1 Department of Commerce, University of Calcutta, Kolkata, West Bengal, India

2 Department of Commerce, Raja Rammohun Roy Mahavidyalaya, Khanakul, West Bengal, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www. creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Financial well-being is a state of being financially healthy and happy. Financial well-being plays an important role in achieving Sustainable Development Goals (SDGs). Increasing financial well-being helps to promote SDGs 1, 3, 10 and 16. SDGs and financial well-being are interconnected in several ways. This article presents a systematic review of the literature on financial well-being and tries to link it with some important SDGs. The study included the research article from the Web of Science and Scopus index database. The article suggests an organising framework to identify significant research gaps and suggests future research directions by critically analysing the existing findings and providing a comprehensive, up-to-date overview of financial well-being and its relationship with SGDs that scholars or researchers from different areas can use to position and design future research. Researchers used R Studio software for the bibliometric analysis.

Financial well-being, sustainable development goals, poverty, R studio, inequalities, strong institutions and health, systematic literature review

Introduction

On 25 September 2015, the United Nations General Assembly adopted the 2030 Agenda for Sustainable Development, along with a new set of development goals that are collectively called the Sustainable Development Goals (SDGs).

According to the United Nations, the SDGs are a ‘blueprint to build a brighter and more sustainable future for all’. The objectives are interrelated and address a variety of issues, such as poverty, inequality, climate change and environmental degradation. The SDGs are a worldwide call to action to eradicate poverty, safeguard the environment, and secure peace and prosperity for all. By doing this, SDGs increase the economic well-being of the country (Singh et al., 2022).

Financial well-being is a combination of two words: ‘finance’ and ‘well-being’. Well-being means the state of being happy and healthy. Financial well-being is thus a state of being financially healthy and happy. If people feel financially secure and independent for the present and future, then they will have achieved financial well-being (Consumer Financial Protection Bureau, 2019). There are different scales developed by different researchers worldwide to measure financial well-being in an appropriate manner. People can increase their financial well-being score by getting a financial education (Singh et al., 2022), saving regularly, evaluating debt advice and planning for current and later life.

The SDGs consist of 17 goals, but they do not target the financial well-being directly despite financial well-being being a key enabler for some of them. The SDGs and financial well-being are interconnected in several ways. First, financial well-being is a key determinant of the overall well-being of the individual and it is essential for achieving many of the SDGs. For example, overall life satisfaction, and greater capacity to absorb financial shocked, can help individuals and households to escape from poverty and build resilience to economic shocks. This, in turn, contributes to the achievement of SDG 1 (No poverty) and SDG 3 (Ensure healthy lives and promote well-being for all at all ages). It is possible to operationalise financial well-being in a variety of socioeconomic and geographic circumstances. As a result, it might be a helpful outcome metric for governments and financial service providers to track progress on goals like ‘eliminating extreme poverty (SDG 1)’, ‘good health and well-being (SDG 3)’, ‘reducing inequalities within and across countries (SDG 10)’ and ‘effective institutions (SDG 16)’ (Fu, 2020).

Objectives of the Study

The objectives of the study are as follow:

Methodology

To achieve a thorough systematic review of the literature (SLR) on link between financial well-being and SDGs, this article follows the methods and processes used for bibliometrics analysis discussed by Bashir and Qureshi (2023), Kreutz et al. (2021), Kumar et al. (2022), Nolan and Garavan (2016) and Zahoor et al. (2020). This is a four-step literature review process. By removing the subjectivity in data collecting and analysis seen in conventional literature reviews, the four-step iterative method ensures stability and clarity of the study. These four steps are identifying the review questions; defining the review’s scope and boundaries; screening and selecting the studies; and analysis and synthesis.

Defining the Review Questions or Objectives

The worldwide research on financial well-being started before independence, and related research that describes financial well-being in the context of poverty, health and well-being, inequality, peace, justice and strong institutions started almost 25 years ago. Since this is a huge timespan and the literatures are still fragmented. there are few systematic literature reviews available (Farid, 2019; Kreutz et al., 2021) on financial well-being, but these literature give an overall view of financial well-being and do not link with the SDGs or any goals related to the SDGs. So, a summary of the literature is need of the situation to provide a clear picture and current status. All over the world, countries are trying to meet the SDGs goals, and if financial well-being has any role or link with the SDGs, then it should be discussed. Therefore, this SLR and bibliometrics seeks to identify, categorise and analyse relevant and important layers of the existing literature in this SLR, highlighting the key elements, potentials and unmet needs, and the relationship between financial well-being and SDGs. To find the solution for this, the article has three key question:

Establishing the Scope and Boundaries of the Review

This article established a variety of distinct criteria for the inclusion and exclusion of research in order to create a complete database of financial well-being and SDGs literature. We set our timeframe to include articles published between 1955 and 2022, choosing 1955 as our starting year because the first article discussing financial well-being and SDGs was published in the year 1995 (Boisjoly et al., 1995; Markham & Bonjean, 1995).

Next, this article defines the conceptual boundaries of financial well-being and SDGs by selecting only those articles that either cover SDGs directly or cover some specific goals of SDGs with financial well-being. Bashir and Qureshi (2023), Fu (2020) and Le Blanc (2015) discuss the relationship of financial well-being with poverty, inequality, health and well-being, and peace, justice and strong institutions. So, this article just tries to find out the relationship between these goals of SDGs and financial well-being.

