1Department of Accountancy and Business Statistics, University College of Commerce & Management Studies, Mohanlal Sukhadia University, Udaipur, Rajasthan, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

A rigorous change is required to be made in the normal accounting cycle to update and improve it. The dynamic development of the industry and transformation towards accounting 4.0 creates pressure to update six-century-old accounting and reporting systems. The main purpose of the article is to identify the need to empower normal accounting systems with three-dimensional (3D) accounting. Descriptive statistics is used for demographical and physiographical report presentation. For testing the hypotheses, the chi-square test and one-way ANOVA have been applied. It is found that the majority of respondents are in agreement for small size business and persons agree to apply a 3D accounting system to the normal accounting cycle. The 3D system is better presented than a normal accounting system; hence, normal accounting cycle should be embedded in the 3D accounting system for better performance. Several important variables have been predicted to explain the requirement of a normal accounting system embedded in the 3D accounting system by using a neural network.

Normal accounting system, accounting 4.0, three-dimensional accounting system, empowerment, embedded

Introduction

The field of accounting has undergone a radical transformation due to advances in science and technology. The two-dimensional entry system is no longer sufficient to meet all stakeholder needs. The standard accounting cycle needs to undergo significant modification to be updated and improved. Three-dimensional accounting (3D accounting) has taken the role of the traditional accounting method.

Businesses and organisations have switched from a two-dimensional to a 3D accounting system. Due to the damage that various financial frauds and intelligence crimes have caused to the economy, this technology is being studied all around the world. It has been shown that accounting technology advancement is necessary. Even though it occurs in developing countries, it is still in its infancy and needs greater attention. It has been questioned why poor countries were not promoting and using green logistics practices (Maurya, 2023).

With the advancement of blockchain technology (BCT), a different concept known as triple-entry accounting (TEA) has regained popularity. In a study by Yuji Ijiri from 1989, the term ‘triple-entry accounting system’ first arose. Later, it was expanded (Gröblacher & Mizdraković, 2019).

Blockchain is a recent technology with potential uses in numerous industries. It has built a name for itself in the financial world using cryptocurrencies. BCT has only seldom been implemented in reality, despite the applications in many industries that its security, resilience, interoperability and dependability have promised. The decision-making process for integrating with this new technology and implementing blockchain is now being conducted among the stakeholders. This article discusses how corporations and individuals can adapt, incorporate and assimilate new technologies. It uses principles that have been created in this area (Dua, 2022).

For the first time, double-entry bookkeeping was combined with breakthroughs in financial encryption, such as the Signed Receipt. TEA is what it was named (Grigg, 2005).

An example of a proposal for a shared transaction record (and thus for 3D accounting) is triple-entry bookkeeping. To come to a consensus on the information in the shared record, it uses triple-signed receipts (Ibaez et al., 2020). TEA is one of the most creative ideas to emerge in recent years (Vadasi et al., 2021).

BCT makes it simpler to record transactions and manage assets in a firm network by enabling a distributed impermanent ledger. Accounting programme deals with the transfer of asset ownership and the maintenance of an accurate financial ledger. This article does a genealogical analysis of shared ledger systems and tracks the development of Resource–Event–Agent (REA), TEA and BCT to clear up any misunderstandings (Kwilinski, 2019).

The article is further divided into eight sections.

The second section elaborates on the previous knowledge on the topic. A summary of single-entry and double-entry bookkeeping systems has been provided. Mainly, the author focuses on identifying the research gap through a review of the literature. Third section explains the journey of three dimensions of accounting and fourth section discusses the need for a normal accounting cycle embedded in three dimensions. These sections depict how 3D accounting has become the need of the hour. The approaches applied by them from 1975 to 2005 continue to go on. It depicts the relationship among REA, TEA and BCT. Also, normal accounting for recording procedures and income statement and position statements have been presented by applying blockchain through charts.

The fifth section describes the objectives of the article to identify the need to embed three dimensions of accounting in the normal accounting cycle and to explore the change that the 3D accounting would bring in the empowerment of accounting to its users.

The next section explains the research design, methodology and statistical tools to test the hypothesis. Then it is elaborated through discussion on the application of artificial neural networks (ANNs) for the prediction of important variables for normal accounting to embed in a 3D accounting system. The study has been concluded in the last section.

