1 Department of Business Studies, School of Business Studies, Central University of Karnataka, Kalaburagi, Karnataka, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Farmers are among the many small investors in India who may save money and invest in various avenues. It is yet to be determined how farmers and ‘the agrarians’ in India perceive different investment opportunities. The present study fills this gap in the investment avenues literature. Surveys and interviews were used to gather primary data, and secondary data sources comprised of journal papers, books and articles. The reliability of the scale and the internal consistency of the variables were evaluated using Cronbach’s alpha. The study employed one-way analysis of variance and rank correlation to assess its goals. The findings of the study show that significant deciding variables for choosing an investment include money, safety, time, trust and risk preferences. The results also highlighted the fact that older, higher-earning farmers and agrarians prefer investing only in bank deposits and postal savings accounts for reasons of safety and security. The findings of the study will help develop an investing tool that meets the needs of the national economy, financial institutions, the government and certain groups like farmers and agrarians while also being appropriate for them.

Investment avenues, farmer’s investing perception, risk factor, decision-making

Introduction

Financial markets are essential to a nation’s economic growth. They speed up investment activity in the nation by moving scarce resources from savers to borrowers (Rao & Lakkol, 2023; Senthilkumar, 2017; Sharma et al., 2023; Shilpa, 2022; Velmurugan et al., 2015). Investment is a serious topic and not a game that may significantly influence investor’s future well-being (Ikhar, 2014; Sharma et al., 2023; Shilpa, 2022). Investing in real estate, buying of house, life insurance, bonds, and postal savings are all examples of investments that can be made even if the individual does not choose specific assets like stock (Krishnamoorthi, 2009). The potential return and risk are two qualities that any investment has in common (Ikhar, 2014; Rao & Lakkol, 2023).

A nation’s capital formation is facilitated by a well-organised financial system that is set up with wise laws and skilful investment channels, paving the way for the nation’s economic progress. The world’s seventh-largest economy, India, is the finest illustration of this. The country’s largest industry is agriculture. The foundation of the Indian economy is agriculture. About 15% of India’s GDP is made up of agriculture and related sectors, which employ two-thirds of the country’s people. Indian farmers have a strong propensity for saving and investing. Agricultural produce and its sale are the sources of income for rural agrarian investors. Rural farmers’ agricultural income is uncertain as a result of natural or man-made disasters. But at the moment, India is experiencing an increase in agricultural production, better technological deployment, augmented corporate earnings, surplus disposable income, higher levels of per capita income, low dependency ratios, etc., which is leading to higher levels of consumption and more room for savings. It is important to look at how these rural individuals save and invest money since their financial decisions are so important. The country’s financial markets will profit significantly if the farmers and rural investors are able to identify and use a financial product that satisfies their specific needs and unique criteria. To promote industrialisation, which would lead to India’s economic success, it is essential to attract farmer income and direct it correctly into the financial system. Agricultural financial products are utterly unknown to the large majority of people who work in agriculture across the world (Anbarasu et al., 2011; Priya & Gayathri, 2019; Shilpa, 2022). Therefore, the primary focus of this study is on farmers’ perceptions of their investments.

Numerous studies have examined how urban and rural investors perceive various investment options and prospects (Deb & Singh, 2018; Naveed et al., 2020; Verma, 2018) along with the factors that impact their investment-related decisions, such as their level of awareness and other demographic and socio-economic factors (Ghodake & Khedkar, 2020; Paramashivaiah & Ramya, 2014; Senthilkumar, 2017). A good amount of research has been done to find out what influences individual investors’ investment behaviour, but the investment behaviour and investment avenues available to rural people, particularly farmers, remain untouched by the research and academic community as the farmers’ standard of living has not increased since they find it difficult to save money or invest it in a variety of investment opportunities. The investment view of farmers or rural residents whose primary source of income is from sales of agricultural output has received little to no investigation, if any. Thus, there is a dearth of significant research in the relevant literature that focuses on the investing choices and behaviours of rural farmers and other agrarian individuals. Thus, the current study makes an empirical attempt to investigate how farmers perceive different investment opportunities and avenues. Additionally, as an unexplored market for Indian investment industry, it seeks to identify prospective factors and potential elements that influence the investment behaviour of farmers and agricultural investors. The farmers’ well-being rests in more consistent and greater income development, which may influence their investment patterns. Consequently, the rationale for researching the investment opportunities and avenues open to farmers and their investment behaviour is challenging.

