1 School of Business Studies, Department of Business Studies, Central University of Karnataka, Gulbarga, Karnataka, India.

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction anddistribution of the work without further permission provided the original work is attributed.

The current study examined key factors influencing farmers’ demand for agricultural finance. It followed a mixed-method approach, with men and women making up an equal half of the sample. The data was gathered using focus groups, structured interviews, open-ended/close-ended and key informant interviews (KIIs). Descriptive statistics, along with logit and multinomial logit models (MNLM), were employed to analyse the data to determine the socioeconomic characteristics of the respondents, the sources, availability, and access to credit, and the pertinent factors that influence credit demand. The findings showed that about 49% of the respondents obtained credit, with males availing more. The respondents mainly preferred formal and semi-formal sources, however, the males preferred formal sources while the females preferred non-formal sources. The variables with a substantial impact on credit demand were identified as being education, financial literacy, family size, and group participation. Further, according to the credit sources, the following factors have a significant impact: (a) formal sources: education level, financial literacy, deposits, knowledge of credit sources, marital status, and household size; (b) informal sources: education level, deposits, household size, and group membership; and (c) non-formal providers: education, gender, and group membership.

Agricultural finance, credit access, credit demand, logit and multinomial logit model, policies and strategies

Introduction

The availability of finance can greatly boost agricultural productivity and farm performance (Chandio et al., 2020; Dey et al., 2022; Kapoor & Shushma, 2024; Mishra et al., 2024; Silong & Gadanakis, 2020). Farmers can make investments in their farms with surplus funds, which is advantageous to them (Raifu & Aminu, 2020; Zhang et al., 2024). Agricultural finance made available to farmers improves overall farm productivity and facilitates the growth of livestock production and other livelihood activities which can assist household economics by providing a reliable source of food, an annual cash flow, and the opportunity to use manure as fertiliser to improve soil quality, and boost crop yields (Carrer et al., 2020; Dey et al., 2022; Pandey et al., 2019; Silong & Gadanakis, 2020; Yeasmin et al., 2024). This makes agricultural financing a crucial element that could aid in productivity-related problems and improve the farmer’s standard of living (Ölkers & Mußhoff, 2023). It also encourages the growth of self-employment in the rural sector for working capital investments through farming and non-farming industries (Kapoor & Shushma, 2024; Ouattara et al., 2020; Zhang et al., 2024).

The agricultural sector, however, has consistently underperformed throughout time in terms of both quantity and quality, making it unable to meet the ever-increasing demand for food while remaining robust and self-sufficient. Many experts have stated that the decreasing trend in agricultural finance availability and assistance, its distribution to farmers, is predominantly a demand issue, even though supply plays a role in this as well (Amrago & Mensah, 2023; Kiros & Meshesha, 2022; Zhang et al., 2024). Moreover, in the study context, the farmers in India have had extremely restricted access to agricultural loans and other financial instruments (GOI, 2021). Agriculture productivity is significantly impacted by this, and the funding sources have been identified as the sector’s problem. However, this widely held idea may not be the only explanation for credit demand; also the lenders’ risk aversion may not be the only factor. Thus, the current study aims to comprehend the sources of agricultural finance available to farmers and the major variables affecting their need for such funding. Consequently, the study attempts to answer the following research objectives; it aims to identify the sources of agricultural finance and describe their features; second, it determines the farmer’s agricultural finance accessibility and lastly, it attempts to examine the pertinent factors influencing farmer’s decision to avail credit from the various sources.

The remainder of the study proceeds as follows: the second section delves into an examination of existing literature and the identification of research gaps. Following that, the third section outlines the specific research methodology employed. The fourth section offers a synthesis of the data analysis findings, while the fifth section draws conclusions and discusses the implications of the study. Finally, it concludes with an exploration of limitations and suggestions for future research directions.

Review of Literature

Researchers have discovered that agricultural finance is a potent tool for development, enabling farm households to adopt modern production technologies and invest in advanced farming methods to enhance productivity (e.g., Dey et al., 2022; Kapoor & Shushma, 2024; Maloba & Alhassan, 2019; Saqib et al., 2016; Silong & Gadanakis, 2020). Numerous global studies indicate that agricultural financing provides essential operational capital, significantly impacting poverty reduction by stabilising household consumption (Adams & Vogel, 1986; Turvey, 2013). The relevant literature clearly shows that access to agricultural finance improves recipients’ living conditions, raises their standard of living and well-being, boosts self-confidence, and increases farm productivity, ultimately leading to higher income (Kapoor & Shushma, 2024; Ölkers & Mußhoff, 2023; Saqib et al., 2016; Yeasmin et al., 2024)

The second concern regarding the availability of agricultural financing relates to demand and readiness, particularly clients’ financial literacy (Sharma et al., 2023; Zhang et al., 2024). For rural residents in a country like India, with diverse social, cultural, and economic profiles, financial literacy is crucial. A better understanding of financial products, services, and market applications could lead to a more effective financial system. Financially literate users are informed and empowered, able to assess financial products and make wise decisions with access to relevant financial data (Adegbite & Machethe, 2020; Amrago & Mensah, 2023; Kapoor & Shushma, 2024). Collins and O'Rourke (2010) described financial education as the process by which financial service consumers gain a better understanding of financial concepts and products through education, information, and objective advice. This equips them with the knowledge and skills to identify financial opportunities and risks and make informed decisions (Carrer et al., 2020; Kapoor & Shushma, 2024; Yeasmin et al., 2024). Financially educated consumers enable the financial industry to effectively support real economic growth and poverty reduction. Enhancing financial capability through financial literacy helps individuals develop the skills needed to become self-sufficient, confident, and capable decision-makers (Adegbite & Machethe, 2020; Amrago & Mensah, 2023; Kapoor & Shushma, 2024). This also encourages individuals to take greater responsibility for their financial decisions while minimising risks in the market, essential for the smooth operation of financial markets (Kapoor & Shushma, 2024).