Review of Literature

A thorough mapping of the literature is necessary to comprehend the present research gaps. Based on the literature assessment, an attempt has been made to determine whether triple entry is necessary with regard to BCT. With the use of distributed ledger technology and blockchain, ‘TEA’ is a novel approach to accounting. Using this strategy, business transactions are stored and recorded as a third entry on the blockchain. In order to create a solid foundation for the discipline and application of triple-entry bookkeeping and accounting, it emphasises the necessity of the Fifth Industrial Revolution in accounting (Noble et al., 2022) and shows how it might potentially address a number of challenges (Sunder, 2018).

It is anticipated that this third entry will provide a transparent, reliable and unchangeable system. The latest accounting technology can prevent financial and accounting crimes such as financial statement manipulation, accounting record falsification and fraudulent banking transactions. It also has an impact on fraudulent practises (Mahtani, 2022). BCT is a type of accounting software (Demirkan et al., 2020). It deals with the ownership transfer of assets and the upkeep of an accurate financial ledger (Peprah et al., 2022).

The use of triple-entry bookkeeping in a correct and thorough manner can significantly decrease errors, lower internal fraud and enhance the operational effectiveness of educational institutions (Mahaini et al., 2022) and investigate possible solutions for some of the issues identified with small size of businesses (Kuruppu et al., 2022).

According to Supriadi (2020), as BCT reduces the cost of ledger maintenance and reconciliation, it has the potential to enhance the accounting profession. Applications for financial technology, decentralised finance and distributed ledger technology can make it easier to integrate AISs and ERP systems and provide major gains in productivity, efficiency and security (Faccia & Petratos, 2021). It produces impenetrable accounting systems for demanding users. It not only reduces costs by providing accurate and well-supported accounting, but it also enables far stronger governance, which has a favourable effect on future requirements for public and corporate accounting (Grigg, 2005). Triple-entry bookkeeping contributes to transparency, future reference, reconciliation, assurance and auditing (Gröblacher & Mizdraković, 2019). Using the blockchain protocol, TEA offers a novel concept called ‘π-account’ that allows users to visualise and analyse accounting book journal entries to obtain a complete picture of blockchain-based economic activity (Chen et al., 2021). Blockchain is a technology that combines a number of innovative elements, including a distributed note-taking and storage system, a consensus algorithm, smart contracts and asymmetric encryption to guarantee network security, visibility and transparency (Dutta et al., 2020). The most reliable and consistent platforms for BCT are accounting systems like Quorum, Sap Hana and Ethereum. Blockchain platforms are also thought to be the most appropriate, safe and robust platforms (Sharma et al., 2022).

It had been highlighted that proper accounting was done based on double entries. Double entry remained unchallenged for more than 700 years. Only in late 1900 and early 2000, some eminent accounting researchers like Yuji Ijiri and William E McCarthy came up with ideas that address the loopholes in double entry and suggested better alternatives like the ‘TEA’ and ‘REA’ and ‘ BCT’ concepts. Due to high costs, small and medium enterprises could not adopt these techniques with useful features. Now the following research questions come to mind.

A. What is the journey of three dimensions of accounting?

B. What is the need and potential of the three dimensions of accounting?

C. How to make the accounting reporting system more proper with optimum use of the right time, right place and the right person?

D. How can normal accounting be more reliable and immutable?

E. Would it be possible to use a 3D application with a normal cycle of accounting?

Research Gap

Most of the article explains the advantages of triple-entry (3D) bookkeeping system that triple-entry-based undistributed ledger and BCT-based accounting system are immutable with its unique feature and are up to the mark in the era of industry 4.0 and have potential for industry 5.0. It is also clear that these technology-based accounting systems have their shortcomings like being costly and complex to understand and adopt by small entrepreneurs. Now, the problem arises whether it is possible to adopt the 3D accounting system for small entrepreneurs with less investments and small size of business? It is not discussed in any paper so far. The author focuses on making it possible to take advantages of this advanced featured technology for small-sized business. Double-accounting-based normal accounting cycle is adopted to maintain accounting by small businesses. Thus, there is a requirement to merge this technology into the normal cycle of accounting in a simplified manner to understand and make it affordable for all types of businesses regardless of their size. Not much work has been done in this area so far. The study would be unique for a small size business that avail the advantages of embedded accounting systems.