Finally, the rest of this paper is structured as follows. The following section provides an overview of the literature on the examined topic that motivates the present study’s research questions. The third section deals with the objectives of the study, and the fourth section highlights the rationale of the study. In the fifth section, the study presents the stepwise methodology employed, and the sampling frame. Next, in the sixth section, the data analysis and results are detailed. Then, the seventh section presents the findings and discussion. In the end, the article concludes discussing the key findings, implications and future research agendas.

Review of Literature

The literature reviewed below aims to illustrate how different investors see distinct investment opportunities. Singh and Chander’s (2006) analysis revealed that the majority of investors rely on their investment decisions in significant part on the advice of experts and financial advisers. Mittal and Dhade (2007) showed that service class prefer to invest in equity and mutual funds, while, business owners prefer debentures and bonds, housewives prefer real estate and gold, professionals prefer investing in postal deposits and derivatives, and students generally prefer equity and derivatives for investment. Research studies by Mittal and Vyas (2008) and Krishnamoorthi (2009) indicate that an investor’s choice of investments is significantly influenced by demographic parameters, such as age, income, education level and marital status. The primary concerns of investors with mutual funds, according to Gupta and Jain (2008), are volatility, price manipulation, brokers’ poor behaviour and corporate leaders’ poor management.

According to Kumar and Vikkraman (2010), for a safe investment, investing in gold after banks is the most preferred option, however, the investors choose to invest in insurance for security reasons. Anbarasu et al. (2011) indicated that the investor’s lack of awareness and information about the various investment options available significantly influence their investment decision. Even though bank deposit plans offer high returns, Pati and Shome (2011) discovered that individuals prefer protected mediums of savings to unsecured ones. Aggarwal and Rani (2011) revealed that investors, regardless of age, income level, job title or educational background, would wish to secure their future by purchasing an insurance policy. According to research by Patel and Patel (2012), investors do not like traditional investment alternatives due to their low returns. Nonetheless, gold investments are popular among female investors. However, Bhatt and Bhatt’s (2012) investigation indicates that due to the decreased risk, investors of all income levels and classifications choose investing in bank and postal deposits. Simultaneously, educated and affluent groups prefer investing in real estate, equity shares, mutual funds, insurance and commodities. According to Umamaheswari and Kumar (2014), for safety and liquidity, the majority of investors choose fixed deposits with banks, followed by gold, Unit Trust of India (UTI) units, non-government firm’s fixed deposits, mutual funds, stock shares and debentures. In their 2013 study, Bairagi and Rastogi looked at investors’ buying habits and knowledge of various types of investments. The study results revealed the effects of an individual’s age, education, employment and income level on investments.

It is also clear from the aforementioned research that the majority of investors prioritise safety and security for their assets first, followed by a desire to maximise returns (Priya & Gayathri, 2019; Rao & Lakkol, 2023; Senthilkumar, 2017; Sharma et al., 2023; Shilpa, 2022; Velmurugan et al., 2015). The literature assessment conducted for the present study on the attitudes of farmers and rural agricultural investors towards different investment opportunities reveals that the biggest influence is dependent on the choices made by all investors. However, no significant attempt is made to identify the critical factors responsible for investment decision-making, their relative importance and particularly how they are related and influenced by the demographic factors. Further, considering the various investment avenues available in the Indian context, the existing literature has not explicitly addressed the investment behaviour/perception of farmers or agrarian individuals as potential investors. Thus, it is evident from the literature that understanding the behaviour and perception of rural individuals, especially farmers towards investment options and choices has not been given adequate attention by the research and academic community. Reportedly, there is no noteworthy research available in the existing body of literature that emphasises on rural farmers/agrarian individuals’ investment behaviour and the options available to them. Thus, the goal of the current study is to ascertain how farmers perceive different investment opportunities.