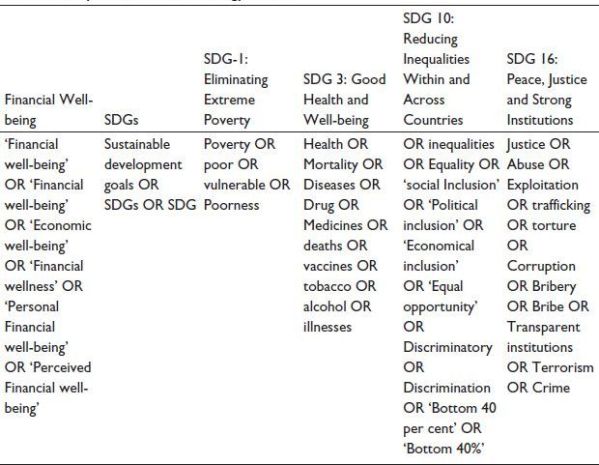

After establishing our conceptual boundaries, we created several keywords. It was important to integrate a corresponding variance in search words due to the diversity in the wording used to describe the concepts. After a brainstorming session and a preliminary article search, we identified 46 keywords related to financial well-being and SDGs, which we mentioned in Table 1.

Two electronic database sources were used for conducting the SLR: Scopus and Web of Science. For searching the relevant literature, we have done some keyword research (mentioned in Table 1) and developed a group of keywords for finding articles that are relevant to this review. We conducted research on how financial well-being is linked to SDGs or how many literatures discuss both financial well-being and SDGs. However, there are very few articles exist that talk about both, so we decided to consider the keywords for the goals of the SDGs.

These keywords have been used in both Scopus and Web of Science databases, and we searched for them in the title, abstract and author’s keywords. The search area for our literature review is not only limited to management, finance, business, accounting and economics but it also includes social science and family studies health and policy service, and so on for identifying the links with SGD-1, 3, 10 and 16 (Bashir & Qureshi, 2023; Fu, 2020; Le Blanc, 2015).

Table 1. Keywords Search Strategy Grid.

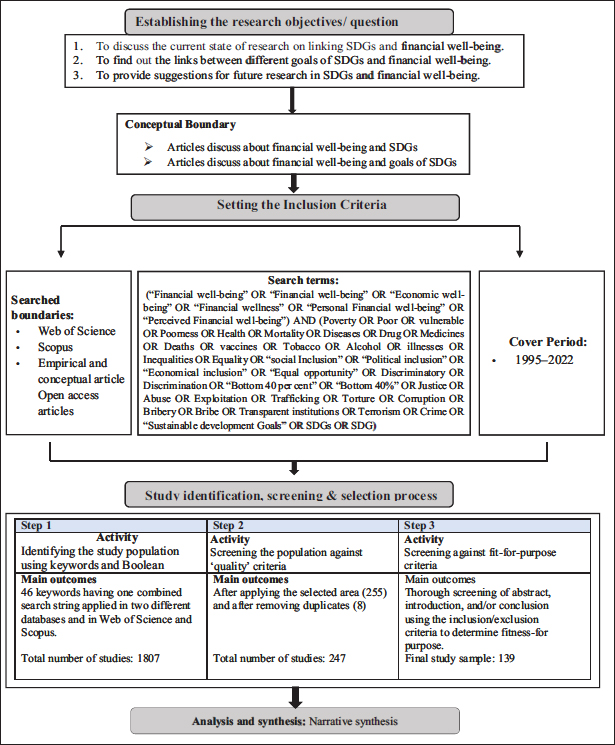

Figure 1. Summary of the Systematic Review Methodology.

Study Identification and the Screening and Selecting Process

This process tries to find, evaluate and choose appropriate articles to support our review questions. The initial search was first carried out in several databases and by using the Scopus and the Web of Science search engines with the keyword combinations, as indicated in Figure 1, to find potential publications published between 1995 and 2022. This process identifies 1,807 articles.

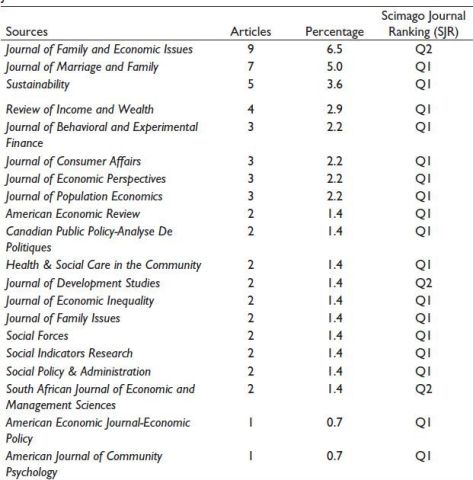

As shown in Table 2, the top 20 journals contributing to the systematic literature review (SLR) on financial well-being and SDGs are listed, with Journal of Family and Economic Issues contributing the highest number of articles.

Second, only peer-reviewed articles and review articles were filtered and, after merging them into one file by using R studio software, eight duplicates were removed and the final articles were reduced to 247.

