (Malhotra, 2008, p. 316). Content validity was established through a review of the existing literature and discussions with experts in the field.

Table 7. Results of KMO and Bartlett’s Test.

Note: *Significant at 1% level.

After confirming the reliability and content validity of the scale, the Kaiser-Meyer-Olkin (KMO) test was applied to check the appropriateness of the collected data for factor analysis (Kaiser, 1974). The KMO measure of sampling adequacy (MSA) confirms that the sample is adequate for conducting exploratory factor analysis. The KMO statistic varies between 0 and 1, with values greater than 0.5 being acceptable. Values between 0.5 and 0.7 are considered mediocre, between 0.7 and 0.8 are good, between 0.8 and 0.9 are great and above 0.9 are superb (Field, 2000). The KMO MSA was found to be 0.893 (Table 7), indicating that the sample is statistically significant for factor analysis.

Barlett’s test of sphericity is used to test whether variables are unrelated, meaning the correlation matrix is an identity matrix (Malhotra, 2008). The approximate statistic is 14640.1 with 435 degrees of freedom, which is highly significant (p < .000), as indicated in Table 7 in the annexure, showing that the data is appropriate for factor analysis (Table 7).

Factor Extraction

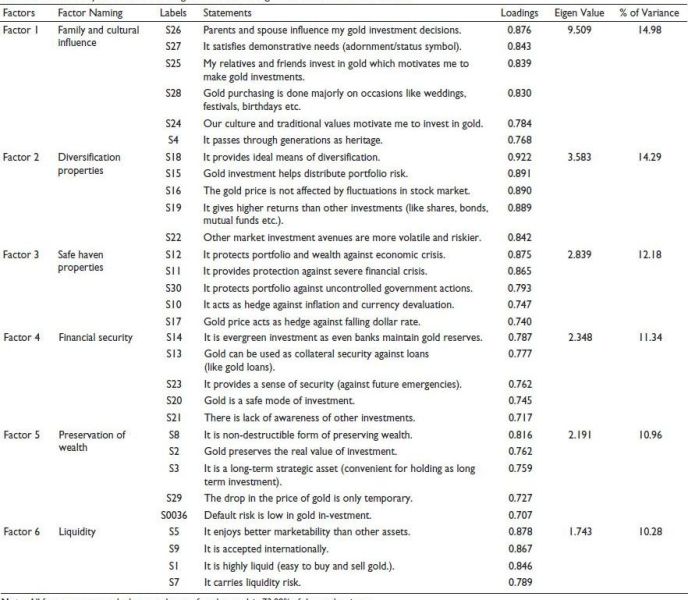

The principal component method with varimax rotation of data reduced the 30 statements to six major factors identifying the motivators behind investing in gold as an alternative asset class in the portfolio. The factor loading greater than 0.40 is considered more important and 0.50 or greater is considered very significant (Hair et al., 2005).

All these factors as extracted and taken together are found to explain 73.99% of the total variance. The data, therefore, were found reliable. Cronbach’s alpha for the entire scale was estimated to be as high as 0.924 (Table 7). Table 8 shows the extracted six factors, loadings of all statements, Eigenvalues and percentage of variance explained by each factor. These factors have been given appropriate names on the basis of the variables that have loaded onto each factor (Table 8).

Family and Cultural Influence

‘Family and cultural influence’ has emerged as the most important factor, which is explaining as high as 14.98% of total variance by far. This factor was found to be associated with six variables, namely the influence of friends and relatives; parents and spouse; influence of cultural and traditional values and the demonstrative needs. These six items explain that the major reason for buying more gold is the influence of family as well as the social and traditional values attached to it. The gold has been deeply rooted in the social psyche of the Indians (Mani & Vuyyuri, 2003), and it has a long history of social value and acts as a store of value (Schoenberger, 2011; Van Tassel, 1979). Further, gold once bought can be passed to daughters as gifts for their financial security (Tariq et al., 2007). Singh and Joshi (2019) stated that there is an old association between the metal gold and Indian Culture.

Table 8. Factor-analytic Results Indicating Factors Influencing Purchase of Gold as Investment.

Note: All factors as extracted taken together are found to explain 73.99% of the total variance.

Diversification Properties

‘Diversification properties’ comes out to be the second important factor which explains 14.29% of the total variance. The variable namely gold gives an ideal means of diversification has the highest factor loading as 0.922. As gold helps in portfolio diversification, it is another reason which attracts investors. Carter et al. (1982), Jaffe (1989), Chua et al. (1990), Blose (1996) and Baur and Lucey (2010) have found gold to be a significant portfolio diversifier as it is presumed to have either no or low correlation with other risky and volatile assets.