Research Aims and Objectives

The current study is largely concerned with the difficulties farmers have while investing, their innate ability to save, the routes they like, and the many variables impacting their view of saving and investing, or the option of various investment avenues. In light of the high-income volatility and unpredictability, the present study aims to answer a few questions: What are the motivational sources that drives farmers’ investment decisions? What are the factors that influence their investment intentions? What is the pattern of their investment? What are their preferred investment options? What factors are responsible for the investment behaviour of farmers?

It sets specific objectives to understand how farmers feel about different investment opportunities. To understand the farmers’ goals for investing and saving. The present study aims to assess farmers’ level of investing knowledge and to identify the factors that affect their choice of investments. It comprehends how farmers view various investment opportunities and their current investing behaviour. It makes an effort to identify the pertinent factors impacting the investor’s choice or preference order among several investment avenues. Finally, it identifies and suggests if necessary, the strategies to improve the farmers’ investment decision-making.

Rationale of the Study

Agrarians, or farmers, are the backbone of society. The study of their investing behaviour is extremely important for a number of reasons. First, due to the unpredictable nature of their income and the agricultural nature of their labour, it has become vital to understand their investment behaviour. Second, financial institutions need to be able to interpret a lot of issues that the academic community has not yet been able to provide answers for. Farmers are unique among groups due to the extreme fluctuations in their income. Therefore, it is imperative to carry out an investigation that delves into their investing patterns and the investment opportunities that suit them. Third, from the standpoint of policymakers, it is also critical to understand the investment behaviour of farmers in order to anticipate future investment behaviour and comprehend the dynamics of how uncertainty affects their decision-making. Therefore, as the aforementioned considerations provide us with good reason to investigate farmers’ investment behaviour, this study focuses on determining the likely impact of a variety of factors, including psychological, behavioural and socio-demographic characteristics, on investment decisions and the investment avenues available to them. With this objective, the present study aims to bridge the gap in knowledge that has been overlooked in the current literature.

Research Methodology

A single cross-sectional descriptive study employing survey methods was conducted. In the study, a variety of farmers were taken into account. To determine and explain the properties and associations of the variables of interest in a scenario, descriptive research was conducted. The study sought to identify the many aspects that affect farmers’ and other agrarians’ preferences for investments as well as how their degree of awareness affects that choice.

Through the use of direct interviewing, a two-part structured questionnaire was created and given to the respondents. The demographic profile in the first section includes both open-ended and closed-ended questions. The questionnaire’s second section asks questions on respondents’ perceptions of various investment opportunities. To maximise response rates, the questionnaire was made available in both Hindi and English. Moreover, this allows to reply in the native language, which ensures the validity of the study. The present study made use of both primary and secondary data for the analysis. Target respondents (farmers from the target demographic) were surveyed for primary data, while papers, magazines and publications were used to gather secondary data. The data collection method employed was convenience sampling and to some extent snowball approach was followed, and the data was nearly clustered. Individuals served as the unit of analysis.

The respondents belonged to rural areas in central Uttar Pradesh. The sample size was determined statistically based on a 95% confidence level to ensure accurate results and adequate representation of the population. Around 100 units were chosen from each district on a pro-rata basis to meet the 600 sample unit target. However, at the end, the village head’s reference was used to select the 30 sampling units from each village. A total of 600 individuals were reached. Despite this, only 513 respondents were deemed eligible for the study.

Data Analysis and Results

The statistical analysis results and their interpretation are discussed in the following section.

For analysis, a sample of 513 respondents from the entire population was taken into account. The analysis and statistical testing (descriptive analysis, one-way analysis of variance [ANOVA] and rank correlation) were carried out using IBM SPSS 20 version software.

Reliability Analysis

Cronbach’s alpha test was used to determine the reliability of the questionnaire, which had elements consisting of awareness of investment avenues and instruments, future investment avenues and investment decision-making factors. Cronbach’s alpha was estimated at 0.782. This demonstrates that the items’ internal consistency is rather high.

The descriptive analysis results show that the respondents have enough land for farming, but the revenue from farming is inadequate. The farmers’ spending patterns reveal that spending on food is their top priority, coming in first with the lowest mean value, followed by housing, health and land preservation spending in second, third and fourth place, respectively. The farmer’s spending on durable goods comes last on his list of priorities.