Based on the above discussion, although some research has been conducted on factors affecting the availability of agricultural credit, no study to date has considered the variables influencing both the supply and demand for agricultural credit in rural India, utilising primary data collected from agrarian households. Additionally, no studies have used secondary data to identify factors affecting the availability of agricultural credit in India. Thus, the present study aims to address these knowledge gaps by analysing the factors influencing the supply and demand for agricultural credit in India.

Furthermore, the literature shows that a thorough understanding of farmers’ credit requirements and the key factors influencing them, along with access to information about various financial instruments and their sources, can significantly impact the utilisation of agricultural finance and productivity. This study recognises these gaps and attempts to address them.

Methodology

The present study employed a mixed-method approach. Primary data was collected via focus group discussions (FGDs-12), key informant interviews (KIIs-10), and structured interviews with both close and open-ended questions. A total of 260 respondents were chosen for the study from 18 villages (nine districts) in central Uttar Pradesh using the multistage sampling techniques. Village revenue officials and district administration assistants helped recruit respondents for the FGDs. To ensure representation, each FGD included at least two male and two female farmers from each village studied in each district. Additionally, two personnel from every financial institution in the districts under investigation were randomly selected to serve as key informants (KIs). Secondary data used to determine the factors affecting agricultural credit supply were compiled from various reports by the Reserve Bank of India, NABARD, other commercial banks, and the Ministry of Agriculture and related ministries.

Data Collection, Data Sources, and Sampling Procedure

In the first stage, Uttar Pradesh was purposefully chosen as the study area due to its expanding agricultural production and a significant increase in diverse economic activities in recent years. Subsequently, 18 villages were randomly selected from the pool of sub-administrative regions across nine districts in central Uttar Pradesh. Finally, a sample of 260 farmers was obtained through simple random sampling.

Structured questionnaires, comprising both open-ended and close-ended questions, were used to collect qualitative and quantitative data from the selected respondents. The survey covered various topics including respondents’ socioeconomic characteristics, sources and availability of agricultural finance, eligibility criteria, and reasons for not obtaining agricultural finance. Prior to administration, the questionnaire was meticulously developed, pre-tested, revised, and approved to ensure alignment with the study objectives.

Interviews were conducted to efficiently engage a large number of individuals and obtain consistent and reliable data by repeating interviews. This method also allowed for assessing the respondents’ comprehension of the subject matter. However, due to predefined questions, the depth of responses was limited. To address this, FGDs were conducted with consideration of the study objectives. FGD participants discussed topics such as sources, accessibility, and availability of agricultural financing, factors influencing finance demand, reasons for not utilising agricultural finance, and alternative income sources.

Additionally, information was gathered through KIIs with carefully selected finance providers possessing extensive expertise in financial services, products, and access methods. The KII guide was designed to reflect the study objectives. Insights gained from KIIs shed light on the language used by these institutions in lending to farmers and provided an understanding of the financial resources and opportunities available to them. This information was used to identify factors and considerations likely to influence farmers’ borrowing decisions, including terms and conditions of access and available alternatives

Model and Data Analysis

Identifying the Credit Sources, their Associated Features and Factors Influencing Access

Surveys and KIIs were employed to analyse credit sources, features, and factors affecting access. Additionally, the participants were requested to list the factors that influence their borrowing decision from the various sources they had encountered; KII data was used to validate the recorded information. Then, modelling was carried out employing the logit and multinomial logistic regression models (MNLM).

A Logit Model - LM

The study employed the LM and the threshold decision-making theory proposed by Hill and Kau (1973) and Pindyck and Rubinfeld (1998). The theory’s postulates that a reaction threshold must be reached by borrowers, contingent on specific conditions, prior to borrowing decision. At a threshold value borrowing is noticed and at a stimulus value below the threshold, there is no borrowing decision. To stimulate this response, the following relationship was used:

(1)

(1)

Alternatively, if Yi is below a critical value, Y*, then Xi becomes zero (i.e., Xi=0), and if Yi is above or equal to the critical value, Y*, then Xi becomes one (i.e., Xi=1). Xi is one (1) in the case of a borrowing decision and zero (0) in the absence. At the threshold level, Y* represents the total impact of the independent variables (Yi). A binary choice model represented by Equation (1) was used to assess the likelihood of accessing credit (Xi) based on independent variables (Yi). The logit estimation empirical model was specified as follows:

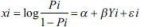

(2)

(2)

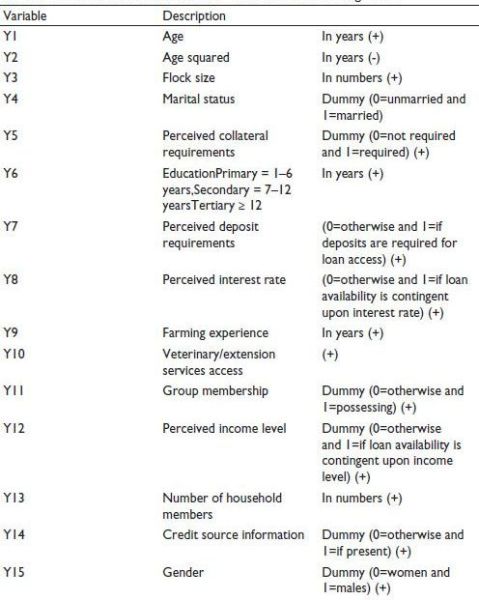

It is assumed that the error term ε, is normally distributed. Thus, in Equation 2, for the response variable, X, Xi denotes the response observed for the ith observation, and log ((Pi)/(1−Pi)) denotes the log odds favouring farmers’ choice to access finance. Further, farmers who chose to borrow were indicated by Xi=1 while those who did not were indicated by Xi=0. The factors that facilitate or hinder farmers from accessing credit were represented by Yi’s; and these are specified from: Y1-Y15 in Table 1. Thus, Table 1 presents the variable selected for the logit and MNL model estimation; while their brief description is provided in the variable selection section.