Safe Haven Properties

The third factor is safe haven properties with amounting to 12.18% of the variance. Baur and Lucey (2010) clearly defined a hedge as ‘an asset that is uncorrelated or negatively correlated with another asset or portfolio on average’. However, an asset may be a hedge which protects our portfolio on average but fails in times of financial stress or economic turmoil. Baur and McDermott (2010) found gold to be a safe haven for equities. It is considered as a safe haven asset which in times of crisis protects wealth from extreme market movements (Abken, 1980; Haugom, 1990; Mishra, 2014; Starr & Tran, 2008). According to Lawrence (2003), gold is indestructible and fungible and this feature sets gold apart from other commodities. It also acts as a hedge against inflation (Patel, 2013; Singh & Joshi, 2019).

Financial Security

‘Financial security’ comes out to be the fourth motivating force behind gold investment with 11.34% of the total variance. It is a safe investment with no credit risk attached as it is retained by central banks as reserves (Mani & Vuyyuri, 2003; Singh & Sharma, 2018). However, there is lack of awareness of other investment options that are available in the market, which forces people to buy gold which is often called a safe asset. Akhter and Sangmi (2015) found that the level of awareness among youth for the stock market is low.

Preservation of Wealth

This factor emphasised gold’s role as a ‘preservation of wealth’ explaining 10.96% of the total variance. In contrast to other financial assets, the real value of gold remains intact and thus, with the passage of time, gold has always protected its real worth against adverse impact of inflation. There is a developing collection of research to study gold’s role as a wealth preserver against the ravages of time. Capie et al. (2005) found that gold is a unique, homogeneous asset that has gained a specific amount of trust of investors in its role as protector of wealth over the centuries. Gold acts as a long-term store of value (Mani & Vuyyuri, 2003; Singh & Joshi, 2019) and has maintained its real purchasing power.

Liquidity

The last factor contributing to 10.28% of the total variance is the liquidity of investment. Gold is almost as liquid as currency and in contrast to other financial assets, it is easy to dispose of (Singh & Joshi, 2019; Vaidyanathan, 1999). It is an asset which is of universal acceptance and when compared with various other financial and physical assets, it provides a liquid form of saving (Kannan & Dhal, 2008).

Conclusion and Future Implications

The study reveals that family and cultural influences are the most significant factors driving gold investment among individual investors, followed by gold’s role as a portfolio diversifier. More than 70% of investors buy gold for occasions, such as weddings and festivals, whereas only about 48% purchase gold primarily as an investment. This indicates that gold continues to be regarded as a traditional asset in India, consistent with findings from previous research across different periods. Interestingly, nearly 60% of respondents prefer to hold gold for the long term, exceeding five years. This tendency to hold an unproductive asset like gold leads to funds being tied up. To address this, if the mindset of people cannot be changed, alternative strategies should be implemented. The government should focus on schemes such as the gold monetisation scheme to mobilise gold and offer various regulated alternative forms of gold investment to shift demand from physical gold to paper gold.

The study also finds that most investors make their own investment decisions, relying on past performance and available market information. This suggests that international news about gold can significantly influence investor decisions. When it comes to taxes on gold, higher taxes are found to negatively impact demand, implying that to curb rising gold demand, the government could impose more taxes. However, this could hinder the growth of the Indian gold market. Therefore, careful consideration is required before implementing any new taxes or duties on gold to avoid adverse effects on the market.

The awareness of gold bullion is high among investors, but knowledge about paper and digital gold is imprecise, necessitating investor education to boost investment in these products. Some investors appreciate the convenience and assured purity of sovereign gold bonds and paper gold for long-term holding. Therefore, marketing should emphasise product convenience, transparent pricing and quick processing. Gold prices typically move inversely to stock prices, making gold a valuable hedge during financial market volatility and currency fluctuations, particularly against the US dollar. Gold also acts as a superior inflation hedge, correlating positively with the consumer price index in India over the past two decades, suggesting that including gold in investment portfolios can reduce risk during financial turmoil and inflation. However, the rising demand for physical gold, primarily met through imports, exacerbates India’s current account deficit. Government policies aimed at curbing gold imports may be ineffective due to gold’s hedging benefits. Thus, addressing inflation directly and providing alternative investment opportunities, along with promoting paper gold through relaxed regulations, may reduce gold imports and support economic stability.