One-Way ANOVA

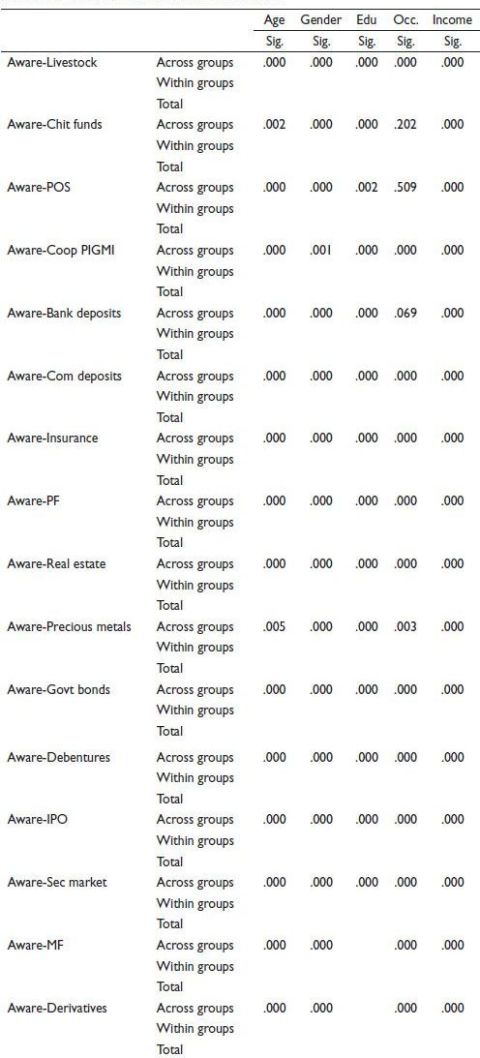

According to Table 1, respondents’ ages have an impact on how aware they are of different investment options. With a p value of 0.000 < 0.05 at the 5% level of significance and an F value of 13.13, 66.94, 47.00, 7.08, 53.19, 40.80, 57.77, 31.32, 66.40, 9.21, 150.93, 53.15, 39.2, 45.98, 37.97 and 53.8, respectively, there appears to be a significant relationship between age and all investment options. With an F value of 150.93.66.40, 9.21, 150.93, 53.15, 39.2, 45.98, 37.97 and 53.8, respectively, age has a stronger impact on respondents’ awareness of investing in government bonds.

Table 1. Results of ANOVA Test for Comparing the Demographic Variables of the Farmers and Awareness About Investment Avenues.

The gender of the respondents influences their level of knowledge about different investment options, it can be deduced from Table 1. With a p value of 0.000 < 0.05 at the 5% level of significance and an F value of 13.13, 66.94, 47.00, 7.08, 53.19, 40.80, 57.77, 31.32, 66.40, 9.21, 150.93, 53.15, 39.2, 45.98, 37.97 and 53.8, respectively, there appears to be a significant relationship between age and all investment options. With an F value of 150.93, gender had a stronger impact on respondents’ awareness of government bond investments. According to the aforementioned table, respondents’ levels of education have an impact on how aware they are of different investment options. With a p value of 0.000 < 0.05 at the 5% level of significance and an F value of 31.17, 16.6, 4.44, 5.30, 20.90, 72.99, 45.40, 106.56, 42.48, 26.43, 56.87, 112.065, 85.48, 70.38, 70.96 and 83.89, respectively, there appears to be a significant link between age and all investment possibilities. With an F value of 112.065, education level had a stronger impact on respondents’ awareness of investments in debt securities.

The social status of the respondents significantly influence their knowledge of the various options, this can be inferred from Table 1 with a p value less than .05 at a level of significance of 5%. With p values of .20, .50 and .069, respectively, there is no correlation between social status and knowledge of investment choices like chit funds, postal savings and bank deposits. According to Table 1, there exists a significant relationship between the farmers’ occupation and their awareness of different investment options, as the observed p value is less than .05 at a level of significance of 5%. On government bonds, the F value is the highest at 99.21.