Lastly, we looked over the study abstracts. To identify the relevancy of the articles, all 247 articles had to go through the fit-for-purpose test in which the researcher has to go through the title, the abstract and, in some cases, the introductions or conclusions (or both) of these studies and analyse them. This procedure ultimately resulted in the selection of 139 publications that made up our final sample. This quantity is sufficient for the systematic review, and other earlier investigations employed comparable quantities of publications (Duhoon & Singh, 2023; Nolan & Garavan, 2016; Zahoor et al., 2020).

Table 2. Top 20 List of Journals Used in the SLR, Journal Ranking and Articles per Journal.

Analysis and Synthesis

Analysis was done using R studio programmes. With the help of this programme, researchers can find out the trends and can do some thematic analysis, which can be very helpful for future researchers.

Current Status of Research on Financial Well-being and SDGs

To know the current status of research on financial well-being and SDGs, this article has examined a number of bibliometric data, including those related to corpus, article, author, country and journal performance, as revealed by the performance analysis and intellectual structure, which encapsulate financial well-being in the context of SDGs knowledge foundation (past) and knowledge production (present), unpacked through science mapping via co-citation and keyword co-occurrence analysis.

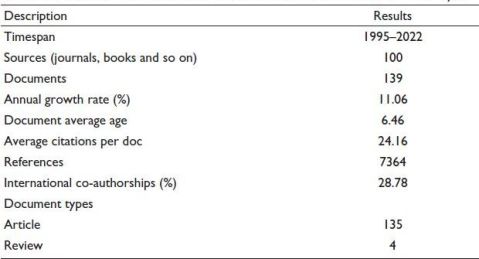

In this corpus, a total of 139 articles from 100 different sources with 7,364 references have been selected for the analysis. Wherein there are 135 research articles and 4 review articles. The annual growth rate of research in financial well-being in the context of SDGs has reached 11.06%, but there are still very few articles on financial well-being that directly discuss the SDGs. In the selected 139 articles, almost 29% of their authors are from a foreign country. From Table 3, it can be seen that the number of review articles in comparison to normal research articles is very low. So, there is a scope for future researchers to write review articles in this area.

Corpus Performance

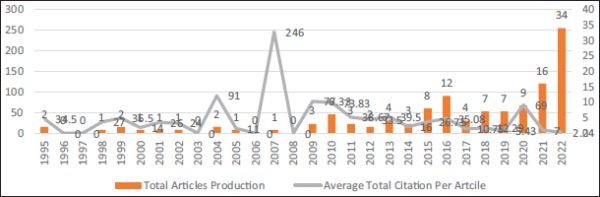

This review analysed a total of 139 articles on financial well-being in the context of SDGs that were published between 1955 and 2022. The growing trend and research interest in the field are shown in Figure 2. For ease of understating the trends in this area, the review period has been divided into three parts (1995–2004, 2005–2013 and 2014–2022).

Table 3. Basic Information About Our Research Data Used for Bibliometrics Analysis.

Figure 2. Production of Article Over the Time Horizon and Average Total Citation per Article.

The first 10 years (1995–2004) witnessed only 10 articles being published, with an average total citation per article of 25, indicating that the field of financial well-being had a very slow growth in the early years because, at that time, the concept of financial well-being was not as popular in finance or business areas but it was popular in other domains such as health and psychology. The next nine years (2005–2013), however, saw a decent growth in the publication of articles (n = 20), which is double that of the earlier period, with an average total citation per article was 26—almost same as earlier period citations. After an article published by Reynolds et al. (2007) in 2007, the research in this area became popular, and in 2007, the average citation per article rose to 246, which was the highest till that point. The recent nine years (2014–2022) have been the most fruitful for research on financial well-being in the SDGs, with a minimum of three publications published each year and a total of 100 published throughout this time. During this period, the popularity of financial well-being shifted from other streams to the streams of finance and management streams. Another reason for the increasing popularity of financial well-being in SDGs is that SDGs came into existence from the United Nations. Before the declaration of SDGs, there were very little research done on poverty and health, well-being, inequality and strong institutions, and peace and justice, but after the declaration of the SDGs, the number of articles in these areas increasing in a very fast manner. We can see that in 2022, the highest number of were articles published (n = 34), far better than any other year.

Article Performance

A global citation analysis was conducted to identify the top 10 articles that have been most cited globally, which enables more accurate tracking of the performance of financial well-being in the context of SGDs.

Brown et al. (2020) was the most cited article globally (507 citations). Their articles analyse the effects of parental stress and child abuse in COVID-19, which can destroy the economic well-being of the child. This article concludes that a greater amount of stress and child abuse can cause a serious amount of financial distress and lower economic well-being.

Currie and Widom (2010) is the second most cited article globally (385 citations). In this article, the authors try to discuss the relationship of education, financial well-being, employment and earning capacity with child abuse and neglect. They conducted a study with a sample of 807 individuals and found that compared to the matched control children, people with histories of childhood abuse and/or neglect had lower levels of education, employment, incomes and assets.

Reynolds et al. (2007) is the third highest-cited article globally (246 citations). It discussed the Child-Parent Centre (CPC) programme and its effects on education, financial well-being, employment, crime rates, health status, behaviours and mental health. This article found that there is a positive relation between the CPC programme at primary level and education, financial well-being, employment and health status and negative relation between the programme and mental health and crime rates.