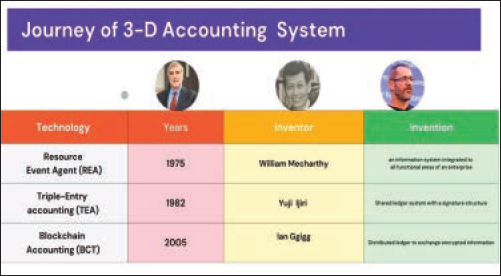

Figure 1. Journey of 3D Accounting System.

Journey of Three Dimensions of Accounting

TEA is a step ahead of the two-dimensional accounting system (traditional double-entry accounting), one that will relieve the bookkeepers and companies from tedious troubleshooting and help remove the mistrust, frauds, or manipulations faced by them (Figure 1).

Resource–Event–Agent (REA) by William E McCarthy

REA is a model presented for re-engineering accounting systems in the time of machine learning. TEA is, in part, a historical by-product of the REA accounting framework designed by McCarthy, while parallels between TEA and the REA framework have been noted (Ijir, 1986).

Resource–Event–Agent (REA), Triple-Entry Accounting (TEA) and Blockchain Accounting (BCT)

Triple-Entry Accounting (TEA) by Yuri Ijiri.

The existing double-entry accounting system was expanded, and an arbitrary third dimension was added to call it triple-entry bookkeeping. Therefore, the third dimension of double-entry bookkeeping must be logically deducible from the current two dimensions (the debit and the credit) to satisfy the essential criteria for a solution to the double-entry problem.

Blockchain Accounting (BCT).

Blockchain is a network of peers that hashes records into a continuous chain of hash-based proof of work to timestamp them, creating a record that cannot be modified unless repeating the proof of work.

Relationship and Working of REA, TEA and BCT.

Blockchain is a decentralised general ledger that other associated parties use. A distributed database with a structured set of blocks can be compared to a blockchain, where each committed block is immutable.

Steps have already been taken in the direction of improvement by many contributors like William McCarthy, Yuri Ijiri and Ian Grigg.

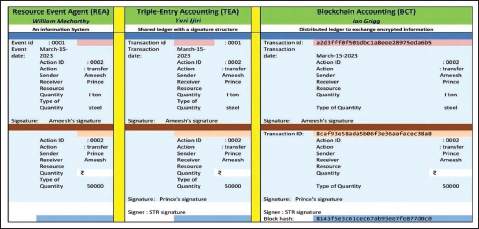

Due to the shortcoming of the double-entry system, BCT is preferred in accounting and financial reporting. This article conducts a genealogical analysis of shared ledger systems, in particular, tracing the development of REA, TEA and blockchain (Ibañez et al., n.d.) (Figure 2).

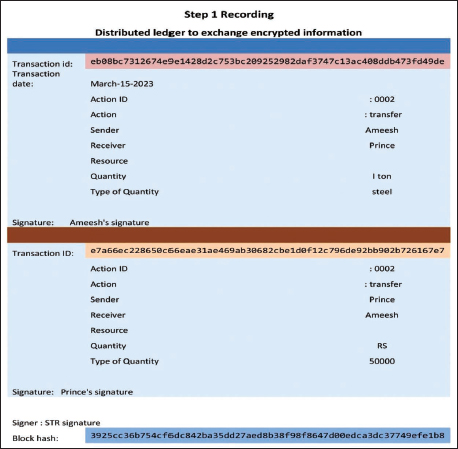

Need of Normal Accounting Cycle Embedded in Three Dimensions

A normal accounting cycle is a normal system of recording transactions, posting, analysing and communicating. It manages business’s records to keep track of income, expenses and other financial activities and is used to create reports. The format of the transaction on the immutable ledger has been presented in Figure 3.

The figure discloses that it becomes more convenient to record the transaction in details by using transaction id, sender & receiver details, quantity, type of product, date, signature, and most important the unique ID the hash value.

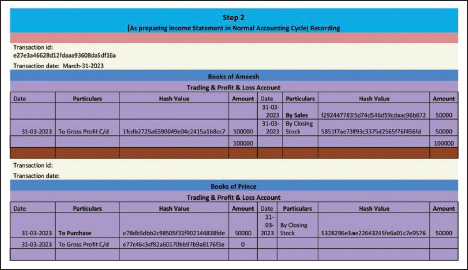

Figure 4 presents the format of an income statement with the application of three layers or 3D accounting statements.

Figure 2. Working of REA, TEA and BCT.