The signs in parentheses reflect a priori predictions of the direction of change in the likelihood of credit accessibility owning to a unit change in any of the model’s explanatory factors.

Table 1. Factors that Facilitate or Hinder Farmers from Accessing Loans.

The Multinomial Logit Model - MNLM

The MNLM was used to evaluate the variables that influence farmers’ choices to avail agricultural finance either from formal, semi-formal, and informal (non-formal) sources. The decision-makers in this situation had to choose between more than two options. Out of the three lending sources which would a farmer choose to obtain credit from? The observed decision in each of these cases is associated with a group of explanatory factors. In theory, the MNLM estimate and interpretation work similarly to the LM in that they forecast the likelihood that a person with a specific collection of traits would select one of the options.

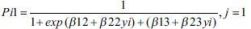

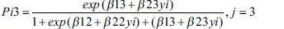

For instance, how likely is it that a farmer who receives a loan will opt for one of the three options? This decision is influenced by a variety of variables. The following is the likelihood that the ith farmer would select option j, just like in the LM: Pij=P[A person i choose option j]. Using these three options for j=1, 2, or 3.

(3a)

(3a)

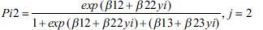

(3b)

(3b)

(3c)

(3c)

The second alternative is particular to β12 and β22 parameters, whereas the third is specific to β13 and β23. Considering this, the identification problem could be solved by setting the parameters unique to the first choice to zero and ensuring that the probability adds up to 1. Equations (3a)-(3c) have a denominator of 1 and a numerator of 1, respectively, where β11=β21=0. More specifically, exp(β11+β21)=exp(0+0yi)=1 would be the term that would be present. The explanatory variables in Equations (3a)-(3c) describe the individual rather than the options available to them, which sets the MNLM apart. These variables represented personal characteristics (Yi). Various values of the parameters were taken into consideration to differentiate the possibilities. As an illustration: assume that the indicator variables Xi1, Xi2, and Xi3 reflect the decision taken by person i. If one chooses option 1, then Xi1=1, Xi2 and Xi3 will be equal to zero. If option 2 is selected, then, Xi2=1, and Xi1 and Xi3 will be equal to zero. Thus, in the MNLM everyone is required to select only one option. Thus, using maximum likelihood estimation (MLE), this model was estimated just like the logit. Let us assume that three persons select options 1, 2 or 3, correspondingly.

Variable Selection for the Logit and MNL Model Estimation

The age of a farmer, Y1, stated in years, is also used to represent maturity and farming experience (Y9). It implies the potential for productive work as well as the ability to use and pay off debts. Since farmers gain production expertise as they age and feel more comfortable obtaining credit to engage in their productive endeavours, it is projected that age will positively impact loan availability (Saqib et al., 2016; Silong & Gadanakis, 2020). The study included age squared (Y2) to ascertain if age is quadratic. It is assumed that farmers would become less involved in economic activities as they become older, including borrowing money and using productive resources. If everything else remains the same, this will have a negative impact on farmers’ ability to get credit. The model incorporated flock size, which is expressed as the count of cattle in numbers (Y3), as a proxy for operation scale that may affect judgements about accessibility to credit. According to Abdullah et al. (2009), expanding the scope of operations would result in more revenue, which would then expand access to credit. The respondents’ agency was represented by the marital status of farmers (Y4). Considering the study region, where a person’s marital status influences their involvement in various economic activities, the variable Y13 representing the size of the family was included in the model. It was found to be necessary for the reason that it was assumed that farmers with bigger household sizes are more likely to obtain credit than the farmers with lower family size. This can be possibly justified as family members may be able to provide readily available farm labour, which could lower production costs and enhance profit ensuring repayment of credit (Saqib et al., 2016; Silong & Gadanakis, 2020). A dummy variable (0=unmarried and 1=married) was used to analyse Y13, with the hypothesis being that it would favourably impact farmers’ decisions about accessing finance.

Since most formal lenders demand collateral from borrowers in order for them to be eligible for credit, the variable Y5 representing collateral was added to the model. A dummy variable (0=not required and 1=collateral required) was used to measure this variable. It was anticipated that when collateral was required, farmers would be less likely to obtain financing. One of the key elements influencing the choice to engage in and get credit is education (Y6), which is crucial for gaining access to and managing productive resources, including credit. Three levels of education were taken into account in the model: elementary education, which lasts 1–6 years, secondary education, which lasts 7–12 years, and higher education, which lasts more than 12 years. It was anticipated that more years of formal education and financial literacy would help farmers to effectively facilitate a loan application to obtain credit (Saqib et al., 2016; Silong & Gadanakis, 2020).

Savings are predicted to have a beneficial impact on borrowing. Deposits (Y7) are crucial for obtaining loans. This is because it may demonstrate that they can produce enough money to pay for their living needs and still have extra. It was quantified using a dummy variable (0 for otherwise and 1 for farmers with savings). Farmers who believe lenders are charging exorbitant interest rates are less inclined to borrow money from them, and vice versa, which is why interest rate level (Y8) was included in the model and quantified as a dummy variable, with 1 denoting high interest rates perceived by farmers and 0 otherwise. To measure access to veterinarian and extension services (Y10), a dummy variable was employed; 1=those who have access, and 0=otherwise. Farmers may carry out farm-related activities more confidently thanks to the technical know-how provided by extension services. Therefore, it stands to reason that expanding livestock producers’ access to veterinary and extension services will also expand their access to finance.