McGarry (2004) is the fourth highest-cited article globally (160 citations). It explains the importance of retirement dates in the financial well-being of an individual. Retirement date is a very crucial decision for the individual because it can affect the economic well-being for the rest of their life.

Nannicini et al. (2013) is the fifth highest cited article globally. This article described that the country or region that has lower social capital has to face higher crime rates, political misbehaviour and so on because the voters’ elected representatives will have lower incentives to achieve social welfare if they are unable to coordinate in punishing political wrongdoing. Additionally, it is less probable that candidates for political office will be chosen based on their general honesty and competency.

Overall, the top 10 most cited articles globally in this corpus collectively had a total of 1,731 citations, which means that each article in the corpus had an average of 173 citations.

Country Performance

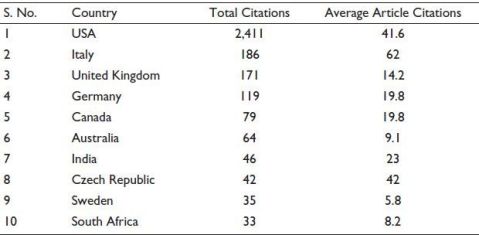

According to Table 4, the top 10 most cited documents related to financial well-being and SDGs are presented, highlighting the most influential works in this domain.

Authors from 34 different nations contributed to the articles in the context of financial well-being and SDGs in the review corpus. Table 5 presents the ranks of countries on the basis of their total citation in this area of research. The top 10 nations account for 95% of the total number of citations in this corpus.

The USA, Italy, the United Kingdom and Germany are the top four countries that have contributed more than 3,000 citations, out of which the USA accounts for 2,411 citations, which is 71% of total citations. It can be observed that the USA is dominating research in this area. But on the basis of average citations per article, Italy has 62 citations per article while the USA has only 41 citations per article. Since the USA has been working in this area from the very beginning, they have the highest number of citations and number of documents in this context.

Table 4. Top 10 Most Cited Documents in Selected Articles and their Total Citations.

Table 5. Top 10 Country in the Selected Articles.

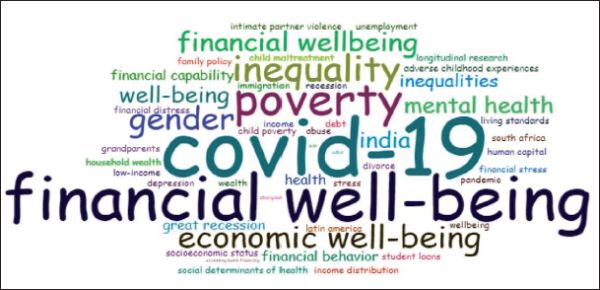

Figure 3. Most Frequent Word Analysis.

Word Cloud Analysis

A co-word analysis states the importance of the research topic by providing the most occurred keywords. The size of the words shows the comparative number of occurrences. In Figure 3, COVID-19 is the biggest word; this means that the study of financial well-being in the context of SDGs has been mostly done with reference to COVID-19. So, there is a scope for research in this area after COVID-19. The words financial well-being, poverty, inequality and mental health represent that the research of financial well-being has been studied with poverty, mental health and inequalities. It is also observed that there is further scope for research in the areas of financial well-being and crime, peace and justice as there are no words related to it.

Co-word Network Analysis

As per the result generated from the R studio, there are five clusters in the co-word network analysis. The colours of these words represent the cluster, and the size of the nodes represents the number of times that word appears in total. The first cluster includes the words COVID-19, financial well-being, mental health, financial capability, pandemic, stress and well-being. These words occurred together many times in an article. That means that research has been done on the effects of COVID-19 or the pandemic on mental health, financial well-being, stress and overall well-being of individuals.

The second cluster includes the words financial well-being, poverty and financial behaviour. That means that the second cluster indicates that studies related to financial well-being, poverty and financial behaviours were conducted.

Figure 4. Co-word Network Analysis.

The third cluster represents the studies related to inequality, household wealth and living standards, which shows the relationship between them. Since a blue line is connecting the third cluster with the second cluster, that means that there are a few research articles that are related to inequality and financial well-being and to COVID-19.

Figure 4 illustrates the Co-word Network Analysis, which visually represents the clusters of research topics that have frequently co-occurred in studies on financial well-being and SDGs. The largest clusters, including COVID-19, financial well-being, and mental health, indicate the dominant research trends in this area.

The fourth cluster includes economic well-being, gender, inequalities, divorce and longitudinal research. In this cluster, longitudinal research has been done on the relationship or the impacts of economic well-being on gender, divorce and inequalities.

The fifth cluster is a combination of two words: well-being and income distribution. The research related to well-being and income distribution has been focused.

Overall, we can see that the popular researches are related to financial well-being and poverty, mental health and COVID-19. Research on financial well-being and inequalities is very little; hence, it can be a trigger for future researchers who can do their research on financial well-being and inequalities.