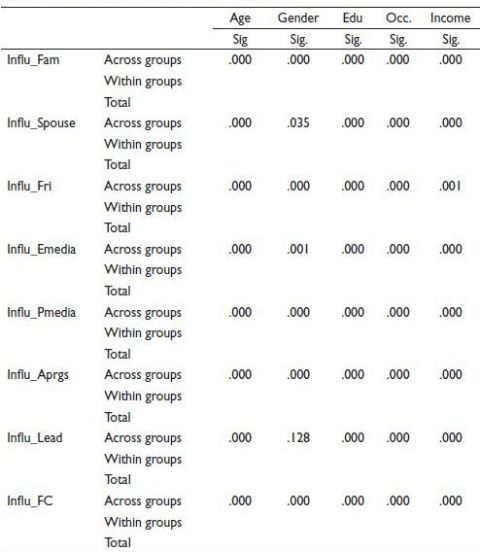

The age of the respondents determines the channels used to make investment decisions, including family, spouse, friends, electronic and print media, awareness campaigns, opinion leaders and financial experts, according to Table 2. The p value for all investment decision-making modes is 0.000 < 0.05. So, we conclude that there is a connection. The family has the greatest F value at 103.6. Thus, it follows that family members are consulted for decisions by people of all ages.

The gender of the respondents determines the channels used to make investment decisions, according to Table 2. All investment decision-making modalities have p values that are less than .05. So, we conclude that there is a connection. With 207.7, a financial consultant has the highest F value. Since p = .128 > .05, there is no correlation between gender and opinion leader as a method of making investment decisions. It can be deduced from the above table that the respondents’ educational background affects the channels they utilise to make investment decisions. The p value for all investment decision-making modes is 0.000 < 0.05. So, we conclude that there is a connection. With 161.07 and 144.9 respectively, the opinion leaders and electronic media had the highest F values, demonstrating that educated respondents frequently seek the advice of experts and read online media viewpoints while making investment decisions.

Table 2. Results of ANOVA Test for Comparing the Demographic Variables of the Farmers and Their Influence on Investment Decisions.

It can be deduced from Table 2 that the respondents’ social position affects the channels they utilise to make investment decisions. The p value for all investment decision-making modes is 0.000 < 0.05. So, we conclude that there is a connection. The F value for spouse and electronic media is the greatest, with 651.3 and 104.2, respectively, plainly showing that spouses’ social position impacts respondents’ investment decisions. The employment of the respondents determines the channels used to make investment decisions, according to the above table. The p value for all investment decision-making modes is 0.000 < 0.05. So, we conclude that there is a connection. The responder certainly consults financial experts when making investment decisions, as shown by the F value for financial consultants, which is the highest at 59.3. From the above table, it can be deduced that the respondents’ tax planning and assessment affect the ways in which they make investment decisions. The p value for all investment decision-making modalities is 0.000 < 0.05. So, we draw the conclusion that there is a relationship. The F value for financial experts is the greatest at 57.4, clearly showing that respondents who fall under the tax bracket seek their assistance.