Financial institutions, particularly in rural areas employ group lending strategies, hence, the variable Y11 was included in the model which represented whether the farmer is a member of a social/support organisations or not. It was measured as a dummy variable (1=indicating membership and 0 otherwise), and it was predicted to correlate positively with improvements in accessing credit. Individuals with low incomes may choose not to apply for loans, and vice versa, hence, the variable Y12 representing income level was taken into consideration. For farmers who believed that their income levels affected their decision to borrow, the measurement was dummy 1; otherwise, it was 0. The inclusion of Y14 in the model representing information access on credit sources was justified by the likelihood that borrowing will be positively impacted by knowing where to obtain credit. Y14 was quantified using a dummy (1=those having information access about available sources of credit and 0=otherwise). Y15 representing gender was incorporated into the model as males are more likely than women to choose to get credit in rural areas. A dummy was used to quantity this (1=males and 0=women).

Results and Discussion

To account for gender differences in socioeconomic features and loan demand the respondents of the study were divided equally between the gender categories. Descriptive data showed that the average age of the male and female farmers in the sample was 32 and 37 years and the minimum and maximum ranged from 19 to 75 years. The average experience of male was 10 years while for female it was 8 years, and the minimum and maximum ranged from 1 year both the genders and 45 and 30 years for male farmers and female farmers respectively. Men make up 90% of the respondents, while women make up 88% who were married. The investigation of the household sizes revealed that the average numbers are 14 and 13 for male and female farmers, respectively, and for each gender the minimum was two while the maximum was 35 and 31 members for male and females, respectively. The range of household sizes for both genders is 10–19 members. On an average the male respondents completed six years of formal education, whereas females completed five years, with both up to an average maximum of 16.

Out of the total 260, 184 respondents pose group membership with 92 each from male and female categories, 76 respondents, comprising both men and women were not members of any group. 62 males representing 48% of male sample availed finance from formal lenders (20%), semi-formal lenders (25%), and non-formal credit (7%) sources. In contrast, 52 females, or 40% of the sample, acquired finance from formal lenders (9%), semi-formal (24%), and non-formal (15%). The veterinarian or extension services were utilised by about 40% and 50% of the male and female farmers respectively. The flock size distribution showed that male farmers on average had flock sizes between 4 and 90, whereas female farmers had flock sizes between 15 and 80. Additionally, flock sizes in the 5–10 range were reported by 32% of males and 33% of females, respectively.

Agricultural Finance Sources and Their Features

The results indicated that farmers primarily avail agricultural finance either from formal, semi-formal, and non-formal sources. The formal lenders are the financial institutions such as commercial banks, which include the private, public, and government banks. Semi-formal lenders include cooperatives, non-governmental organisations (NGOs), and social/support groups for farmers. Friends, relatives, spouses, business associates, store owners, and other moneylenders are among the informal lenders.

Financial institutions offer a range of financial services and products, encompassing credit, insurance, and savings options. Generally, large amounts are often provided by formal lenders who have specific protocols and formal settings; nevertheless, the requirements for these loans can be burdensome for farmers in rural areas. This is mostly because of cumbersome administrative processes that farmers, especially the women in particular find difficult to follow because of their limited expertise. A descriptive analysis indicated that men gets formal education for eight years, whereas women only for four. As a result, because of their low level of educational fulfilment women farmers face more difficulties with documentation and administrative processes.

According to KIIs, a large number of small-holder rural farmers are apparently excluded from formal systems due to the high lending rates and the demand for security collateral before obtaining credit. In case of the semi-formal providers, compared to traditional financial institutions, these quasi-financial firms’ operating licences have fewer onerous criteria. Particularly, farmers who are registered members of the cooperatives and other support organisations receive financial assistance. These organisations generate funds by the gradual accumulation of savings from registered members, which are then usually given to members in need for a fee (interest rate charges). Other ways that social groups lend money to their members include gathering up individual members’ capital resources and depositing them into government, private, or faith-based bank accounts, NGOs’ accounts, and personal bank accounts. Groups can also extract substantial amounts of money and charge their members a fee for access to these funds. These groups might potentially provide institutional lenders pooled security in exchange for lump sum loans, which are regularly given to deserving members and interest is applied to repayments throughout the predetermined time frame. In case of non-formal sources, they prefer lending to farmers in cash or production inputs, because they are closer and can be delivered more quickly. Despite this, loans from non-formal lenders are typically short-term and have significant charges, particularly if they are obtained from moneylenders or merchants.

A qualitative study corroborates this; several farmers recorded that semi-formal creditors are easily accessible due to their proximity and prompt delivery of loans; moreover, their repayment terms are fixed and cannot be altered. This helps eliminate some of the main barriers to getting loans for agricultural uses. Quantitative findings also showed that semi-formal providers account for 49% of the agricultural finance accessed by participating farmers, followed by formal creditors (29%), and non-formal providers account for 22% of the total. Further, more males (53%) than females (45%) accessed agricultural finance. Furthermore, it is revealed that male respondents avail 51% finance from formal 40% from semi-formal and 9% from non-formal sources; while female respondents avail 20%, 45% and 35% from the three sources, respectively. As compared to males, fewer women have obtained credit from formal and semi-formal sources, except the non-formal sources. This is caused by a number of reasons, including restricted education and mobility, non-ownership of productive assets which can be used as collateral, and most importantly cultural and societal barriers. The results of this study are consistent with the findings of Saqib et al. (2016), Chandio et al. (2020), and Silong and Gadanakis (2020).