Figure 3. Recording Procedures with Three Layers of Accounting.

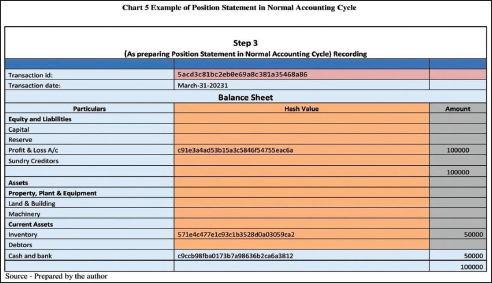

Figure 5 presents the format of the position statement with the application of three layers or 3D accounting statements. The hash value has been generated for every entry. The main purpose of financial reporting has always been to provide information for the main stakeholders (Mizdrakovic, 2021).

Objective of the Study

The aim of this article is to present and measure the relationship among the evolution of three dimensions of accounting systems: REA, TEA and BCT. The purpose of the study is to explore whether there is a need to embed three dimensions of accounting in the normal accounting cycle. The objective of the article is to explore the change that three dimensions of accounting would bring in the empowerment of accounting to its users also.

Rationale of the Studies/ Theoretical Framework

In light of the evolving nature of time and technology, it is vital to adapt new strategies to current financial statements and financial reporting objectives. A 3D accounting system has replaced the two-dimensional one used by businesses and companies. The shortcomings of the double-entry system led to the development of the triple-entry system. This technique has been investigated globally due to the harm that numerous financial frauds and intelligence crimes have done to the economy. To empower accounting, the article focuses on implementing a new decentralised ledger and 3D accounting system integrated with the normal accounting cycle.

Figure 4. Income Statement in Normal Accounting Cycle.

Figure 5. Example of Position Statement in Normal Accounting Cycle.

Research Methodology

Sampling Design and Statistical Technique

Data collected for the study are primary. A structured questionnaire was prepared to obtain the opinion of accountants and auditors of different natures (small, medium and large size) of businesses. For further study, the questionnaire was sent to 200 professionals but only 126 duly filled responses were received. The questionnaire is segregated into two parts; one is based on opinion towards the implementation of a 3D accounting system, and the second for demographic questions like age, gender, education, nature of business, and so on. Questions have been framed on a 5-point Likert scale. The respondents were asked to implement 3D accounting system to embed the normal accounting cycle.

Hypotheses

H1: There is no significant difference among the opinion of respondents regarding the need of 3D accounting systems in the normal accounting cycle and their demographical information.

H2: There is no significant difference in the opinion of respondents regarding the need for the embedment of a 3D accounting system in the normal accounting cycle.

Further, data have been analysed in two steps. Descriptive statistics used for demographical and physiographical report presentation. For testing the hypotheses, the chi-square test and one-way ANOVA have been applied. Also, the neural network has been used to assess the model’s suitability and predict the key elements needed for the integration of 3D into the standard accounting system.

Result and Discussion

Demographic information such as age, gender, nature of work and qualification of respondents has been presented in Table 1.

Table 1 and Table 2 present the descriptive statistics for demographical variables and other variables presenting the application of 3D accounting along with the Levene test result of homogeneity. Respondents were offered specific skills related to knowing which feature of 3D is more important. The question ‘Hash value makes it immutable’ has the highest mean value and the mean value varies between 2.5 and 3.5. It is found that the variance ranged between 0.5 and 1.72. The value of C V is also very low which shows that there is little variation in responses of respondents. The highest agreement (1.419) was for ‘Hash value makes it immutable’ and the least agreement (0.59) was for ‘Good in supply chain management’. Values of C V were low indicating consistency in responses.

Results of the Levene test show that p values for both types of demographic variables along with all statements have been found more than .05. This shows that the data distribution is homogeneous and hence parametric tests are to be used. To test the hypothesis, one-way ANOVA has been applied.

Table 3 reflects the demographical presentation of respondents. The study focused on analysing the requirement of 3D accounting system whether the opinion of respondents has been varied with its demographical status. The interest and intention are reflected in the demographic characteristics of 126 respondents. The majority of respondents are male (76.2%), between the age of 35 years (70.6 %). The respondents who indulged in small businesses were 54.8%; those with middle size businesses were 23.8% and the remaining (21.4%) had large size businesses.