Relationship Between SDGs and Financial Well-being

Eliminating Extreme Poverty (SDG 1)

As per the World Bank, more than 700 million people whose income is less than or equal to US $2.151 per day are living in poverty. As per Singh et al. (2022), economic well-being and poverty are negatively related, and financial well-being is a powerful tool against poverty (Bashir & Qureshi, 2023). Providing knowledge about how to achieve financial well-being, that is, knowledge about how to improve financial condition by maintaining mental satisfaction, to the poor people facilitates the first SDG: eliminating extreme poverty (Xiao & Porto, 2022). Income enables people to satisfy their basic and universal requirements. Regardless of social comparisons or other factors, persons with higher incomes are more likely to be able to satisfy their basic requirements, such as those of food, safety, health and pleasant housing. As a result, they are more likely to report having higher financial well-being (Diener et al., 1993). So, we can say that financial well-being helps people to overcome poverty because higher financial well-being means that the person must be able to fulfil his or her basic needs. Financial well-being helps individuals to protect themselves from danger including unemployment, health emergency, insolvency, poverty and retirement. If an individual achieves financial well-being, it automatically leads to them meeting their current and future requirements, having freedom of choice and living a better quality of life (Consumer Financial Protection Bureau, 2019; Fields, 2000). An individual can meet their current and future obligations when they have sufficient savings and investments and have financial literacy (Consumer Financial Protection Bureau, 2019). Lower financial well-being can increase the chances of financial crises among people, which can increase extreme poverty by 10% (Antoniades et al., 2020).

Xiao and Porto (2022) stated that financial behaviour is the most important and effective tool for improving financial well-being for people in poverty.

Good Health and Well-being (SDG 3)

Financial well-being and mental health are strongly correlated (Brown et al., 2020; Currie & Widom, 2010; Friedline et al., 2021). The lives of individuals may be significantly impacted by stress related to money and finances (Brown et al., 2020). According to research done in the USA, over 72% of adults say that they feel anxious about money at least occasionally, while nearly 25% say they feel extremely stressed about money. Globally, 3.6% of people exhibit symptoms of anxiety disorders, while 4.4% have depressive disorders (Hassan et al., 2021). According to the American Psychological Association (APA), financial stress is the main contributor to harmful habits including smoking, gaining weight, and abusing alcohol and other drugs.

Strong financial well-being helps people to live stress-free lives by enabling them to meet medical emergency costs (Benson-Egglenton, 2019). According to research, one of the main reasons why individuals stay in poverty in developing nations is because of out-of-pocket expenses for health care. Sometimes people have to spend their life savings on a medical emergency. Medical insurance is one example of a financial service that might offer a formal avenue for reducing the risks associated with medical emergencies. Savings are a crucial tool for managing medical bills, whether they are expected or unexpected. Mental health and financial well-being have a significant relationship. By improving their financial well-being, people can increase their mental satisfaction, which will finally lead to good health and well-being (Benson-Egglenton, 2019; Farid, 2019).

Reducing Inequalities Within and Across Countries (SDG 10)

Financial well-being can help reduce inequality by providing individuals and families with the means to improve their economic standing and achieve financial stability. This can include access to financial services such as banking and credit, as well as the ability to earn a steady income and manage their money effectively. When individuals are financially secure, they are better able to afford necessities such as food, housing and healthcare, which can help reduce the gap between the wealthy and the poor. Financial well-being can also provide people with the opportunity to save and invest, which can help them build wealth and create a more equal society. To improve well-being and reduce financial difficulties for those at the bottom side of the income distribution, it is essential to address inequality and poverty. Inequality of income has an impact on opportunities and achievements in every aspect of life. Poorer households have less access to healthcare and education than wealthier households, which hinders them from reaching their full potential (OECD, 2015).

Income inequality, which is strongly connected with poverty, can be decreased, in addition, by a sound financial system. Instability affects many areas of developing nations. The lower half of the population frequently controls less than 10% of the total wealth, and inequality is prevalent both in industrialised and developing nations (Prakash et al., 2022). In contrast to their 20% share of total family income, the bottom 40% own only 3% of all household wealth in the 18 OECD nations (OECD, 2015).

Financial literacy (components of financial well-being) can increase the speed of achieving financial well-being. Financial education and literacy can help individuals understand how to manage their money, make informed financial decisions and achieve their financial goals. By providing access to financial education and resources, people can be empowered to improve their financial well-being and reduce inequality (Bansal & Kumar, 2020).

Peace, Justice and Strong Institutions (SDG 16)

According to the United Nations Development Programme (UNDP), SDG 16 aims to ‘significantly reduce illicit financial and arms flows, strengthen the recovery and return of stolen assets and combat all forms of organized crime’. Improving financial well-being is seen as an important part of achieving this goal, as financial well-being can help people build resilience, manage risks and invest in their own and their families' futures. This can in turn contribute to social stability and the overall well-being of individuals and communities. A high level of financial well-being helps people to live stress-free and happy lives. When people are mentally happy and satisfied with their lives, then they less likely to commit fraud, robberies or any other type of violence; they will not even commit acts of domestic violence (Benson-Egglenton, 2019). Omoniyi and Omoniyi (2014) discussed that poverty is the main reason for the high crime rate and terrorism. We had previously discussed how financial well-being helps to reduce poverty. Reducing poverty will automatically lead to less crime and less terrorism. As per Xiao and Porto (2022), financial behaviour is the most effective component of financial well-being in case of fraud victims to improve their financial well-being.