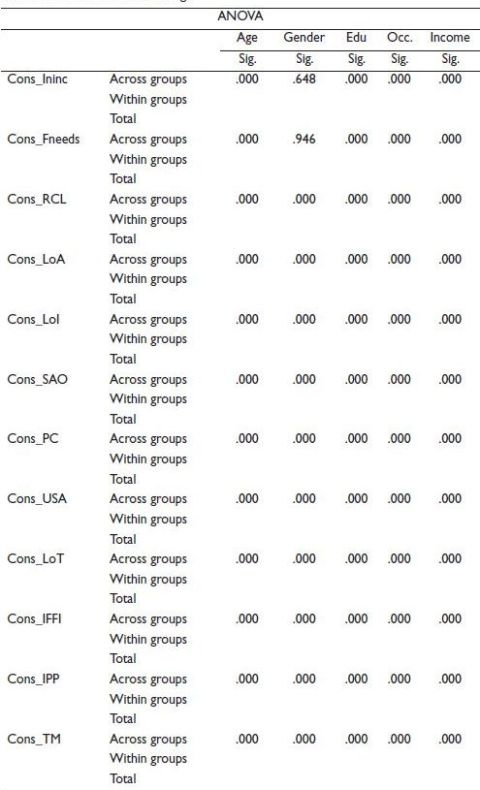

The age and gender of the respondents affects the limitations on savings, such as insufficient income, numerous family needs, risk of capital loss, lack of awareness, lack of information, seasonality of agricultural operations, procedural complexities, unusable savings avenues, lack of trust in investment avenues, insufficient formal financial institutions, instability of produce prices and traditional mindset, as shown in Table 3. A p value of 0.000 < 0.05 at the 5% level of significance is displayed for each restriction. With a high F value of 137.68, the respondents’ traditional mindset proves to be a significant impediment. In case of respondents’ gender, according to Table 3, a p value of 0.000 < 0.05 at the 5% level of significance is displayed for each constraint. However, it does not affect saving restrictions like insufficient income and various family requirements, which had p values of .94 and .64, respectively, larger than .05.

Table 3 demonstrates how the respondents’ educational background affects the limitations on savings. A p value of 0.000 < 0.05 at the 5% level of significance is displayed for each restriction. The responders’ lack of knowledge is a significant obstacle with a high F value of 208. The occupation of the respondents is shown in Table 3 to have an impact on the limitations on savings. A p value of 0.000 < 0.05 at the 5% level of significance is displayed for each constraint. The most significant factor is traditional thinking, with an F value of 106.53.

The annual income of the respondents, as shown in Table 3, affects the limitations on savings. A p value of 0.000 < 0.05 at the 5% level of significance is displayed for each constraint. The respondents’ lack of knowledge is a significant obstacle with a high F value of 177.3.

Table 3. Results of ANOVA Test for Comparing the Demographic Variables of the Farmers and Constraints of Savings.

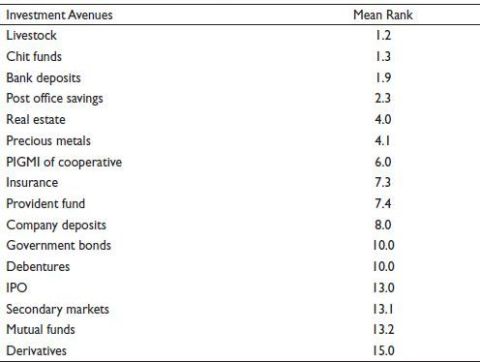

Table 4. Ranks of Investment Avenues Are Preferred by the Farmers.

According to one-way ANOVA, there is a strong correlation between the farmers’ demographic characteristics, including age, gender, educational attainment, occupation, income level and their knowledge of available investment opportunities along with the factors that affect their investment decisions and potential future investments. It demonstrates how important demographic factors for farmers play in shaping their investing behaviour.

Rank Correlations

According to the rank correlation, farmers prefer investing in livestock above other types of investments, including chit funds, bank deposits and post office savings. It is quite obvious that farmers choose risk-free investing opportunities. The final resort for investments with a high mean score of 13, 13, 1 and 15, respectively, are regarded to be initial public offerings (IPOs), secondary markets, mutual funds and derivatives.

Findings and Discussion

Due to their inconsistent income and the dearth of new information accessible in rural areas, farmers and agricultural individual investors sometimes find themselves unable to make rational judgments. The study’s findings show that the majority of respondents spend the bulk of their income on accommodation and food to survive daily. Independent of their respective demographic factors, farmers face a variety of obstacles to saving, including low income, a large number of family needs, the risk of capital loss, lack of awareness, a lack of information, the seasonal nature of agricultural operations, procedural difficulties, unusable savings options, a lack of trust in investment options, a lack of formal financial institutions, unstable produce prices and a traditional mindset. Farmers’ traditional mindsets and a lack of information are the main obstacles to their savings and investings.