Factors Impacting Respondent’s Demand for Availing Agricultural Finance

The examination of variables influencing respondents’ demand for agricultural financing has been conducted using the LM. This study employs logit theory to illustrate that borrowers have a response threshold they must surpass to make loan decisions, based on specific criteria and data. Consequently, if a particular stimulus value falls below the threshold, the individual will opt not to borrow; however, borrowing occurs once the critical threshold value is reached, triggering a response. The findings of the LM are presented in Table 2.

The LM results showed that all levels of education and group involvement and participation significant at 1% level, and size of household significant at 5% level substantially influence farmers’ decisions to avail agricultural finance. Further, it is evident that a farmer with an elementary school diploma has a logarithmic rise in the likelihood of acquiring finance of 0.314 more than a participant with no formal education. For respondents who have finished their secondary and postsecondary education, the log of odds rises by 0.489 and 0.630, respectively and at 1% significance level, these increases are found to be statistically significant. Given the aforementioned, it is anticipated that a farmer’s decision to borrow and their capacity to obtain agricultural finance would be positively impacted by the number of years of formal education they have completed, and vice versa. Qualitative study also demonstrated that the only people who qualify for loans from former lenders are those who work for a living and have bank accounts with deposits. Furthermore, it is evident that having a formal education positively correlates with the financial literacy required to be proficient while applying for loans and completing the applications. The log of odds for access chances is changed for group members compared to non-members by 0.118, and is significant at 1% significance level.

Table 2. The Logit Model Estimating Famers Access to Agricultural Finance.

Note: *, **, *** represents 10%, 5% and 1%, significant level, respectively.

The likelihood of obtaining credit is positively influenced by larger households since larger households tend to have more easily accessible family labour for timely completion of key farm tasks, which would lower production costs and increase yields that would ensure loan repayment. In particular, as predicted, it was revealed that farmers are less likely to receive agricultural finance as they age past their economically active age group because they do not anticipate being productive enough to repay the loan borrowed. Additionally, unmarried women are also less likely to receive loans. Qualitative research results showed that single women lack husbands who could guarantee their access to agricultural financing. Additionally, it is anticipated that respondents who are single will borrow less frequently because they could not have large households that can support the labour needs of their farms. As per the qualitative results, this is quite feasible given that domestic labour is the main employer in the research area. The likelihood that farmers will be able to get agricultural financing is lowered when they are forced to offer collateral. Farmers and KIs typically stated that the need for collateral is a major barrier to obtaining finance; some farmers acknowledged they are afraid to provide the banks their property as collateral. They refuse to give lenders, for any reason, power over their land holdings too because they think that their immediate and direct relatives and extended families are the rightful inheritors and should be passed down through the generations. Further, farmers did express their preference to keep their dignity intact by not having their debts bother their children when they pass away.

Contrary to what was anticipated, increasing farming experience did not increase access to agricultural financing. However, the flock size may rise along with farming expertise, and farmers may stop borrowing to fund improvements to their farms that would boost earnings. Farming experience might potentially be used as a proxy for ageing, which according to the study would eventually decrease productivity (age square) and so have an impact on borrowing.

Access to Agricultural Finance and the Existing Lenders: Examining the Relevant Factors

Analysing the factors that influence how simple it is to get a loan from the present lenders reveals deep insights. Given that there are variables influencing these decisions, what is the likelihood that a farmer would obtain loans either from the three recognised sources if the respondents are presented with more than two options? This is the reason the MNLM has been used. In all these cases, the observed choice is linked to a set of explanatory variables. Specifically, the MNLM predicts and clarifies the probability that an individual with a given set of characteristics would choose either one among the three: X1 (formal institutions), X2 (semi-formal institutions), or X3 (non-formal institutions), with X4 representing non-access. Our findings are consistent with previous studies (Carrer et al., 2020; Dey et al., 2022; Maloba & Alhassan, 2019; Ölkers & Mußhoff, 2023; Raifu & Aminu, 2020; Silong & Gadanakis, 2020; Yeasmin et al., 2024).

Access to Agricultural Finance and Formal Sources: Examining the Relevant Factors

According to the findings, farmers are less likely to acquire financing from traditional sources when they reach the age square of their economically productive years. The results also demonstrated a negative association between flock size and farmers’ likelihood to obtain loans from formal lenders, which defied the a priori assumptions. Although this association was not statistically significant, it might have been due to the rise in agricultural profits brought about by increased flock sizes, which may have made farmers rethink the necessity for borrowing. Farmers’ marital status negatively affected their ability to obtain finance from formal lenders; specifically, the odds of obtaining finance from formal lenders decreased by 1.4 for single respondents compared to married respondents. At the 10% level of significance, this association is statistically significant. Thus, the study concludes that married farmers have a higher chance than unmarried of receiving credits from formal institutions.

According to a qualitative study, single women were not able to obtain agricultural funding since they did not have the support that husbands usually give at the application stage. Wives who have granted their husbands access to agricultural financing usually serve as guarantors and endorse their spouses’ applications. The collateral did not meet the presumptive assumptions that it would negatively affect people’s access to formal lenders. The results indicated that the presence of collateral had an impact on farmers’ chances of obtaining formal loans, but not in a statistically significant way. Primary, intermediate, and postsecondary education all adhered to the presumption that they would positively influence the possibility of securing finance. Our results are in agreement with the findings of Carrer et al. (2020), Silong and Gadanakis (2020), Raifu and Aminu (2020), Kiros and Meshesha, (2022), and Yeasmin et al. (2024).

In comparison to a person without any formal education, the log of probabilities of acquiring agricultural finance from formal sources improves by 0.910 for respondents with an elementary education, and at 10% significance level this increase is found to be statistically significant. In a manner similar to this, those with postsecondary and university education also see increase in their log odds of 0.85 and 1.0, respectively. At the 1% level of significance, these two increases are statistically significant. The a priori hypothesis of a positive correlation between deposits made with formal providers and farmers’ chances of getting loans from them was satisfied with a probability of 0.58.