Limitations and Suggestions for Future Research

This study focuses on the motivating factors behind gold as an investment avenue. However, these factors are based on the perception of the investors, which may keep on changing with time. Therefore, the study could be periodically updated by enlarging the sample size. The main limitations of the study are that the sample is skewed towards respondents residing in major cities of northern India (Amritsar, Jalandhar, Ludhiana, Chandigarh, Gurugram and Noida), and it may be difficult to generalise the results. Thus, its scope can be expanded by extending the study to a larger area.

Further, it is known that gold is a traditional asset interwoven in the culture of India. It is suggested that the study may be replicated with a considerate proportion of respondents from business class as well.

Acknowledgements

‘The author is grateful to the anonymous referees of the journal for their extremely useful suggestions to improve the quality of the article’. Usual disclaimers apply.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Arwinder Singh  https://orcid.org/0000-0002-3079-9955

https://orcid.org/0000-0002-3079-9955

Abken, P. A. (1980). The economics of gold price movements. Federal Reserve Bank of Richmond. https://fraser.stlouisfed.org/files/docs/publications/frbrichreview/rev_frbrich198003.pdf

Akhtaruzzaman, M., Boubaker, S., Lucey, B. M., & Sensoy, A. (2021). Is gold a hedge or a safe-haven asset in the COVID–19 crisis? Economic Modelling, 102, 105588. https://doi.org/10.1016/j.econmod.2021.105588

Akhter, A., & Sangmi, M. U. D. (2015). Stock market awareness among the educated youth: A micro-level study in India. Vision, 19(3), 210–218.

Allese, K. (2008). Understanding the development and influences of the price of gold [Unpublished BA Thesis, Business International University, pp. 15–22]. School of Business, Audentes.

Batten, J. A., Ciner, C., & Lucey, B. M. (2010). The macroeconomic determinants of volatility in precious metals markets. Resources Policy, 35(2), 65–71.

Baur, D. G., & Lucey, B. M. (2010). Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45(2), 217–229.

Baur, D. G., & McDermott, T. K. (2010). Is gold a safe haven? International evidence. Journal of Banking & Finance, 34(8), 1886–1898.

Blose, L. E. (1996). Gold price risk and the returns in gold mutual funds. Journal of Economics and Business, 48(5), 499–513.

Blose, L. E. (2010). Gold prices, cost of carry, and expected inflation. Journal of Economics and Business, 62(1), 35–47.

Capie, F., Mills, T. C., & Wood, G. (2005). Gold as a hedge against the dollar. Journal of International Financial Markets, Institutions and Money, 15(4), 343–352.

Carter, K. J., Affleck-Graves, J. F., & Money, A. H. (1982). Are gold shares better than gold for diversification? Journal of Portfolio Management, 9(1), 52–55.

Chua, J. H., Sick, G., & Woodward, R. S. (1990). Diversifying with gold stocks. Financial Analysis Journal, 46(4), 76–79.

Chua, J. H., & Woodward, R. S. (1982). Gold as an inflation hedge: A comparative study of six major industrial countries. Journal of Business Finance and Accounting, 9(2), 191–197.

Dempster, N. (2006). The role of gold in India. World Gold Council.

Elfakhani, S., Baalbaki, I. B., & Rizk, H. (2009). Gold price determinants: Empirical analysis and implications. Journal for International Business and Entrepreneurship Development, 4(3), 161–178.

Faff, R., & Chan, H. (1998). A test of the intertemporal CAPM of the Australian equity market. Journal of International Financial Markets, Institutions and Money, 8(2), 175–188.

Field, A. (2000). Discovering statistics using SPSS for Windows. Sage Publications.

Gaur, A., & Bansal, M. (2010). A comparative study of gold price movements in Indian

and global markets. Indian Journal of Finance, 4(2), 32–37.

Hair J. F., Jr., Anderson R. E., Tatham R. L., & Black W. C. (2005). Multivariate data analysis (2nd ed.). Pearson Education.

Haugom, H. N. (1990). Supply and demand for gold [Doctoral dissertation, Simon Fraser University]. Department of Economics.

Hillier, D., Draper, P., & Faff, R. W. (2006). Do precious metals shine? An investment perspective. Financial Analyst Journal, 62(2), 98–106.

Jaffe, J. F. (1989). Gold and gold stocks as investments for institutional portfolio. Financial Analysts Journal, 45(2), 53–59.

Jain, A., & Biswal, P. C. (2016). Dynamic linkages among oil price, gold price, exchange rate, and stock market in India. Resources Policy, 49, 179–185. https://doi.org/10.1016/j.resourpol.2016.06.001

Jastram, R. (1977). The golden constant: The English and American experience, 1560-1976. John Wiley & Sons.