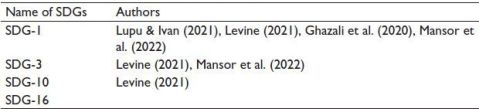

As observed in Table 6, various SDGs, such as SDG-1 (No Poverty) and SDG-3 (Good Health and Well-being), have direct links with financial well-being, as identified by multiple authors.

Measurement of Financial Well-being

As per the Consumer Financial Protection Bureau (CFPB), financial well-being is the degree to which a person feels financially secure based on how much he or she (a) has command over monthly and daily finances; (b) has the ability to withstand a financial shock; (c) has the financial flexibility to make decisions that allow him or her to enjoy life and (d) is currently on a path to reach his or her financial goals.

Savings and expenses (Consumer Financial Protection Bureau, 2019) can satisfy the first two criteria, (a) and (b) and financial inclusion (Levine, 2021) can justify the other two criteria, (c) and (d), because if an induvial has access to financial services, they will enjoy financial flexibility and it can help them to achieve their future goal (Consumer Financial Protection Bureau, 2019). In the research conducted by CFSI (2018), Fu (2020), and García-Mata and Zerón-Félix (2022), they used savings, spendings, borrow and plan to measure financial well-being. Further savings and expenses are needed to meet people’s financial commitments, and for investment for feeling financially secure (Carton et al., 2022). Global research indicates that those who put money aside for their future appear to feel happier, sleep better and have better mental health than those who do not.2 Financial inclusion helps people to have the financial freedom to make choices among the different financial instruments and to have a sense of social belonging (Carton et al., 2022; Consumer Financial Protection Bureau, 2019; Fu, 2020). A number of writers (Carton et al., 2022; Consumer Financial Protection Bureau, 2019; Fu, 2020; Vlaev & Elliott, 2014) have shown that factors like savings, spending and financial inclusion may be used in secondary data to quantify financial well-being.

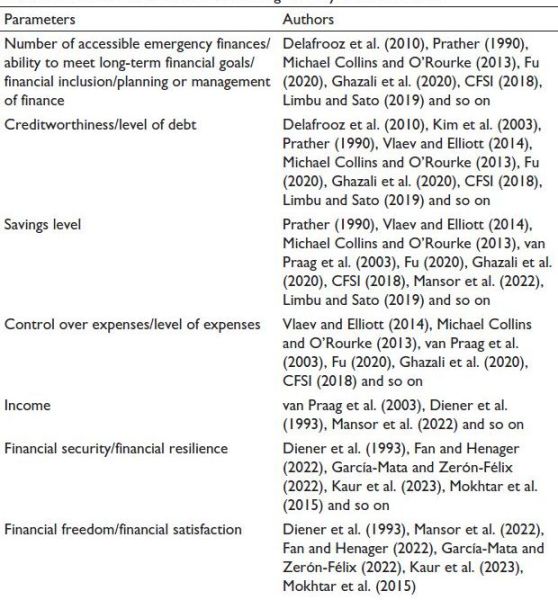

Table 7 lists the key parameters that have been used in different studies to measure financial well-being, including factors like savings levels, creditworthiness, and income.

Table 6. Link of SDGs with Financial Well-being.

Table 7. Parameters of Financial Well-being Used by the Researchers.

Conclusion

Earlier the research in financial well-being was already popular among the other streams, but after 2000 it started to get popular in commerce, finance and management. The SDGs are also a new and emerging topic. This article plays an important role in finding out the link between the SDGs and financial well-being by doing bibliometric analysis. This article has gone through several steps and methods for using bibliometric analysis by using R Studio. This article finds that financial well-being can be measured with savings, expenses and financial inclusion. Again, it can be clearly seen that the relationship between financial well-being and SDGs is not popular. On the basis of this bibliometric analysis, there are a few scopes for research, which are mentioned as follows:

If a researcher can do the empirical research on financial well-being and SDGs, it will be a great contribution to the research corpus.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest concerning the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Notes

ORCID iD

Mantosh Sharma  https://orcid.org/0009-0005-3241-0463

https://orcid.org/0009-0005-3241-0463

Antoniades, A., Widiarto, I., & Antonarakis, A. S. (2020). Financial crises and the attainment of the SDGs: An adjusted multidimensional poverty approach. Sustainability Science, 15(6), 1683–1698. https://doi.org/10.1007/s11625-019-00771-z

Attanasio, O. P., & Pistaferri, L. (2016). Consumption inequality. Journal of Economic Perspectives, 30(2), 2–28. https://doi.org/10.1257/jep.30.2.3

Bansal, G., & Kumar, J. (2020). Financial literacy and financial well being: An empirical study. Deenbandhu Chhotu Ram University of Science and Technology.