The study’s findings show that demographic factors have a major impact on farmers’ perceptions and investment choices. Furthermore, regardless of their age or gender, respondents’ investing decisions are primarily impacted by their family, spouse, friends, the media (print and electronic), awareness campaigns and financial counsellors. The survey also found that educated respondents occasionally consult financial professionals and take into account online media opinions when making investing decisions. Farmers with stronger saving tendencies are compelled to save as a precaution since agricultural revenue is uncertain and vulnerable to large swings due to many factors, including monsoons, price fluctuations, demand variations, etc. Nonetheless, the positive intention to invest in various instruments, the potential of fulfilling the financial objective to cover future needs, and the financial risk inclination of farmers and agrarian rural investors all play a role in characterising their investment behaviour. This will also help with the development of strategies to ensure that the return on their investment portfolio matches their level of certainty about their finances. The empirical findings show that people who were more financially prepared were more inclined to make investments. The findings indicate that farmers with good business expertise and experience are better able to employ financial instruments and professional advice when making decisions. The financial service providers and financial institutions may thus take a closer look at these factors to gain a better understanding of the farmers’ investment patterns and to direct them accordingly, which would be advantageous to both parties. Governments and policymakers could design financial instruments to entice farmers’ savings and investment decisions, which will lead to industrialisation and result in the economic prosperity of the country if they have a comprehensive understanding of the savings and investments made by farmers through this study.

Conclusion

The present study aims to uncover the potential elements that influence the investing behaviour of farmers and agricultural investors, a market niche that has yet to be fully explored in India. However, the outcomes can be implied across the globe to all the farmer’s community and agricultural rural investors having similar income conditions and the information accessibility.

The present study and its findings will serve as a roadmap for creating and introducing more specialised financial products. The results of this study shed light on information that financial product and service marketers may utilise to get a firm foothold in the current competitive environment.

According to the results, farmers’ conventional mindsets and a lack of information are the two main obstacles preventing them from saving and investing. The government and financial institutions should launch financial literacy initiatives to help farmers make wise investment choices in light of this. The research would be useful for determining how demographic factors affect investment choices and would also serve as a wake-up call for financial service organisations and businesses to devise suitable strategies so that all investment outlets have a successful reach. According to the results, farmers prefer investing in PIGMI of cooperatives over IPOs, secondary market instruments, mutual funds, ULIPs, and derivatives and also in livestock, bank deposits, postal savings, insurance policies, provident funds and government bonds. Such a tendency will limit the nation’s economic growth until these savings are invested in the financial markets, which will lead to industrialisation. It is time for the government and financial institutions to launch initiatives to promote financial literacy to help farmers make prudent investment choices.

Managerial/Practical Implications

The current study adds to the body of literature in two ways. First off, as far as is known, this is one of the few first research of its kind that focuses on farmers’ investing behaviour. Second, it differs from previous studies in that it additionally examines the impact of demographic characteristics along with the investment behaviour of farmers. Additionally, the research adds to the expanding body of knowledge about farmers’ investment strategies in both established and emerging markets.

The findings and suggestions will assist farmers in making more informed investment decisions and will act as a wake-up call for enterprises, financial service providers and the government to develop strategies that are suitable for rural areas, particularly considering farmers, in order to maximise the potential of all investment opportunities. Governments are recommended to launch ‘investor awareness’ programs to help investors in rural and agricultural regions have a better technical grasp of financial products and how the financial markets operate overall.

Limitations and Future Research Directions

Although the current study tried very hard and accurately to accomplish the aforementioned goal, there are some restrictions. The study’s primary time constraint prevented it from being completed, and it solely focused on farmers in northern India. In the future, the study can be extended to different parts of the country and emerging economies, so that the results can be generalised and more coherent policies can be framed. For better understanding, future studies can also consider the role of investor personality and cultural dimensions. Only 513 people were included in the sample for the initial data collection, which may not accurately represent the views of the general public. Further, in future studies, robust methodologies capturing intricate details can be employed along with complimentary data analysis techniques so that the results can be verified and made robust.

Acknowledgement

The authors are grateful to the anonymous referees of the journal for their constructive suggestions to improve the quality of the paper. Usual disclaimers apply.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest concerning the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Samridhi Kapoor  https://orcid.org/0000-0001-6132-1500

https://orcid.org/0000-0001-6132-1500

Aggarwal, S., & Rani, M. (2011). Attitude towards insurance cover. IUP Journal of Risk & Insurance, 8(1), 62–69.

Anbarasu, D. J., Paul, S. C., & Annette, B. (2011). An empirical study on some demographic characteristics of investors and its impact on pattern of their savings and risk coverage through insurance schemes. IUP Journal of Risk & Insurance, 8(1), 7.