People who saved with most formal institutions often desired loans because they expected easy financing in return; however, this is not statistically significant. Farmers preferred formal sources, even if interest rates were thought to be excessive. Contrary to expectations, farmers with more expertise in agriculture are less likely—albeit not statistically significantly—to utilise formal lending institutions. Even if access to formal lenders is positively correlated with farmers’ exposure to extension services, this correlation was found to be insignificant. However, compared to a participant without access to agricultural financing information, the log of the probability of obtaining a loan increases by 0.53 for the former, and at 5% significance level, it is statistically significant. This makes sense since people who are aware of their sources will be able to make informed decisions about which lenders to choose. Group membership did not match the presumptive assumption of having access to government agricultural finance; however, since most farmers received funding from the support groups they belong to, this finding is statistically insignificant.

Farmers would rather invest their money than take out loans from formal lenders, therefore contrary to predictions, the ideas that high earners utilise these sources for financing do not apply to this study. The probability of farmers obtaining formal lending is higher in larger households due to the easy access to family labour. The results showed that farmers with larger households are more likely to obtain formal financing by 0.039, which is statistically significant at the 1% significance level. The research findings corroborate the a priori expectations regarding the gender of the respondents. This suggests that female farmers in rural areas have lower access to formal financing than do their male counterparts; this difference is statistically insignificant, though. The results of this study are consistent with the findings of Carrer et al. (2020), Silong and Gadanakis (2020), Ölkers and Mußhoff (2023), and Yeasmin et al. (2024).

Access to Credit and Semi-formal Sources: Examining the Relevant Factors

A farmer’s ability to obtain finance from semi-formal institutions has been greatly impacted by a number of factors, including household size, group membership, education levels across the board, and deposits. This shows that a participant with a high school diploma has a 0.8 higher chance of getting financing from semi-formal institutions than a person with no formal education. For those who have completed secondary and postsecondary education, the log of odds raised by 0.8 and 0.9, respectively. At the 1% significance level, each of these increases is found to be statistically significant.

For respondents with deposits and group participation compared to those without, the log of likelihood of obtaining finance from semi-formal sources increased by 0.55 and 0.530, respectively; further at the 1% significance level, each of these increases is found to be statistically significant. The log of the probability of obtaining credit drops by 0.063 for non-group members, and at the 1% significance level this loss is statistically significant. The study looked at 82 male farmers and 22 female farmers who were both members of cooperatives or other social groups. Members of these organisations pool the resources (financial and human) needed to manage the association in order to offer members services that are within their means. Both quantitative and qualitative findings point to semi-formal providers as the primary sources of agricultural finance for both men and women. These semi-formal providers are most frequently social groups, cooperatives, rotating financial associations, and NGOs to which farmers belong.

Farmers’ deposits and savings with semi-formal credit institutions were expected to positively correlate with their chance of obtaining credit from these institutions, as predicted a priori. The log of the probability that people with big households would get loans from semi-formal lenders showed increase of 0.038, and at the 10% significance level this increase is found to be statistically significant. Again, the availability of family labour in certain circumstances may be the cause of this. Farmers’ access to knowledge and information about credit sources and gender positively impacted their capacity to seek credit from semi-formal sources, even if none of these traits was statistically significant in predicting the likelihood of doing so.

The findings show that, at the 1% significance level, farmers with more than six years of education had a higher log of their chance of borrowing by 0.84, and by up to 0.94 for those with a university degree. The probability that farmers would be granted finance from these sources increased with group involvement, as expected; for group members, the log of possibilities increased by 0.699. Farmers believe it is easier to get loans from moneylenders because membership in a group confers social capital and local recognition. The findings of our study are consistent with the findings of Silong and Gadanakis (2020), Carrer et al. (2020), and Dey et al. (2022).

Non-traditional Lenders’ Ability to Provide Funding and Factors Affecting it

The probability that respondents would obtain financing from informal sources is significantly influenced by group participation, secondary and higher education levels, and flock size. For those with larger flock sizes than those with smaller flock sizes, results indicated a significant increase (0.019) in the log of probabilities of availing finance from non-formal creditors at the 10% significance level. Large flock sizes give a kind of borrowing surety from these sources since they can be counted on to repay debts and occasionally return the favour by giving animals in return.

There is a link between borrowing from informal lenders and group membership because, as respondents in the FGDs and KIs emphasised, such borrowing depends largely on relationships and social networks. However, a few factors negatively affected access: deposits and gender. Based on the results, farmers who have savings and deposits are probably not going to sought these lenders for financing. Further, women are more likely seek funding from non-formal sources, according to quantitative and qualitative research findings. The results of the present study are in accordance with the findings of previous studies (Dey et al., 2022; Ölkers & Mußhoff, 2023; Raifu & Aminu, 2020; Saqib et al., 2016; Silong & Gadanakis, 2020).

The overall adjusted R2 for the MNLM findings was 0.31, indicating that all of the independent variables account for around 31% of the variations in the likelihood of farmers securing financing from various sources. The possibility that farmers will be able to get financing from these sources is influenced by all of the factors taken into account in the MNLM estimation combination, as indicated by the log-likelihood ratio statistic’s significant finding at 1%.