H1: There is no significant difference among the opinion of respondents regarding the embedment of 3D accounting systems in the normal accounting cycle and their demographical information.

The opinion that 3D accounting system needs embedment has been segregated into three criteria: first, those who have a positive opinion of it, second, those who have a negative opinion, and third, those who are neutral.

There were three demographic factors, the effect of which could be tested—gender, age, and nature of working and qualification. To test the significant difference between demographics and respondents’ opinions towards the embedment of a 3D accounting system, a chi-square test has been applied.

While testing the hypotheses based on gender, none of the items was found to have significantly different opinions. Similarly, age was also not found to have a significant association between respondents’ opinions. Hence, gender-wise and age-wise hypotheses results have not been presented. It was concluded that there is no significant difference among the opinion of respondents based on gender and age.

Table 4 presents the results of the chi-square test for opinion. Their opinion has been tested with their nature of work; it is found that the chi-Square test statistic was significantly associated, as the p value is less than 0.05. There is a significant difference in the overall opinion of respondents on their business size, that is, small, medium and large.

It can be concluded that respondents’ opinion differs significantly regarding the need for a 3D accounting system and the opinion of the respondent is significantly different based on the size of the business. The majority of respondents are in agreement for small size business persons agreeing to apply 3D accounting system to the normal accounting cycle. It may be due to loopholes in traditional systems like manipulation of financial data presentation.

H2: There is no significant difference in the opinion of respondents regarding the need for the embedment of a 3D accounting system in the normal accounting cycle Table 5 ANOVA.

Since the data are normal and homogenous, one-way ANOVA has been applied to test the hypothesis. All the statements have been framed to know the opinion of respondents and there is no significant difference in the opinion of respondents on the need to empower normal accounting cycle and it should be embedded in the 3D accounting system. It means a normal accounting system is equivalent to a 3D accounting system and there is no need to embed it. P values for all the changes are less than .00 and thus null hypothesis is rejected for all the changes at a 5% level of significance. The 3D accounting system is better presented than the normal accounting system; hence, it should be embedded in the 3D accounting system for better performance.

Application of ANN for Prediction of Important Variables for Normal Accounting to Embed in 3D Accounting System

Every ANN starts with an artificial neuron as its fundamental building piece. Its structure and features were inspired by the biological neuron, the fundamental unit of biological neural networks (systems) that include the brain, spinal cord and peripheral ganglia. Similar to a biological neural network, an ANN is a mathematical model that attempts to imitate its structure and functions. A simple mathematical model (function) known as an artificial neuron serves as the fundamental building block of every ANN.

The neural network has been used to assess the model’s suitability and predict the key elements needed for the integration of 3D into the standard accounting system.

Multilayer Perceptron

The productivity of basins is attempted to be measured using an ANN. Using SPSS 21 in the Windows XP environment, the neural network approach has been used to validate the analysis of the effects of various oil production components. The results of the analysis are given in Table 6.

Table 6’s summary of case processing reveals that 47.6 cases are assigned to the training sample, and 31% is used to test the sample which is used to validate the model. 21.4% of the data been allocated as a holdout cases. Like the human brain, data must be trained. Fresh holdout instances will be subject to the real test.

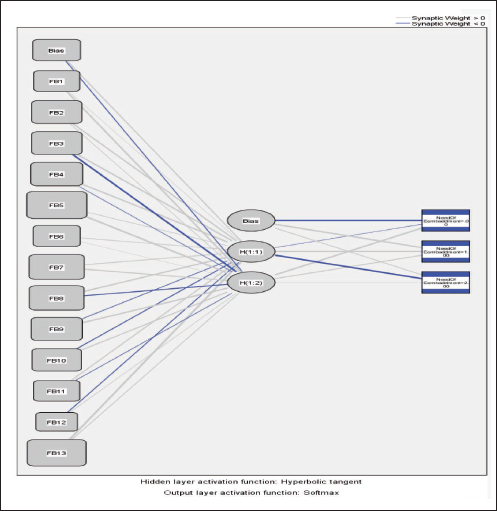

Table 7 provides details on the network. It explains how work is done. Input, hidden and output layers make up its three working layers. It demonstrates that 13 units are operating in the input layer, 2 units in the hidden layer and 3 units in the output layer.

Information on the network is shown in Figure 6. It explains how work is done. Input, hidden and output layers make up its three working layers. It is an entire connected graph with input, a hidden layer and output. The replies or dependent variables are contained in the output layer. There are a few secret units that operate each output unit. Once more, the particular type of operation depends in part on the network type and in part on user-controllable requirements.