Bairagi, U., & Rastogi, C. (2013). An empirical study of saving pattern and investment preferences of individual household with reference to Pune city. ASM’s International E-Journal of Ongoing Research in Management and IT, 1–11.

Bhatt, K. A., & Bhatt, K. (2012). Effects of investor occupation and education on choice of investment: An empirical study in India. International Journal of Management, 29(4), 439–453.

Deb, S., & Singh, R. (2018). Dynamics of risk perception towards mutual fund investment decisions. Iranian Journal of Management Studies, 11(2), 407–424.

Ghodake, S. P., & Khedkar, E. B. (2020). A study of the savings and investment pattern of rural household with special reference to Nashik district: A pilot study. Vidyabharati International Interdisciplinary Research Journal, 11(1), 73–83.

Gupta, L. C., & Jain, N. (2008). The changing investment preferences of Indian households. Society for Capital Market Research and Development. www.scmrd.org.

Ikhar, M. K. (2014). Investor’s attitude towards the selection of investment option with special reference to derivative investments. Asian Journal of Management, 5(2), 145–149.

Krishnamoorthi, C. (2009). Changing pattern of Indian households: Savings in financial assets. RVS Journal of Management, 2(1), 79–90.

Kumar, K. J. S., & Vikkraman, P. (2010). Investors preference on financial services. Global Business and Management Research, 2(2–3), 253–274.

Mittal, M., & Dhade, A. (2007). Gender difference in investment risk-taking: An empirical study. The ICFAI Journal of Behavioral Finance, 4(2), 32–42.

Mittal, M., & Vyas, R. K. (2008). Personality type and investment choice: An empirical study. The ICFAI University Journal of Behavioral Finance, 5(3), 7–22

Naveed, M., Ali, S., Iqbal, K., & Sohail, M. K. (2020). Role of financial and non-financial information in determining individual investor investment decision: A signaling perspective. South Asian Journal of Business Studies, 9(2), 261–278.

Paramashivaiah, P., & Ramya, S. K. (2014). Changing risk perception of women investors: An empirical study. Indian Journal of Finance, 8(6), 22–33.

Patel, C. Y. P., & Patel, C. C. Y. (2012). A study of investment perspective of salaried people (private sector). Asia Pacific Journal of Marketing & Management Review, 1(2), 126–146.

Pati, A. P., & Shome, D. (2011). Do households still prefer bank deposits? An analysis of shift in savings and savings determinants. IUP Journal of Bank Management, 10(1), 46–59.

Priya, C. R., & Gayathri, R. (2019). Income, savings, cognizance and farmers’ investment archetype-A pragmatic exploration. TRANS Asian Journal of Marketing & Management Research (TAJMMR), 8(2), 25–49.

Rao, A. S., & Lakkol, S. G. (2023). Influence of personality type on investment preference and perceived success as an investor. IMIB Journal of Innovation and Management, 1(2), 147–166.

Senthilkumar, P. (2017). A study on investment pattern and awareness of farmers in Pollachi Thaluk. International Journal of Interdisciplinary Research in Arts and Humanities, 2(1), 4–8.

Sharma, P., Mishra, B. B., & Rohatgi, S. K. (2023). Revisiting the impact of NPAs on profitability, liquidity and solvency: Indian banking system. IMIB Journal of Innovation and Management, 1(2), 167–180.

Shilpa, P. S. B. (2022). Investigating the factors affecting Investment Intention of Rural agrarian investors: Evidence from India. Journal of Positive School Psychology, 6(4), 2917–2933.

Singh, J., & Chander, S. (2006). Investors’ preference for investment in mutual funds: An empirical evidence. The IUP Journal of Behavioral Finance, 3(1), 55–70.

Umamaheswari, S., & Kumar, M. A. (2014). A study on the investment perspectives of the salaried strata at Coimbatore district. International Journal of Research in Business Management, 2(2), 99–108.

Velmurugan, G., Selvam, V., & Nazar, N. A. (2015). An empirical analysis on perception of investors’ towards various investment avenues. Mediterranean Journal of Social Sciences, 6(4), 427–435.

Verma, O. P. (2018). Saving and investment pattern of rural households of Himachal Pradesh. PRAGATI: Journal of Indian Economy, 5(2), 75–86.