Bashir, I., & Qureshi, I. H. (2023). A systematic literature review on personal financial well-being: The link to key Sustainable Development Goals 2030. FIIB Business Review, 12(1), 31–48. https://doi.org/10.1177/23197145221106862

Benson-Egglenton, J. (2019). The financial circumstances associated with high and low wellbeing in undergraduate students: A case study of an English Russell Group institution. Journal of Further and Higher Education, 43(7), 901–913. https://doi.org/10.1080/0309877X.2017.1421621

Boisjoly, J., Duncan, J. G., & Hofferth, S. (1995). Access to social capital. Journal of Family Issues, 16(5), 122–136. https://journals.sagepub.com/doi/abs/10.1177/019251395016005006?journalCode=jfia

Brown, S. M., Doom, J. R., Lechuga-Peña, S., Watamura, S. E., & Koppels, T. (2020). Stress and parenting during the global COVID-19 pandemic. Child Abuse and Neglect, 110, 104699. https://doi.org/10.1016/j.chiabu.2020.104699

Carton, F. L., Xiong, H., & McCarthy, J. B. (2022). Drivers of financial well-being in socio-economic deprived populations. Journal of Behavioral and Experimental Finance, 34, 100628. https://doi.org/10.1016/j.jbef.2022.100628

CFSI. (2018 October 7). Introduction to CFSI financial health. Center for Financial Services Innovation.

Consumer Financial Protection Bureau. (2019, January). Getting started with measuring financial well-being: A toolkit for financial educators (pp. 1–36) Consumer Financial Protection Bureau.

Currie, J., & Widom, S. (2010). Long-term consequences of child abuse and neglect on adult economic well-being. Child Maltreatment, 15(2), 111–120. https://doi.org/10.1177/1077559509355316

D’Acci, L. (2011). Measuring well-being and progress. Social Indicators Research, 104(1), 47–65. https://doi.org/10.1007/s11205-010-9717-1

Delafrooz, N., Paim, L., Sabri, M. F., & Masud, J. (2010). Effects of financial wellness on the relationship between financial problem and workplace productivity. World Applied Sciences Journal, 10(8), 871–878. https://scholar.google.com/scholar

Diener, E., Sandvik, E., Seidlitz, L., & Diener, M. (1993). The relationship between income and subjective well-being: Relative or absolute? Social Indicators Research, 28, 195–223.

Duhoon, A., & Singh, M. (2023). Corporate governance in family firms: A bibliometric analysis. IMIB Journal of Innovation and Management, 2(1). https://doi.org/10.1177/ijim.231174155

Fan, L., & Henager, R. (2022). A structural determinants framework for financial well-being. Journal of Family and Economic Issues, 43(2), 415–428. https://doi.org/10.1007/s10834-021-09798-w

Farid, S. F. (2019). Conceptual framework of the impact of health technology on healthcare system. Frontiers in Pharmacology, 10, 1–10. https://doi.org/10.3389/fphar.2019.00933

Fields, G. S. (2000). The dynamics of poverty, inequality and economic well-being: African economic growth in comparative perspective. Journal of African Economies, 9(Suppl. 1), 45–78. https://doi.org/10.1093/JAFECO/9.SUPPLEMENT_1.45

Friedline, T., Chen, Z., & Morrow, S. P. (2021). Families’ financial stress & well-being: The importance of the economy and economic environments. Journal of Family and Economic Issues, 42(s1), 34–51. https://doi.org/10.1007/s10834-020-09694-9

Fu, J. (2020). Ability or opportunity to act: What shapes financial well-being? World Development, 128. https://doi.org/10.1016/j.worlddev.2019.104843

García-Mata, O., & Zerón-Félix, M. (2022). A review of the theoretical foundations of financial well-being. International Review of Economics, 69(2)145–176. https://doi.org/10.1007/s12232-022-00389-1

Ghazali, M. S., Syed Alwi, S.F., Abdul Aziz, N.N., & Hazudin, S.F. (2020). Pathway to financial well-being: A review on the role of psychological factors. Environment-Behaviour Proceedings Journal, 5(13), 55. https://doi.org/10.21834/e-bpj.v5i13.2063

Hassan, M. F., Hassan, N. M., Kassim, E. S., & Said, Y. M. U. (2021). Financial wellbeing and mental health: A systematic review. Estudios de Economia Aplicada, 39(4). https://doi.org/10.25115/eea.v39i4.4590

Kaur, G., Singh, M., & Gupta, S. (2023). Analysis of key factors influencing individual financial well-being using ISM and MICMAC approach. Quality and Quantity, 57(2), 1533–1559. https://doi.org/10.1007/s11135-022-01422-9

Kim, J., Garman, E. T., & Sorhaindo, B. (2003). Relationships among credit counseling clients’ financial wellbeing, financial behaviors, financial stressor events, and health. Journal of Financial Counseling and Planning, 14(2), 75–87.

Kreutz, R. R., Silva, W. V. da, Vieira, K. M., & Dutra, V. R. (2021). State-of-the-art: A systematic review of the literature on financial well-being. Revista Universo Contábil, 16(2), 87. https://doi.org/10.4270/ruc.2020212

Kumar, S., Lim, W. M., Sivarajah, U., & Kaur, J. (2022). artificial intelligence and blockchain integration in business: Trends from a bibliometric-content analysis. Information Systems Frontiers, 25, 871–896. https://doi.org/10.1007/s10796-022-10279-0

Le Blanc, D. (2015). Towards integration at last? The sustainable development goals as a network of targets. Sustainable Development, 23(3), 176–187. https://doi.org/10.1002/sd.1582

Levine, R. (2021). Finance, growth, and inequality. IMF Working Papers, 2021(164), 1. https://doi.org/10.5089/9781513583365.001

Limbu, Y. B., & Sato, S. (2019). Credit card literacy and financial well-being of college students: A moderated mediation model of self-efficacy and credit card number. International Journal of Bank Marketing, 37(4), 991–1003. https://doi.org/10.1108/IJBM-04-2018-0082