Kaiser, H. F. (1974). An index of factorial simplicity. Psychometrika, 39(1), 31–36.

Kaliyamoorthy, S., & Parithi, S. (2012). Relationship of gold market and stock market: An analysis. International Journal of Business and Management Tomorrow, 2(6), 1–6.

Kaminska, I. (2011 March 15). Simply amazing commodity collateral shenanigans in China. Financial Times. https://www.ft.com/content/769b87ae-2a45-384f-9259-

ad1cf1158608

Kannan, R., & Dhal, S. (2008). India’s demand for gold: Some issues for economic development and macroeconomic policy. Indian Journal of Economics and Business, 7(1), 107–128.

Lawrence, C. (2003). Why is gold different from other assets? An empirical investigation. World Gold Council.

Malhotra, N. K. (2008). Marketing research: An applied orientation (5th ed.). Pearson Prentice-Hall.

Mani, G. S., & Vuyyuri, S. (2003). Gold pricing in India: An econometric analysis. Economic Research, 16(1), 29–44.

McCown, J. R., & Zimmerman, J. R. (2007). Analysis of the investment potential and inflation-hedging ability of precious metals. https://doi.org/10.2139/ssrn.1002966

Michaud, R. O., Michaud, R., & Pulvermacher, K. (2006). Gold as a strategic asset. World Gold Council Report. https://ssrn.com/abstract=2402862

Mishra, P. K. (2014). Gold price and capital market movement in India: The Toda–Yamamoto approach. Global Business Review, 15(1), 37–45.

O’Connell, R. (2007). Gold as a safe haven. World Gold Council.

O’Connor, F. A., Lucey, B. M., Batten, J. A., & Baur, D. G. (2015). The financial economics of gold: A survey. International Review of Financial Analysis, 41, 186–205. https://doi.org/10.1016/j.irfa.2015.07.005

Pandey, S. (2023). An empirical study of the movement of sectoral indices and macroeconomic variables in the Indian stock market. IMIB Journal of Innovation and Management, 1(1), 82–93.

Patel, S. (2013). Gold as a strategic prophecy against inflation and exchange rate. Business Perspectives and Research, 2(1), 59–68.

Pulvermacher, K. (2004). Gold and hedge funds: A comparative analysis. World Gold Council.

Schoenberger, E. (2011). Why is gold valuable? Nature, social power and the value of things. Cultural Geographies, 18(1), 3–24.

Shahzad, S. J. H., Bouri, E., Roubaud, D., & Kristoufek, L. (2020). Safe haven, hedge and diversification for G7 stock markets: Gold versus bitcoin. Economic Modelling, 87, 212–224. https://doi.org/10.1016/j.econmod.2019.07.023

Singh, N. P., & Joshi, N. (2019). Investigating gold investment as an inflationary hedge. Business Perspectives and Research, 7(1), 30–41.

Singh, N. P., & Sharma, S. (2018). Cointegration and causality among dollar, oil, gold and sensex across global financial crisis. Vision, 22(4), 365–376.

Starr, M., & Tran, K. (2008). Determinants of the physical demand for gold: Evidence from panel data. The World Economy Journal, 31(3), 416–436.

Sumner, S., Johnson, R., & Soenen, L. (2010). Spillover effects among gold, stocks, and bonds. Journal of Centrum Cathedra, 3(2), 106–120.

Tariq, H., McKechnie, D. S., Grant, J., & Phillips, J. (2007, May). Shopping for gold: A ritual experience [Paper presented]. Academic Business World International Conference, Nashville, Tennessee, USA. http://www.ABWIC.org/Proceedings/2007/ABW07-203.doc

Tran, T. N., Le, C. D., & Hoang, T. T. P. (2017). Does the State Bank widen the gap between international and domestic gold prices? Evidence from Vietnam. Global Business Review, 18(1), 45–56.

Vaidyanathan, A. (1999). Consumption of gold in India: Trends and determinants. Economic and Political Weekly, 34(8), 471–476.

Van Tassel, R. C. (1979). New gold rush. California Management Review, 22(2), 24–35.

Verghese, J., & Chin, P. N. (2022). Factors affecting investors’ intention to purchase gold and silver bullion: Evidence from Malaysia. Journal of Financial Services Marketing, 27, 41–51. https://link.springer.com/article/10.1057/s41264-021-00092-2

Verma, S., & Sharma, M. (2014). A study of the factors affecting gold as an investment option. International Journal of Business Insights & Transformation, 8(1). https://openurl.ebsco.com/EPDB

WGC. (2017 February 6). Gold demand trends full year 2017. World Gold Council. https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-

full-year-2017