Conclusion

The study’s findings are solid, and expected to improve the understanding of lenders about the financial needs of farmers. Furthermore, the policy suggestions would assist financial institutions and the government in addressing problems encountered in the process of developing financial innovations meant to sustainably provide loan services that are particularly tailored to farmers’ requirements. Utilising a multistage sampling approach, 260 respondents, comprising 130 men and women, were selected from 18 villages across nine districts within the state, based on information obtained from the state agriculture and cooperatives ministries. The study investigated the pragmatist paradigm through KIIs, FGDs, and surveys. Furthermore, a total of 12 FGDs were conducted, each involving farmers from every tested village. Additionally, 10 KIs from selected credit providers were interviewed within and around the research area. To achieve its objectives, the study employed a range of mixed-methods research methodologies, procedures, and strategies, along with analytical methods targeting various socioeconomic strata.

As a result, the study employed a strong methodology to guarantee the achievement of valid and trustworthy outcomes. Out of the three main financial sources-formal, semi-formal, and non-formal, about 49% of respondents access finance via semi-formal lenders, making them the most common source of agricultural finance. While, only 29% and 22%, respectively, accessed from formal and non-formal creditors. Further gender-specific analysis showed that a greater proportion of male availed financial assistance; however, the males obtained it from both formal and semi-formal sources, whereas the females mainly obtained it from non-formal providers. These findings indicate that women are more likely to face discrimination when trying to avail credit services, especially from formal lenders. The LM results indicated that among the parameters evaluated that effect respondents’ access to credit, education level, group membership, and size of household were demonstrated to be positively and considerably related with likelihood of acquiring credit. Our results are in agreement with the findings of earlier studies (Carrer et al., 2020; Dey et al., 2022; Kiros & Meshesha, 2022; Maloba & Alhassan, 2019; Raifu & Aminu, 2020; Yeasmin et al., 2024).

The results of the MNLM showed that education, credit sources information and awareness, savings and deposits, size of family, and marital status are among the variables that are strongly linked to obtaining credit from formal lenders; while, education, saving and deposits, group membership, and size of family were all significant factors in determining a person’s eligibility and ability for obtaining finance from semi-formal lenders. In the case of non-formal credit institutions, access to credit was positively impacted by group membership, gender, education, saving and deposits, and flock size. These essential components must thus be the focus of policies intended to improve farmers’ access to financing. In order to foster a climate that is favourable for learning, it would first be beneficial to support and encourage the formation of farmer groups and to foster their involvement via effective leadership. Experts might be included in these groups to offer targeted training and the necessary assistance from different service-providing institutions. These might include financial literacy, training to upgrade knowledge and new skills development, awareness and information about various financial instruments and services, value-added agricultural processes, and help accessing markets for inputs, outputs, and services. Furthermore, group involvement and engagement on social media provide a forum for beneficial knowledge sharing, which is crucial for regulating the nexus between financial inclusion and institutional frameworks. Furthermore, being a part of a group allows one to profit from social collateral. Our findings are consistent with previous studies (Carrer et al., 2020; Dey et al., 2022; Kiros & Meshesha, 2022; Saqib et al., 2016; Silong & Gadanakis, 2020; Yeasmin et al., 2024).

Managerial and Policy Implications

In numerous instances, farmers’ decisions to access credit are shaped by their socioeconomic status. According to the aforementioned analysis, farmers exhibit a negative response to interest rates and the complexity of the credit application process. Bank officials may take into account factors such as farm size and occupational experience when determining which households are eligible for credit disbursement.

Commercial banks ought to endeavour to raise awareness among farmers regarding the available facilities and the advantages of agricultural credit. It is important to make information in advertisements and informational materials as simple as possible so that farmers with low literacy levels may grasp them and understand adequately. To improve education quality and implementation, more efforts may be put into encouraging and expanding the enrolment of rural farmers in formal and informal learning environments. Revisions to formal financial sector laws may also prove beneficial in promoting outreach to rural regions with easily comprehensible and secure financial products. This could be accomplished by positioning financial institutions in close proximity to one another. Furthermore, by providing a range of savings choices, emphasis should be placed on the use of deposits and savings that take into account the various necessities, prerequisites and constrictions faced by farmers, ensuring that those who are less fortunate can also manage to have the minimum deposits. The credit providers could take into account accepting social and/or physical collateral. In addition, these organisations might carry out market research to have a comprehensive grasp of rural farmers’ preferred goods and financial demands in order to provide financial services that are specifically catered to their need. Funding for informal lenders in rural communities should be considered, as more women and farmers in these areas obtained credit from these sources. By doing this, their shortcomings will be lessened and their strengths will be strengthened. This is especially crucial because the majority of informal lenders are highly skilled professionals with direct knowledge of their local customers. Nevertheless, they are unable to lend to many borrowers due to their severe resource constraints. However, such a situation can be taken care with the help of credit layering concept in which formal financial institutions take assistance of lenders and assign loan provisions to them as they have first-hand information about their local clientele that have high repayment rates (Dey et al., 2022; Kong et al., 2014; Ölkers & Mußhoff, 2023; Raifu & Aminu, 2020; Turvey, 2013; Yeasmin et al., 2024). Thus, informal lenders may act as community-level intermediates between borrowers and formal lenders. This will help in simplifying the administrative process, streamline the application and repayment procedures, accomplish timely and fast credit distribution, lower transaction costs, and minimise proximity-related issues.

Considering all things, the study recommendations will help and support lenders and borrowers in maintaining easy and reasonably priced financial services. Furthermore, it would help to create beneficial loan packages that would incentivise farmers to partake more lucrative economic activities by combining credit with extra services like tracking progression of their productive undertakings and putting them in touch with organisations or groups that would facilitate their productive endeavours.

The outcomes and findings are anticipated to enhance lenders’ comprehension of farmers’ financial requirements. Additionally, the policy suggestions would aid financial institutions and the government in tackling challenges encountered in developing financial innovations aimed at consistently providing loan services tailored to farmers’ needs.