The importance of each predictor or independent variable, which in turn impacts the shape of the neural network, is computed in the picture to offer the sensitivity analysis. The combined training and testing samples served as the basis for the analysis.

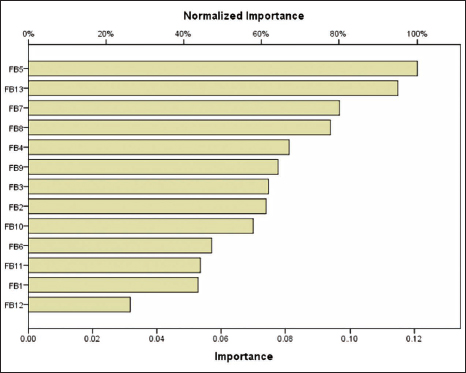

Each predictor or variable’s relevance and normalised importance are shown in Figure 7. It is crucial to note that sensitivity analysis requires a lot of calculation time and money if there are a lot of predictors or instances. A measure of an independent variable’s relevance is how much the predicted value of the network model shifts for various values of the independent variable. When stated as a percentage, normalised importance is calculated by dividing the importance value by the biggest importance value.

More authenticity and trustworthiness, good governance with no error, hash value that makes it immutable, improvement in traditional accounting, saving time and resources, and fast and vast disclosure are found to be the most important variables to explain the requirement of a normal accounting system embedded in the 3D accounting system.

Figure 6. Prediction of Influenced Factor to Empower Normal Accounting Cycle.

Source: SPSS.

Managerial Implications

This explanation will help practitioners to understand and analyse the adoption of blockchain technology in togetherness of normal accounting cycle for small and medium enterprises, and for academicians, it will act as the base to develop new approach of tradition accounting embedded to blockchain accounting .This study would prove useful for them and for academician for further research. This article would be usefulness to decision-makers by providing understanding about blockchain technology and its adoption. Academia will find utility of blockchain technology embedded to normal accounting cycle.

Figure 7. Normalizes Importance (Extracted from SPSS).

Source: SPSS.

Limitations/Future Research

This article provides an approach of togetherness of traditional vs. techno-oriented accounting and reporting system. It is a starting point to be familiar with blockchain to be embedded to normal accounting. Small and medium businesses have limited resources and thus less adoption power of technology that makes their work complex and leads to possibility of errors and frauds.

Conclusion

In this acco-tech and disruptive technologies era, TEA is becoming more prevalent worldwide. The bookkeeping and accounting method has evolved and been impacted by every phase of the economy. The introduction of technology has altered the way how businesses function today. The triple-entry bookkeeping system was updated as a result of the introduction of blockchain technology.

Here, the triangle-related component is covered. The 3D accounting is an addition to double entry which is consisting of the entries for debit and credit recorded. Instead of using a double-entry system, a triple-entry system is used for the movement of cash or currency equivalents. The term was expanded by adopting a novel notion of a third entry that corresponds to 3D accounting to increase the dependability of the conventional double-entry accounting system.

It can be concluded that respondents’ opinion differs significantly regarding the need for a 3D accounting system and the opinion of the respondent is significantly different based on both the demographical information like the size of the business and psychological information like features of the 3D accounting system. All the characteristics of 3D accounting have been framed to know the variation in the opinion of respondents. It is found that there is no significant difference in the opinion of respondents on the need to empower the normal accounting cycle and it should be embedded in the 3D accounting system. This accounting system is better presented than a normal accounting system; hence, it should be embedded in the 3D accounting system for better performance.

Acknowledgement

The author is grateful to the anonymous referees of the journal for their extremely useful suggestions to improve the quality of the article. Usual disclaimers apply.