Lupu, A. C., & Ivan, O. R. (2021). Achieving the sustainable development goals. The Annals of the University of Oradea Economic Sciences, 30(2), 147–154. https://doi.org/10.47535/1991auoes30(2)016

Mansor, M., Sabri, M. F., Mansur, M., Ithnin, M., Magli, A. S., Husniyah, A. R., Mahdzan, N. S., Othman, M. A., Zakaria, R. H., Mohd Satar, N., & Janor, H. (2022). Analysing the predictors of financial stress and financial well-being among the bottom 40 percent (B40) households in Malaysia. International Journal of Environmental Research and Public Health, 19(19), 12490. https://doi.org/10.3390/ijerph191912490

Markham, W. T., & Bonjean, C. M. (1995). Community orientations of higher-status women volunteers. Social Forces, 73(4), 1553–1571. https://doi.org/10.1093/sf/73.4.1553

McGarry, K. (2004). Health and retirement do changes in health affect retirement expectations. Journal of Human Resources, XXXIX(3), 624–648. https://doi.org/10.3368/jhr.XXXIX.3.624

Michael Collins, J., & O’Rourke, C. (2013). Finding a yardstick: Field testing outcome measures for community-based financial coaching and capability programs (August, pp. 1–17). University of Wisconsin-Madison http://fyi.uwex.edu/financialcoaching/files/2013/07/Report_Final.pdf

Mokhtar, N., Husniyah, A. R., Sabri, M. F., & Abu Talib, M. (2015). Financial well-being among public employees in Malaysia: A preliminary study. Asian Social Science, 11(18), 49–54. https://doi.org/10.5539/ass.v11n18p49

Nannicini, T., Stella, A., Tabellini, G., & Troiano, U. (2013). Social capital and political accountability. American Economic Journal: Economic Policy, 5(2), 222–250. https://doi.org/10.1257/pol.5.2.222

Nolan, C. T., & Garavan, T. N. (2016). Human resource development in SMEs: A systematic review of the literature. International Journal of Management Reviews, 18(1), 85–107. https://doi.org/10.1111/ijmr.12062

OECD. (2015 October). Inequality inclusive growth: Policy tools to achieve balanced growth in G20 economies. https://www.oecd.org/g20/topics/inclusive-growth/

Omoniyi, M. B. I., & Omoniyi, A. O. (2014). Unlocking potentials in developing country through education: A panacea for economic growth and poverty alleviation. Mediterranean Journal of Social Sciences, 5(23), 868–872. https://doi.org/10.5901/mjss.2014.v5n23p868

Palomäki, L. M. (2019). Does it matter how you retire? Old-age retirement routes and subjective economic well-being. Social Indicators Research, 142(2), 733–751. https://doi.org/10.1007/s11205-018-1929-9

Prakash, A. S., Gupta, A. K., & Kaur, S. (2022). Economic aspect of implementing green HR practices for environmental sustainability. IMIB Journal of Innovation and Management, 1(1). https://doi.org/10.1177/ijim.221109016

Prather, C. G. (1990). The ratio analysis technique applied to personal financial statements: Development of household norms. Journal of Financial Counseling and Planning, 1, 53–67.

Reynolds, A. J., Temple, J. A., Ou, S. R., Robertson, D. L., Mersky, J. P., Topitzes, J. W., & Niles, M. D. (2007). Effects of a school-based, early childhood intervention on adult health and well-being: A 19-year follow-up of low-income families. Archives of Pediatrics and Adolescent Medicine, 161(8), 730–739. https://doi.org/10.1001/archpedi.161.8.730

Riphahn, R. T. (1999). Income and employment effects of health shocks: A test case for the German welfare state. Journal of Population Economics, 12(3), 363–389. https://doi.org/10.1007/s001480050104

Singh, H. P., Singh, A., Alam, F., & Agrawal, V. (2022). Impact of sustainable development goals on economic growth in Saudi Arabia: Role of education and training. Sustainability, 14(21), 1–25. https://doi.org/10.3390/su142114119

van Praag, B. M. S., Frijters, P., & Ferrer-i-Carbonell, A. (2003). The anatomy of subjective well-being. Journal of Economic Behavior and Organization, 51(1), 29–49. https://doi.org/10.1016/S0167-2681(02)00140-3

Vlaev, I., & Elliott, A. (2014). Financial well-being components. Social Indicators Research, 118(3), 1103–1123. https://doi.org/10.1007/s11205-013-0462-0

Wolff, E. N., & Zacharias, A. (2009). Household wealth and the measurement of economic well-being in the United States. Journal of Economic Inequality, 7(2), 83–115. https://doi.org/10.1007/s10888-007-9068-6

Xiao, J. J., & Porto, N. (2022). Financial capability and wellbeing of vulnerable consumers. Journal of Consumer Affairs, 56(2), 1004–1018. https://doi.org/10.1111/joca.12418

Zahoor, N., Al-Tabbaa, O., Khan, Z., & Wood, G. (2020). Collaboration and internationalization of SMEs: Insights and recommendations from a systematic review. International Journal of Management Reviews, 22(4), 427–456. https://doi.org/10.1111/ijmr.12238