Limitations and Future Research Directions

While the study holds several strengths, it also presents certain limitations that could be addressed in future research endeavours. Subsequent studies could explore time series data to corroborate the findings of the current study and offer fresh insights. Moreover, incorporating additional variables related to financial inclusion into the model could enhance its robustness. Geographically, expanding the study to other regions within the country or to different countries could augment the generalisability of the results and provide novel insights, thereby informing policy development. Despite the relevance of the policy implications drawn from the study’s small sample size, their applicability nationwide may be limited. However, this limitation may not be overly restrictive, as the policy implications could potentially be relevant to other regions in India, given the prevalence of informal credit alongside formal credit limitations imposed by formal lending procedures.

Acknowledgement

The authors are grateful to the anonymous referees of the journal for their extremely useful suggestions to improve the quality of the article. Usual disclaimers apply.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Samridhi Kapoor  https://orcid.org/0000-0001-6132-1500

https://orcid.org/0000-0001-6132-1500

Adams, D. W., & Vogel, R. C. (1986). Rural financial markets in low-income countries: Recent controversies and lessons. World Development, 14(4), 477–487.

Adegbite, O. O., & Machethe, C. L. (2020). Bridging the financial inclusion gender gap in smallholder agriculture in Nigeria: An untapped potential for sustainable development. World Development, 127, 104755.

Amrago, E. C., & Mensah, N. O. (2023). Trade credit from agrochemical vendors as an alternative source of finance for cabbage producers in the Bono East Region of Ghana. Agricultural Finance Review, 83(1), 43–82.

Carrer, M. J., Maia, A. G., Vinholis, M. D. M. B., & de Souza Filho, H. M. (2020). Assessing the effectiveness of rural credit policy on the adoption of integrated crop-livestock systems in Brazil. Land Use Policy, 92, 104468.

Chandio, A. A., Jiang, Y., Rehman, A., Twumasi, M. A., Pathan, A. G., & Mohsin, M. (2020). Determinants of demand for credit by smallholder farmers': A farm level analysis based on survey in Sindh, Pakistan. Journal of Asian Business and Economic Studies, 28(3), 225–240.

Dey, S., Singh, P. K., & Mhaskar, M. D. (2022). Determinants of institutional agricultural credit access and its linkage with farmer satisfaction in India: A moderated-mediation analysis. Agricultural Finance Review, 83(2), 211–241.

GOI. (2021). Agricultural Statistics at a Glance 2021, Directorate of Economics and Statistics, Ministry of Agriculture and Farmers Welfare, Govt. of India.

Hill, L., & Kau, P. (1973). Application of multivariate probit to a threshold model of grain dryer purchasing decisions. American Journal of Agricultural Economics, 55(1), 19–27.

Kapoor, S., & Shushma, H. (2024). Perception of farmers as investors towards various investment avenues: An empirical analysis. IMIB Journal of Innovation and Management, (In press).

Kiros, S., & Meshesha, G. B. (2022). Factors affecting farmers' access to formal financial credit in Basona Worana district, North Showa zone, Amhara regional state, Ethiopia. Cogent Economics & Finance, 10(1), 2035043.

Maloba, M., & Alhassan, A. L. (2019). Determinants of agri-lending in Kenya. Agricultural Finance Review, 79(5), 598–613.

Mishra, A., Vangaveti, A., & Majoo, S. M. (2024). Fintechs reshaping the financial ecology: The growing trends and regulatory framework. IMIB Journal of Innovation and Management, 2(1), 34–44.

Ölkers, T., & Mußhoff, O. (2023). Exploring the role of interest rates, macroeconomic environment, agricultural cycle, and gender on loan demand in the agricultural sector: Evidence from Mali. Agribusiness, 1(1), 1–29.

Ouattara, N. B., Xueping, X., Bi, T. B. A. Y., Traoré, L., Ahiakpa, J. K., & Olounlade, O. A. (2020). Determinants of smallholder farmers’ access to microfinance credits: A case study in Sassandra-Marahoué District, Côte d’Ivoire. Agricultural Finance Review, 80(3), 401–419.

Pandey, B., Bandyopadhyay, P., & Guiette, A. (2019). Impact of different sources of credit in creating extreme farmer distress in India. Benchmarking: An International Journal, 26(6), 1676–1691.

Pindyck, R. S., & Rubinfeld, D. L. (1998). Econometric models and economic forecasts. In Business & economics (Vol. 4(1), p. 634). McGraw Hill.

Raifu, I. A., & Aminu, A. (2020). Financial development and agricultural performance in Nigeria: What role do institutions play? Agricultural Finance Review, 80(2), 231–254.

Saqib, S. E., Ahmad, M. M., & Panezai, S. (2016). Landholding size and farmers’ access to credit and its utilisation in Pakistan. Development in Practice, 26(8), 1060–1071.

Sharma, P., Mishra, B. B., & Rohatgi, S. K. (2023). Revisiting the impact of NPAs on profitability, liquidity and solvency: Indian banking system. IMIB Journal of Innovation and Management, 1(2), 167–180.

Silong, A. K. F., & Gadanakis, Y. (2020). Credit sources, access and factors influencing credit demand among rural livestock farmers in Nigeria. Agricultural Finance Review, 80(1), 68–90.

Turvey, C. G. (2013). Policy rationing in rural credit markets. Agricultural Finance Review, 73(2), 209–232.

Yeasmin, S., Haque, S., Adnan, K. M., Parvin, M. T., Rahman, M. S., Rahman, K. M., Salman, M., & Hossain, M. E. (2024). Factors influencing demand for, and supply of, agricultural credit: A study from Bangladesh. Journal of Agriculture and Food Research, 16, 101173.

Zhang, Z., Song, J., Shu, T., & Zhao, T. (2024). Changes in rural financial exclusion’s supply and demand factors from the perspective of digital inclusive financial policies. Cogent Economics & Finance, 12(1), 2305480.