Declaration of Conflicting Interests

The author declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The author received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Asha Sharma  https://orcid.org/0000-0002-0098-6274

https://orcid.org/0000-0002-0098-6274

Chen, W. B., Tsai, C. T., & Tahnk, J. (2021). Implementing triple entry accounting system with π account on block-chain protocol. Journal of Internet Technology, 22(2), 491–497. https://doi.org/10.3966/160792642021032202023

Demirkan, S., Demirkan, I., & McKee, A. (2020). Blockchain technology in the future of business cyber security and accounting. In Journal of Management Analytics, 7,(2). https://doi.org/10.1080/23270012.2020.1731721

Dua, A. (2022). Review of adoption theories in the context of blockchain. IMIB Journal of Innovation and Management, 1(1). https://doi.org/10.1177/ijim.221085415

Dutta, P., Choi, T. M., Somani, S., & Butala, R. (2020). Blockchain technology in supply chain operations: Applications, challenges and research opportunities. Transportation Research Part E: Logistics and Transportation Review, 142. https://doi.org/10.1016/j.tre.2020.102067

Faccia, A., & Petratos, P. (2021). Blockchain, enterprise resource planning (ERP) and accounting information systems (AIS): Research on e-procurement and system integration. Applied Sciences (Switzerland), 11(15). https://doi.org/10.3390/app11156792

Finance, A., Peprah, W. K., Jr, R., & Abas, P. (2022). Applicability of Blockchain Technology to The Normal Accounting Cycle Applicability of Blockchain Technology to The Normal Accounting Cycle. February, 0–5. https://doi.org/10.11114/afa.v8i1.5492

Grigg, I. (2005 December). Triple entry accounting [work-in-progress]. Triple Entry Accounting. Systemics, Inc. https://doi.org/10.13140/RG.2.2.12032.43524

Gröblacher, M., & Mizdrakovic, V. (2019). Triple-entry bookkeeping: History and benefits of the concept. https://doi.org/10.15308/finiz-2019-58-61

Ibañez, J. I., Bayer, C. N., & Tasca, P. (n.d.). REA , Triple-Entry Accounting and Blockchain : Converging Paths to Shared Ledger Systems. 1–56.

Ijiri, Y. (1986). A Framework for Triple-Entry Bookkeeping . The Accounting Review

Kuruppu, S. C., Dissanayake, D., & de Villiers, C. (2022). How can NGO accountability practices be improved with technologies such as blockchain and triple-entry accounting? Accounting, Auditing and Accountability Journal, 35(7). https://doi.org/10.1108/AAAJ-10-2020-4972

Kwilinski, A. (2019). Implementation Of Blockchain Technology in Accounting Sphere. Academy of Accounting and Financial Studies Journal.

Mahaini, M. F., Danessa, F. R. A., & Wulandari, A. K. (2022). Treping system (New trebit for bookkeeping system): Implementasi Triple Entry Accounting dalam Sistem Entitas Pendidikan. Journal of Applied Managerial Accounting, 6(1), 47–58. https://doi.org/10.30871/jama.v6i1.3928

Mahtani, U. S. (2022). Fraudulent practices and blockchain accounting systems. Journal of Accounting, Ethics and Public Policy, 23(1), 97–148.

Maurya, A. M., Padval, B., Kumar, M., & Pant, A. (2023).To study and explore the adoption of green logistic practices and performance in manufacturing industries in India. IMIB Journal of Innovation, 1(2), 207–232.

Mizdrakovic, V. (2020). Triple-entry bookkeeping : History and benefits of the concept. February. https://doi.org/10.15308/finiz-2019-58-61

Noble, S. M., Mende, M., Grewal, D., & Parasuraman, A. (2022). The Fifth Industrial Revolution: How harmonious human–machine collaboration is triggering a retail and service [r]evolution. Journal of Retailing, 98(2), 199–208. https://doi.org/10.1016/j.jretai.2022.04.003

Peprah, W. K., Abas, P. R., & Ampofo, A. (2022). Applicability of blockchain technology to the normal accounting cycle. Applied Finance and Accounting, 8(1). https://doi.org/10.11114/afa.v8i1.5492

Sharma, A., Bhanawat, S. S., & Sharma, R. B. (2022). Adoption of blockchain technology based accounting platform. Academic Journal of Interdisciplinary Studies, 11(2). https://doi.org/10.36941/ajis-2022-0042

Sunder, S. (2018). Yuji Ijiri: Accounting for a better society. Accounting, Economics and Law, 8(1). https://doi.org/10.1515/ael-2017-0045

Supriadi, I. (2020). The effect of applying blockchain to the accounting and auditing. Ilomata International Journal of Tax and Accounting, 1(3). https://doi.org/10.52728/ijtc.v1i3.101

Vadasi, C., Bekiaris, M., & Koutoupis, A. G. (2021). co un tin g R es ea rch Jo ur. January.